The Federal Reserve meeting concludes today. It’s an understatement to say the FOMC committee’s statement this afternoon is highly anticipated.

With the ECB moving to a more dovish stance, traders fully expect the same.

This has created a slew of positive triggers across stock market futures.

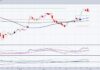

S&P 500 futures broke through and held 2923 to test the next level of resistance but have stalled into the wait state. The bullish backdrop I have mentioned still holds but technical divergence and the sense that somehow an easing from the Federal Reserve is bullish (especially given the economic backdrop) makes me tentative with the size of my trading positions.

THE BIG PICTURE – Daily momentum has shifted positive and now with the breach of 2923, we are now in breakout territory that I suspect needs retesting levels near 2909. Under the current bullish momentum, this fade seems unlikely for now but we are definitely awaiting a news event.

INTRADAY RECAP – Rangebound break to the upside but caught between yesterday’s initial balance (the first hour of US trading). Traders are still holding gold but fading off its highs.

A dovish Fed will send this lower alerting value players to enter at support levels. The Fed funds rate futures still predicts the likelihood of rate reduction ahead by September – but this number has drifted lower in the last few days as markets continue to rise. The dollar sits at intraday resistance after struggling to breach for a couple of days.

Sellers want to move us below 2908 intraday. Pullbacks into higher lows will be buy zones intraday and traders have a bullish slant overall but breakouts are not likely to hold.

Manage your risk by waiting for the edges and playing the range (with stops) with a bullish slant. The backdrop of global slowdown and trade chatter still prevails.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.