Stock Market Futures Trading Considerations For Apr 4, 2017

For the first time in several days, the S&P 500 (INDEXSP:.INX) broke key support levels but recovered quickly only to settle at the lower congestion levels near 2350. Traders will need to stay focused on the early action today.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

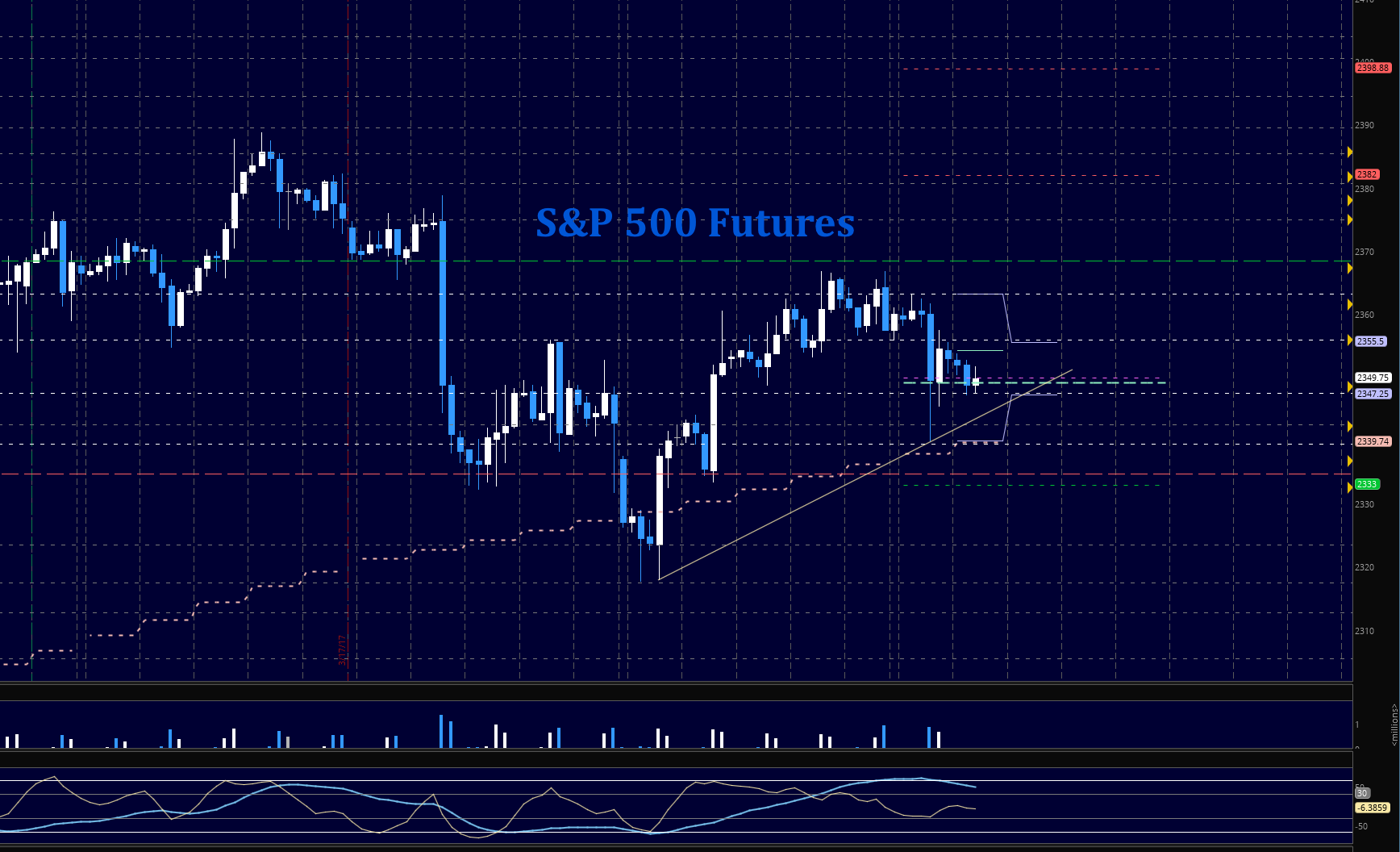

S&P 500 Futures (ES)

We are weakened a bit, but nothing shows a significant drift down at this time. It seems we are caught in a wider range that holds support now near 2330. Today, holding 2347 will be the tell for bullish behavior- below there, traders will try to recapture the level at first break, and if they fail, we’ll test the 2339 area again. A breach of 2355 will send us back to the top of the congestion range.

