Since the beginning of October, the market has experienced a nasty pullback for those who weren’t prepared.

The main talk going around is the downside in crowd favorites like Amazon (AMZN), Apple (AAPL), Google (GOOGL), Nvidia (NVDA) and Netflix (NFLX) and whether or not to buy the dip.

This post is not to to offer insight on each stock. My high-level opinion is that these institutional-type stocks need to build a constructive base.

If these names (and the overall Technology sector) continue to go down everyday, that is an issue for bulls. Technology represents too large of a sector weighting in the S&P 500 to think otherwise.

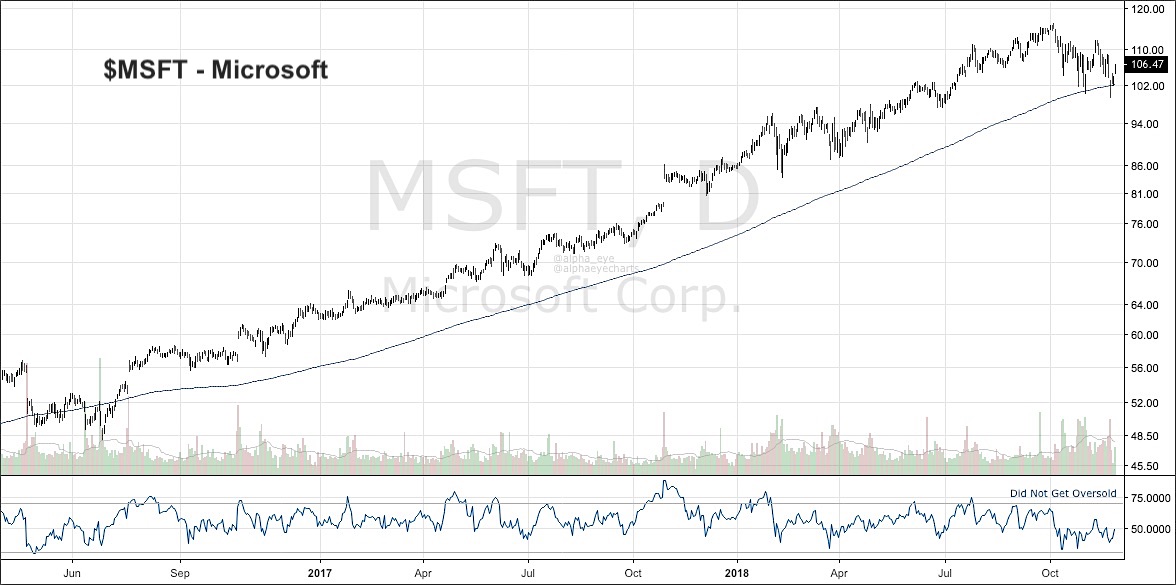

With that said, what I find interesting is another institutional tech stock that is NOT being talked about: Microsoft (MSFT). Microsoft is an absolute beast. It is the definition of an uptrend and has not closed below it’s 200 day simple moving average since July 2016.

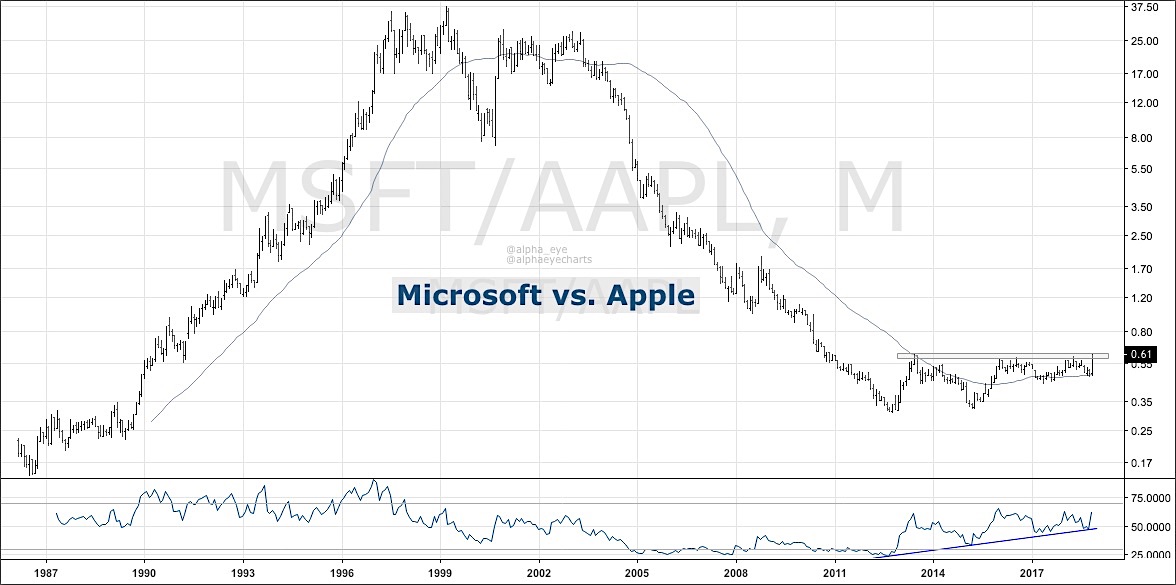

That is not the case for AMZN, AAPL, GOOGL, NVDA or NFLX, which are all 5-35% below theirs respectively. It is worth noting that Microsoft has underperformed all other stocks mentioned for years. With that said, I see an intermarket relationship opportunity presenting itself that has been developing since late 2013: Long MSFT / Short AAPL.

From their highs made on October 3rd, Microsoft is down -8% and Apple is down -25%. You wouldn’t know anything happened to the overall market looking at MSFT’s chart. In August, Apple hit the 1 trillion market cap level. This was great for headlines but an arbitrary level to actual market participants.

After spending 3 months consolidating at that valuation, it has been lost. Now what?

If we get a breakout in this ratio, I believe Microsoft will outperform Apple going forward. And there is a lot of upside above in this ratio. Now that does not mean Apple is going to zero or it cannot go up alongside Microsoft. The chart implies Microsoft will outperform Apple’s on a percentage gain basis.

To take advantage of this opportunity, you can buy an equal dollar amount in MSFT long and AAPL short. If putting on a pair trade is not your style, you can just long Microsoft from a relative strength perspective it has shown.

If you own both MSFT and AAPL in your portfolio, this is a ratio you want to watch closely going forward. Let’s see what happens. Thanks for reading!

Twitter: @AlphaEyeCharts

The author does not have a current position in MSFT or AAPL. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.