Stock Market Futures Trading Considerations For April 13, 2017

The Volatility Index and futures have shown the way lower for stocks. Increased volatility has lead the S&P 500 (INDEXSP:.INX) in a sideways to lower chop… and we’ve drifted into deeper support levels. For the first time in a while, we did not bounce sharply off the lows, but held them with a small bounce into yet another lower high. Momentum is negative, and particularly so in the financials sector (XLF). Bounces will likely find sellers today, particularly at the first pass into resistance.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

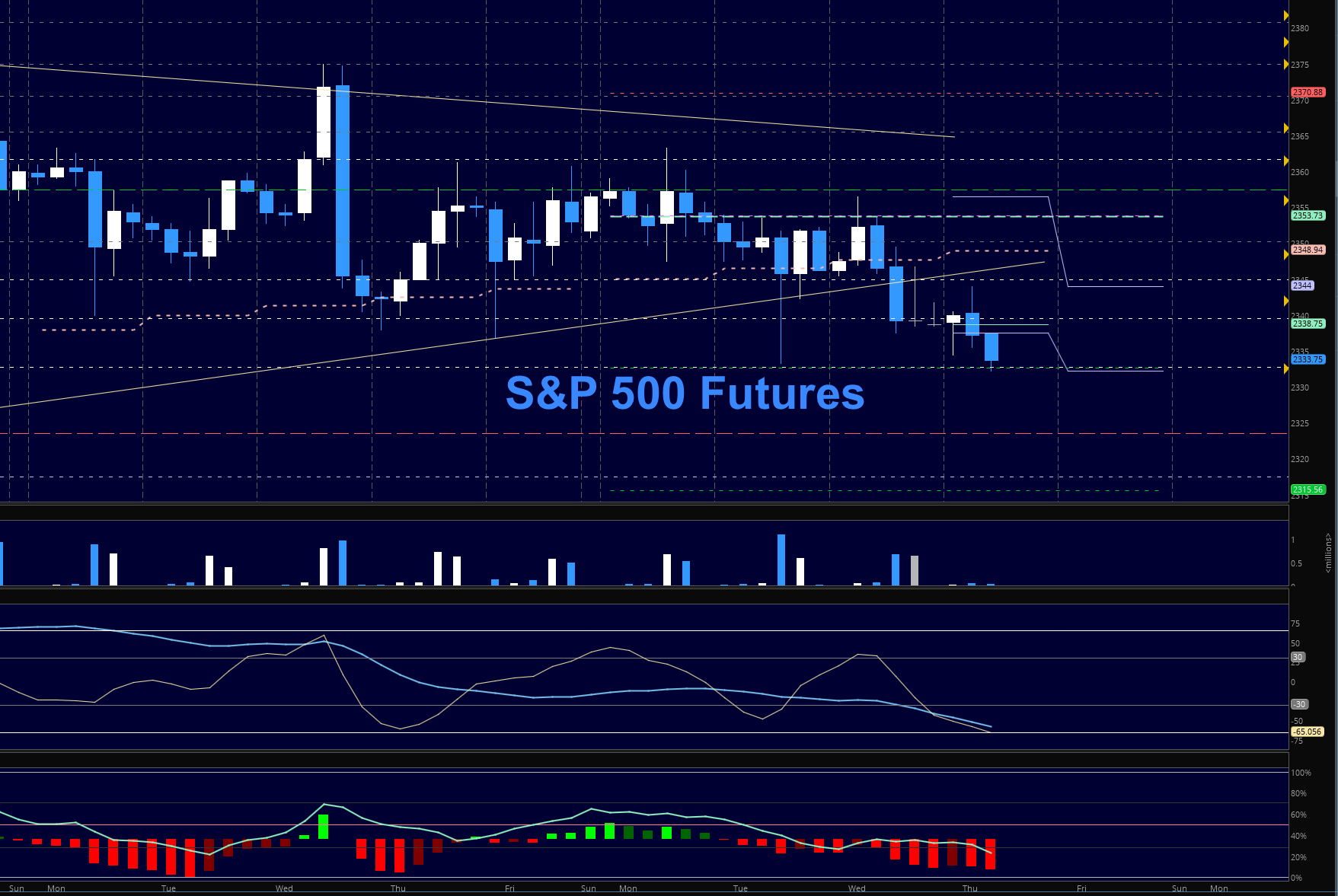

S&P 500 Futures

Though we are drifting lower, there is hope that we can stabilize in the 15 point range between 2319 and 2334, there is still hope that buyers can pull us off these edges. If ever the buyers needed to prove themselves out, it is today. Volume will drop off into the afternoon and the markets are closed tomorrow in observance of Good Friday. Gold and the 30-year bonds are holding their upper levels and are still in bullish formations- those will be good assets to watch for added color in market movement today.

