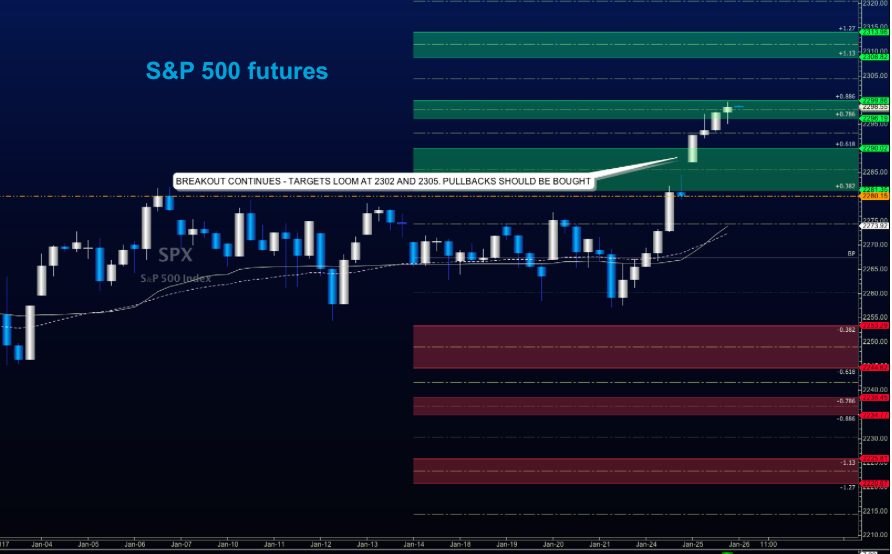

Stock Market Futures Considerations For January 26, 2017

A monster breakout registered yesterday on the S&P 500 (INDEXSP:.INX) and held into new highs. Pullbacks today should find buyers as the traders try to reach 2302 and 2305 on futures. We are essentially above resistance so sellers should be floating around here – the bottom line is that we don’t need to buy the breakout without the confirmed retest formation.

Buying pressure on S&P 500 futures will likely strengthen above a positive retest of 2297.25, while selling pressure will strengthen with a failed retest of 2290. Price resistance sits near 2300.5 to 2301.5, with 2303.5 and 2309.75 above that. Price support holds between 2287.5- 2290, with 2284 and 2280.5 below that

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For January 26

Upside trades – Two options for entry

- Positive retest of continuation level -2297.5

- Positive retest of support level– 2292.5

- Opening targets ranges – 2295.25, 2297.25, 2299.5, 2301.75, 2303.5, 2306.75, 2309.75, 2313.5 and 2320

Downside trades – Two options for entry

- Failed retest of resistance level -2295.25

- Failed retest of support level– 2290.5

- Opening target ranges – 2292.5, 2290.5, 2287.5, 2284, 2280.5, 2278.25, 2275, and 2272.25, 2268.75, and 2264.5

Nasdaq Futures

Trending formations have continued as the NQ_F continues to move with other indices overnight. Though at resistance, pullbacks are likely to be bought until we get a failed retest of important levels above set by Fibonacci retracements.

Buying pressure will likely strengthen with a positive retest of 5162.5, while selling pressure will strengthen with a failed retest of 5144. Price resistance sits near 5166.25 to 5168.5, with 5173.5 and 5178.75 above that. Price support holds between 5147.5 and 5140.5, with 5130.75 and 5122.75 below that.

Upside trades – Two options

- Positive retest of continuation level -5162.5

- Positive retest of support level– 5151.5

- Opening target ranges – 5155.75, 5158.75, 5162.5, 5166, 5168.5, 5773.5, 5178.75, 5183.5, and 5188.25

Downside trades- Two options

- Failed retest of resistance level -5158.5( needs confirmation – very countertrend)

- Failed retest of support level– 5144.5

- Opening target ranges –5148.75, 5144.5, 5140.75, 5137.25, 5132.75, 5126.5, 5122.5, 5117.75, 5113.75, 5109.5, 5103.75, and 5098.75

Crude Oil –WTI

Oil has been essentially range-bound for more than 15 days, with support and resistance holding steady. I see that the support lines are creeping up a bit, but resistance is also drifting down. A squeeze is on the horizon, so I’ll be looking for a wedge break to confirm and then continue into the bigger channel boundaries.

Buying pressure will likely strengthen with a positive retest of 53.49, while selling pressure will strengthen with a failed retest of 52.09. Price resistance sits near 53.49 to 53.66, with 53.8 and 54.18 above that. Price support holds between 52.53 and 52.03, with 51.6 and 51.4 below that.

Upside trades – Two options

- Positive retest of continuation level -52.98

- Positive retest of support level– 52.6

- Opening target ranges – 52.84, 53.14, 53.27, 53.46, 53.86, 54.16, 54.28, 54.51, 54.76, 55.06, and 55.24

Downside trades- Two options

- Failed retest of resistance level -52.79

- Failed retest of support level– 52.5

- Opening target ranges – 52.63, 52.53, 52.26, 52.08, 51.78, 51.52, 51.24, 51.04, 50.82, 50.47, 50.3, and 50.16

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.