Broad Stock Market Futures Outlook for June 22, 2018

In a failure to hold support, traders took the primary trend (bullish) out of play until early this morning. The bounce here, however, has much to prove at across the board these levels are now resistance.

We will stall here at the first pass for sure so successful bottom pickers will trim some gains, and look for higher lows to re-enter, or step to the side if we fade off proper support.

S&P 500 Futures

As we considered our completion formation yesterday, we saw lots of profit taking at the target region. Resistance levels to watch today are 2767 – support to watch is 2757. Yesterday’s deep fade has found buyers as expected, but we are still in a crosscurrent that could easily give way to more selling, or buyers that take us to higher pockets of resistance. Volume remains quite thin, and again, lows will find value buyers through this cycles. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2767.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2761.25

- Resistance sits near 2771.5 to 2774.5, with 2778.25 and 2785.25 above that.

- Support sits between 2757.5 and 2750.5, with 2742.25 and 2737.75

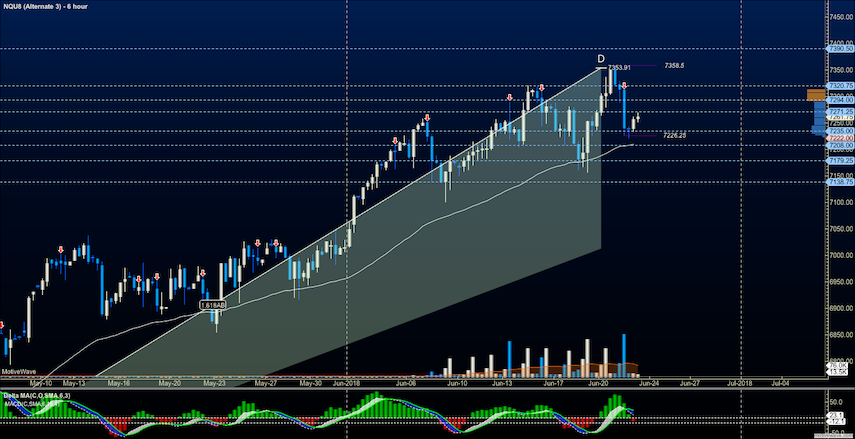

NASDAQ Futures

Rejection zones in the alternate ABCD pattern at completion works for intraday trading yesterday. The current bounce action is having trouble breaching 7271. This will be the frontline of resistance today while support zones sit near 7230. Crosscurrents remain heavy and price action is quite congested. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7282.75

- Selling pressure intraday will likely strengthen with a bearish retest of 7235.5

- Resistance sits near 7274.5 to 7294.5 with 7317.5 and 7336.5 above that.

- Support sits between 7252.5 and 7235.5, with 7222.5 and 7208 .75 below that.

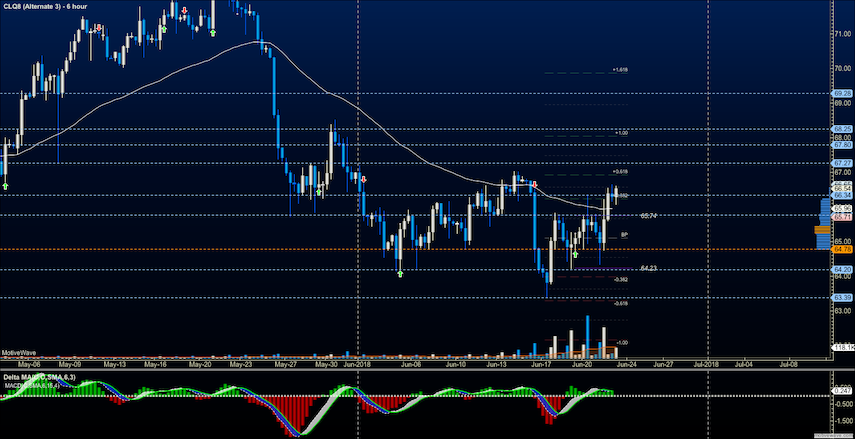

WTI Crude Oil

A rounded bottoming formation is in progress. In a resolution of price, traders held us above 65.6 to move us in a test of higher resistance above. I am expecting choppy action near 67 and will be watching for higher lows to hold. If they begin to break, we will return to the congestion regions just above 65. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 67.27

- Selling pressure intraday will strengthen with a bearish retest of 65.7

- Resistance sits near 66.83 to 67.02, with 67.33 and 67.78 above that.

- Support holds near 66.7 to 67.2, with 67.8 and 68.25 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.