- Buying pressure will likely strengthen above a positive retest of 2361.5

- Selling pressure will likely strengthen with a failed retest of 2336.5

- Resistance sits near 2344.5 to 2351.75, with 2357.5 and 2361.25 above that

- Support holds between 2336.5 and 2332.5, with 2325.5 and 2319.5 below that

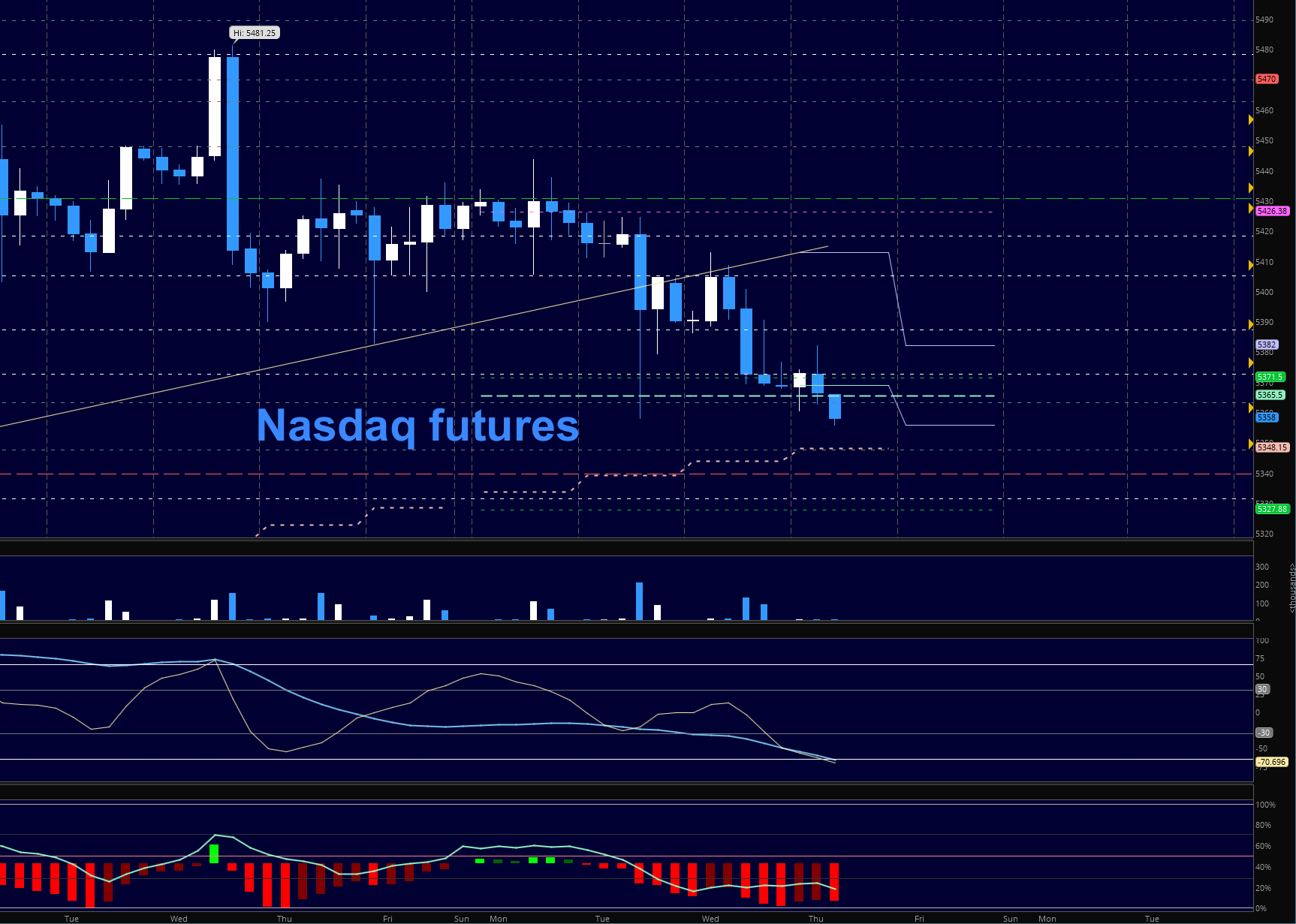

NASDAQ Futures

NQ_F- Momentum is now negative, suggesting that bounces will find sellers. We’ve been testing support near 5360 for several hours. Lower highs are anticipated under the selling pressure with more support levels near 5348 and 5334. Failed bounces will be likely today until the recapture of 5388 or so. Should buyers not be able to hold the against the selling pressure against them, it should signal that trending motion down may be on the horizon.

