Inflation is a spotlight topic in the media with more reports and predictions surfacing every day.

Since the Fed has been sorely wrong on its inflation predictions, the country is closely monitoring interest rate hikes.

With prices increasing and potentially looking to move higher, people are feeling the pain.

While the Fed’s idea of transitory inflation was based on supply chain problems being temporary, we are seeing that fixing supply chains alongside the Ukraine war and persistent Covid variants is not so easy.

The Fed also failed to understand growing food products takes time and cannot easily be scaled back to pre-pandemic levels.

Having said that, has the Fed finally grasped the severity of the inflation problem?

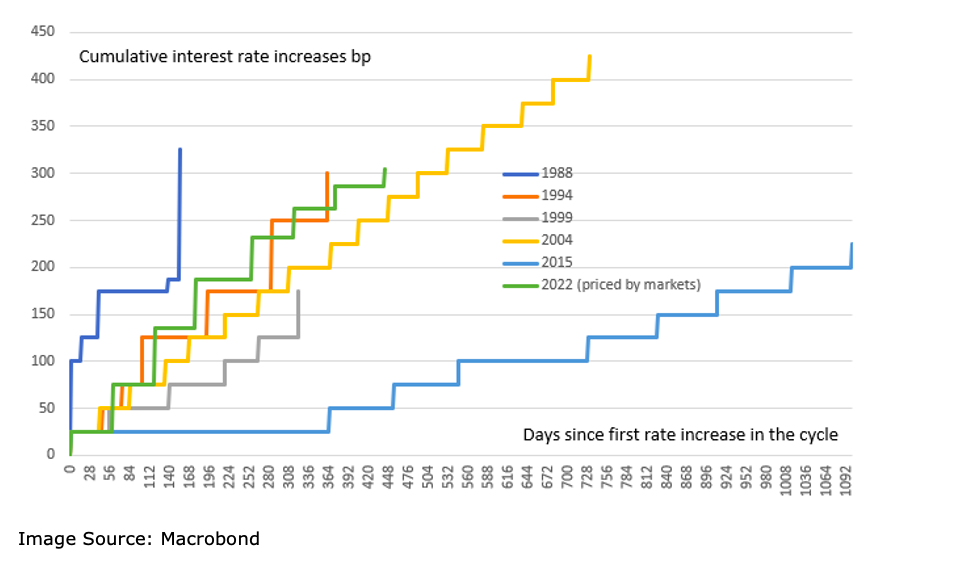

The above picture shows a cumulative interest rate increase in basis points (BP) over a set number of days.

Different colored lines represent the frequency of interest rate hikes in different periods.

The green line shows 2022.

While the rate hike pattern for 2022 roughly aligns with the progression found in 1994 and 2004, it should also be noted that inflation was under 3% in both these years.

The last time inflation was over 8.5% was in 1981 at 8.9%.

With that said, while the Fed seems more aggressive with its rate hikes, this image shows the Fed is using about the same frequency of rate hikes compared to years with much less inflation.

Therefore, while the Fed did not want to go for a .75% rate increase this past Wednesday, it might need to in the near future.

What does this mean for the market?

Large rate increases are viewed as a negative for the market, however, high inflation and poor economic outlook also don’t bode well.

This doesn’t leave the Fed with a great situation to deal with, but possibly hitting the market with larger rates will benefit the economic outlook for the long run if inflation continues to push higher.

Read Mish’s market update: Is China A sleeping Giant?

Mish’s Market Update: Is China A Sleeping Giant?

Watch Mish Latest StockCharts video: A Roadmap for a Volatile Trading Range Market

Stock Market ETFs Trading Analysis:

S&P 500 (SPY) 405 to hold.

Russell 2000 (IWM) 181 watch to hold.

Dow (DIA) 322 support.

Nasdaq (QQQ) 309.65 pivotal.

KRE (Regional Banks) If can hold current area. Watching for a move over 65.

SMH (Semiconductors) 253 resistance. 225.80 support.

IYT (Transportation) Needs to hold 237.

IBB (Biotechnology) Breaking down. Looking for support.

XRT (Retail) 75 resistance. 70 pivotal.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.