- Buying pressure will likely strengthen above a positive retest of 2355.5 (but more resistance is ahead nearby)

- Selling pressure will likely strengthen with a failed retest of 2347

- Resistance sits near 2363.5 to 2366.5, with 2369.5 and 2374.25 above that

- Support holds between 2347.5 and 2342.5, with 2339 and 2330.5 below that

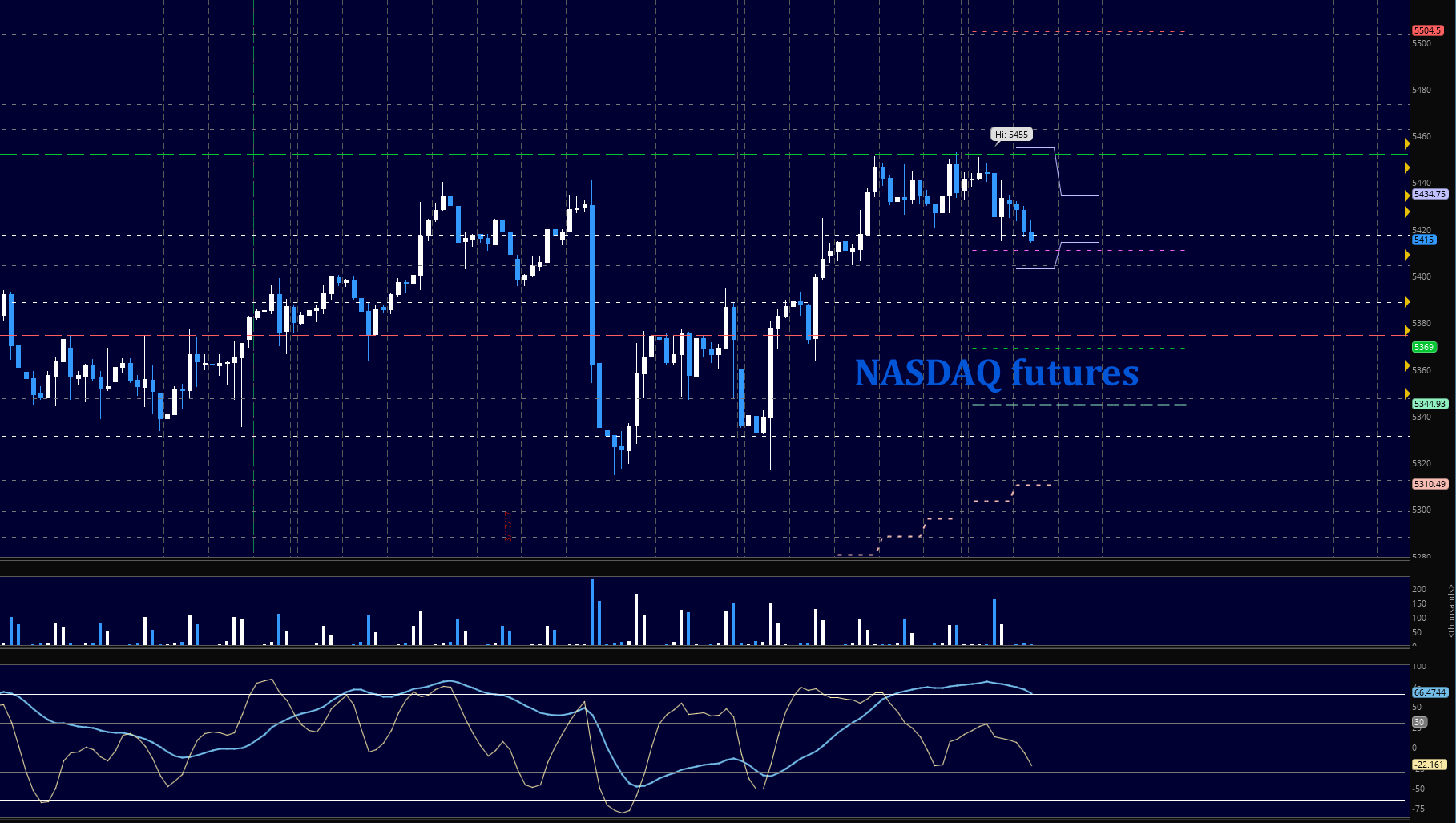

NASDAQ Futures (NQ)

Momentum drifted lower while sellers forced traders into lower support. New support levels to watch are in the 5404 region. Deep fades will be bought in this environment. The chart is not in a breakdown formation. Continue to use caution going long at the upper edge of the ranges. Note the levels on the chart for price bounds. The strength of intraday trend is down – 5388.5 looks like a potential test.