- Buying pressure will likely strengthen with a positive retest of 5389.5 (use caution as sellers sit close by- wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5357.25

- Resistance sits near 5389.5 to 5404.75, with 5417.75 and 5434.25 above that

- Support holds between 5357.5 and 5347.5, with 5334.5 and 5325.5 below that

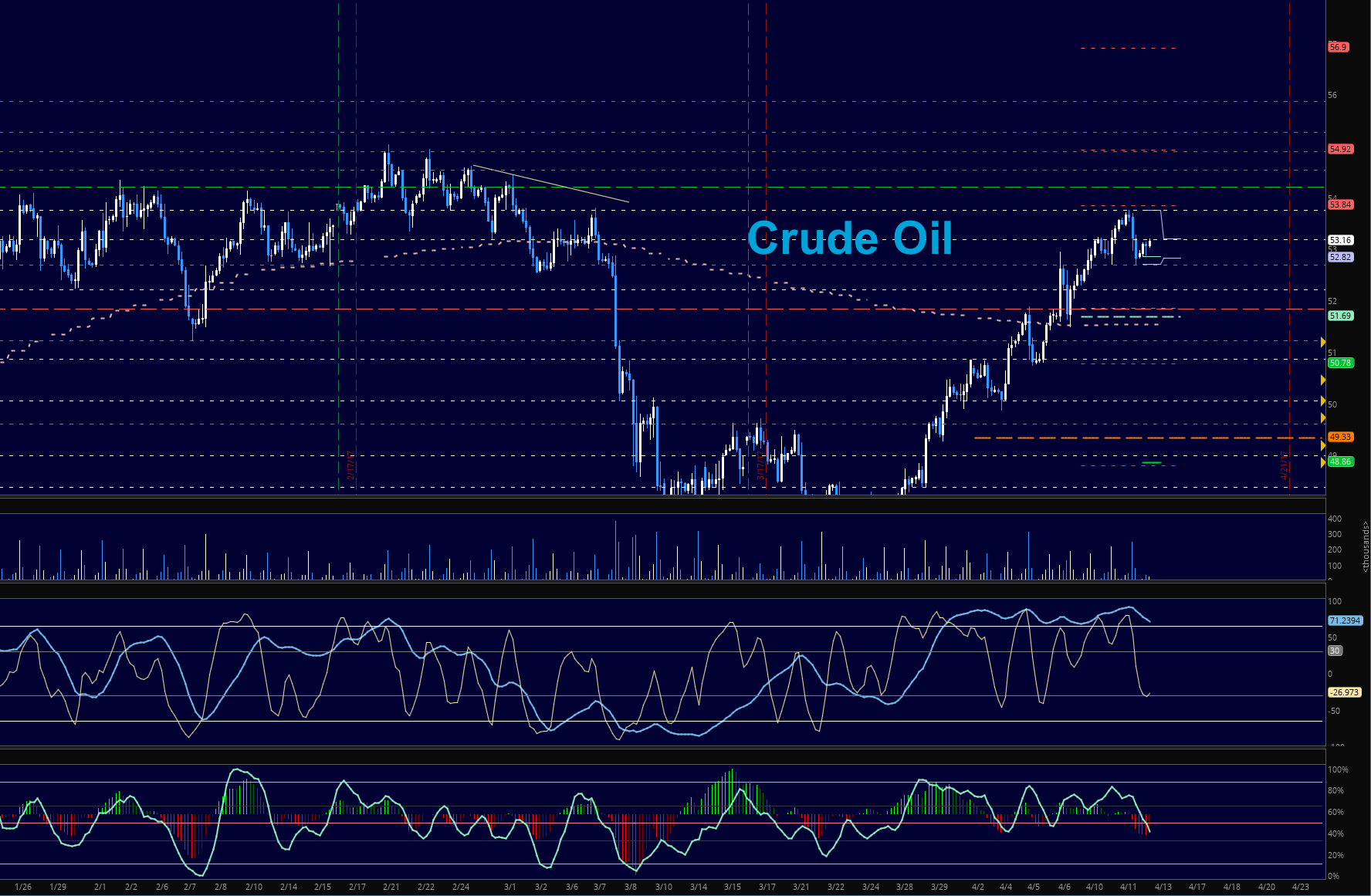

Crude Oil –WTI

CL_F -A test of Monday’s low gave us a value buying area late in the trading day yesterday, and now 53.25 sits as resistance. The chart has climbed dramatically and these formations usually will fade before resuming upside. It is not unlikely that we test 51.69 before moving forward but traders are still clearly bullish and the ride to deeper support should be quite choppy.

- Buying pressure will likely strengthen with a positive retest of 53.76

- Selling pressure will strengthen with a failed retest of 51.54

- Resistance sits near 53.3 to 53.78, with 54.11 and 54.53 above that.

- Support holds between 52.8 and 51.54, with 50.88 and 50.26 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.