THE BIG PICTURE

The major stock market indices, made new highs once again in week 30 as the Dow Jones continues to rip higher (while the others churn a bit).

S&P 500 futures traded above/below the 10 day ema at the MML highs. The S&P 500 (INDEXSP:.INX) also put in a weekly Doji (indecision) Heikin Ashi bar.

The VIX Volatility Index bounce back above 10 last week after trading with a 9 handle for several days. Worth watching.

We are well into earnings season and most of the major FANG/FAAMG numbers are out without much disappointment. The Nasdaq (INDEXNASDAQ:.IXIC) and tech lovers still are waiting on Apple (NASDAQ:AAPL) earnings.

Technically by the charts, with open gaps now closed out in week 30, any deeper downside will have quite a drop to close out the next level down on Dow Jones futures (YM). S&P 500 futures (ES) and Nasdaq futures (NQ) gaps are concerning, but nothing we couldn’t take care of in a weeks price action if we lose support off the moving averages. The trailing 50 period moving average will be the first level of support on the indices. As long as price action holds above the 10ema, short term 10ema for support and MML levels upside on the higher time frames to manage the trade. If we break these levels, open gaps will be in play downside. Keep your eyes on the small caps as they are holding at the lows of week 30 and at the opposite end, the YM at the highs.

The summertime price action as we lead into August is surely not playing out to the norm which is ok. Keep it simple and watch the charts and leave the bias out of where the market should be. Best defense is a trailing stop on the longer time frames above your entry and far enough back to give the market some room to chop as the DIP buyers seem to be the only TREND holding up this market. Intraday, just simply wait for the setup whatever that may be and stick to your plan.

As always be ready for both directions in the unpredictable market.

Key events in the market this week are earnings, ADP and Non-Farm Payrolls.

Technical momentum probability REMAINS in a UPTREND on the bigger pic as we hold above the key moving averages. As always, BEWARE of the catalyst wrench (Washington Politics) that looms overhead of if and when the market may sell off in reaction to unsettling news.

THE BOTTOM LINE

Waiting for the APPL earnings and NFP may be the highlight of the week aside from Washington indecision makers. The VIX which remains content at these levels and price action holding at or above the 10ema, will keep this market in an uptrend momentum. It is the catalyst which we monitor for weekly that will flush the market at any given chance. It appears the Russia/Chinese/North Korean tension may be enough to do just that.

The case for higher highs is just as strong and whether you trade the intraday futures or indices ETF’s, momentum clearly resting on the uptrend is a much stronger play.

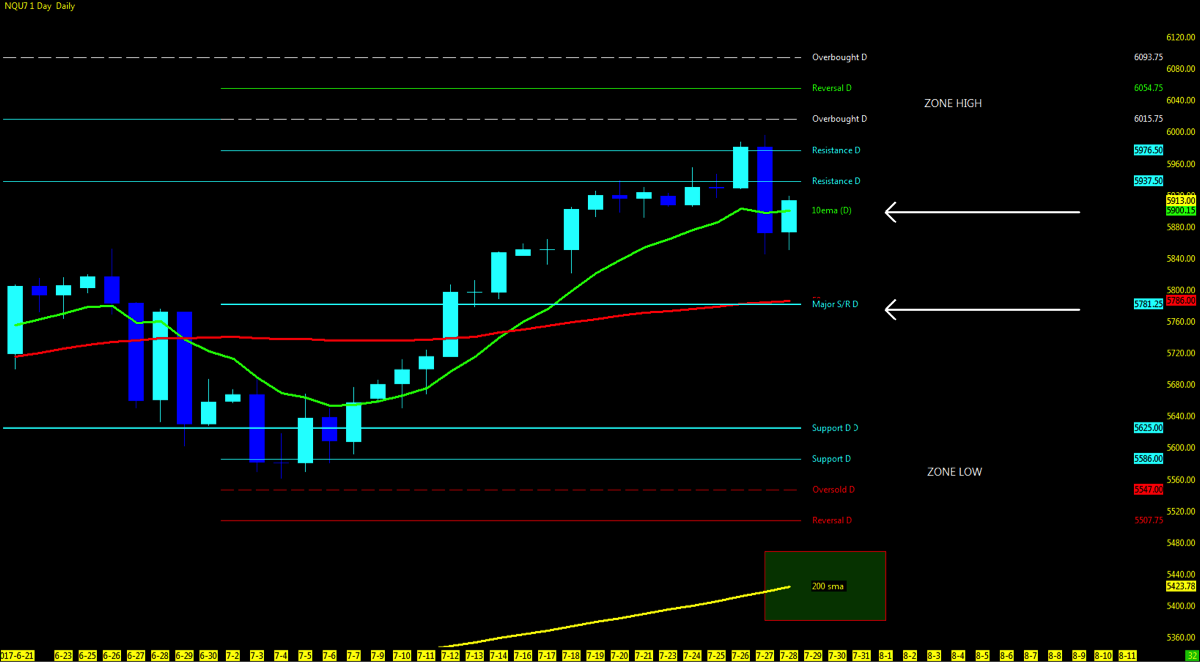

NQ – Nasdaq Futures

Technical Momentum: UPTREND

Using the Murray Math Level (MML) charts on higher time frames can be a useful market internal tool as price action moves amongst fractal levels from hourly to daily charts. Confluence of levels may be levels of support/resistance or opportunities for a breakout move.

- Multiple MML Overlay (DAILY )

Lowest Open Gap: 4017

ES – S&P Futures

Technical Momentum: UPTREND

- Multiple MML Overlay (DAILY )

Lowest Open Gap: 1860.75

Thanks for reading and remember to always use a stop at/around key technical trend levels.

Twitter: @TradingFibz

The author trades futures intraday and may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.