- Buying pressure will likely strengthen with a positive retest of 5434.5 (use caution as sellers sit up here-wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5402.75

- Resistance sits near 5442.5 to 5452, with 5462.5 and 5473.5 above that

- Support holds between 5402.75 and 5388.5, with 5374.5 and 5347.5 below that

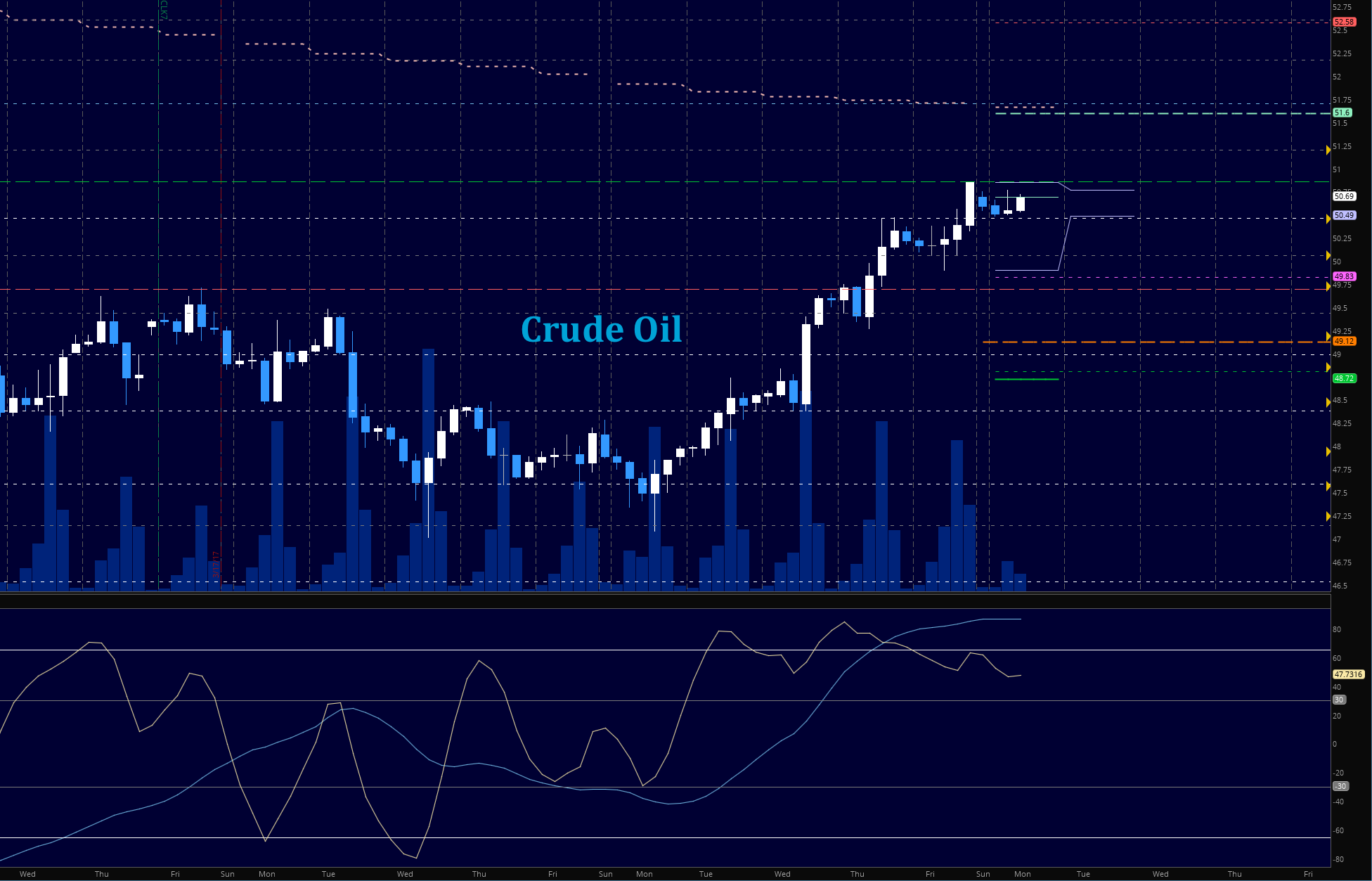

Crude Oil –WTI

Newest releases show a drift down in the level of inventories, forcing prices upward further. There still seems to be a magnet pulling price into 51.7, so this remains the terminal target for this cycle with 52.5 above that. As momentum suggested yesterday, we faded into support near 49.9 before bouncing overnight. Volume is lighter, and we are struggling to breach 50.5 which is a near-term resistance level. A test of higher support is likely but the volume at higher highs in this cycle make me very cautious about holding longs into anything higher than near term visible resistance. Deeper fades will still find balance as the traders shift into more bullish positions. Today, we have the API report after the close and the EIA reports will be released tomorrow.

- Buying pressure will likely strengthen with a positive retest of 50.8

- Selling pressure will strengthen with a failed retest of 50.06

- Resistance sits near 50.86 to 51.22, with 51.64 and 51.77 above that.

- Support holds between 50.2 and 50.02, with 49.78 and 49.12 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.