There is little doubt that at the core of most every investor’s portfolio is a healthy allocation to dividend-paying equities. And for many good reasons. One being that Dividends enjoy preferential tax treatment.

Bond yields had been declining since the 1980s, enticing more investors to harvest cash flow from equities instead of bonds. The volatility of dividend strategies has been less than the overall market and the returns have been comparable.

Cash flow, better taxation, returns, and less risk… that’s like a four of a kind in the investment world. Not to mention, when investors have ventured into growth pockets in the Canadian market, the experience has not been great. With memories of Nortel, Encana, Biovail, Potash, and Research in Motion, there have been enough boom/busts to make any investor return to the warm comfort of their dividend payers.

As managers of a few dividend strategies, we are squarely in the camp that dividend-paying companies should be at the core of most portfolios, whether we are managing them or not. But this isn’t a pompom ethos about dividends; instead, we are going to share our views on a risk for dividend strategies – namely rising yields. A good portion of the performance attributes that dividend strategies have delivered for investors over the past decades can be explained by falling bond yields. Many dividend companies are treated as bond proxies or as long duration investments, so when yields fall, their price tends to rise. That has been a tailwind for many years but is starting to become a headwind as yields move higher.

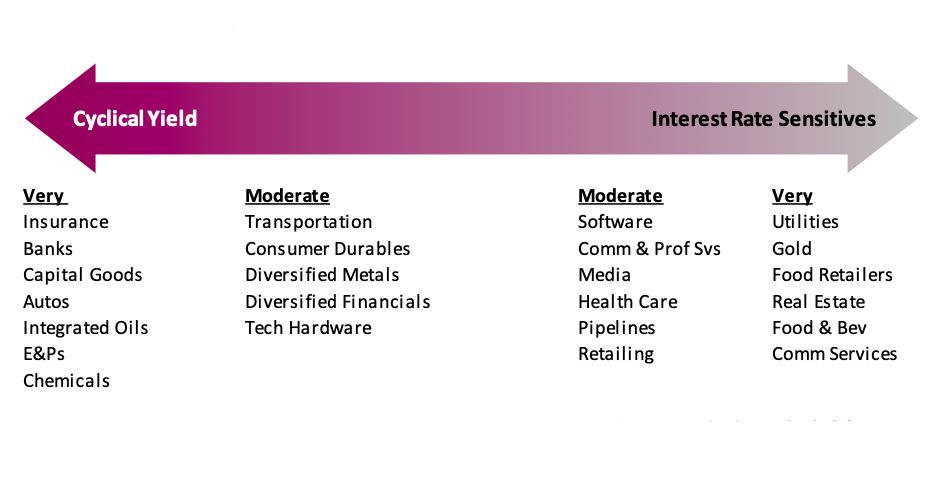

But not all dividend-paying companies have the same sensitivity to changes in bond yields. Some are very sensitive, which we refer to as ‘Interest Rate Sensitives.’ Some are less sensitive to yields – or may actually benefit from rising yields – and we refer to those as ‘Cyclical Yield.’ As the name suggests, Cyclical Yield dividend-payers tend to be in industries that are more economically sensitive. If the economy is doing well, they should do well and bond yields should rise. Conversely, Interest Rate Sensitives are less sensitive to economic activity and react more to yields in the opposite direction.

Based on historical correlations and beta (slope) to changes in bond yields, we sorted dividend-paying sub-industries. This ranking incorporated a 10+ year period and a focus on periods of rising yields (there have not been too many over the past decade). This helps provide a guide for which companies or industries in the Cyclical Yield grouping can better handle rising yields. Conversely, those that would benefit should yields move lower are in the Interest Rate Sensitive group.

If you believe, as we do, that bond yields have embarked on an upward trajectory due to solid economic growth and inflationary pressures, tilting more towards Cyclical Yield would be prudent. Of course, this does come at a risk. Cyclical companies that pay dividends do not do well if the economy slows. Their cyclical nature does make the dividend sustainability a bit more tenuous, while many Interest Rate Sensitives are at less risk from an economic slowdown. A combination from both buckets makes for a better dividend portfolio, with perhaps a tilt towards the Cyclical Yield companies in the current environment.

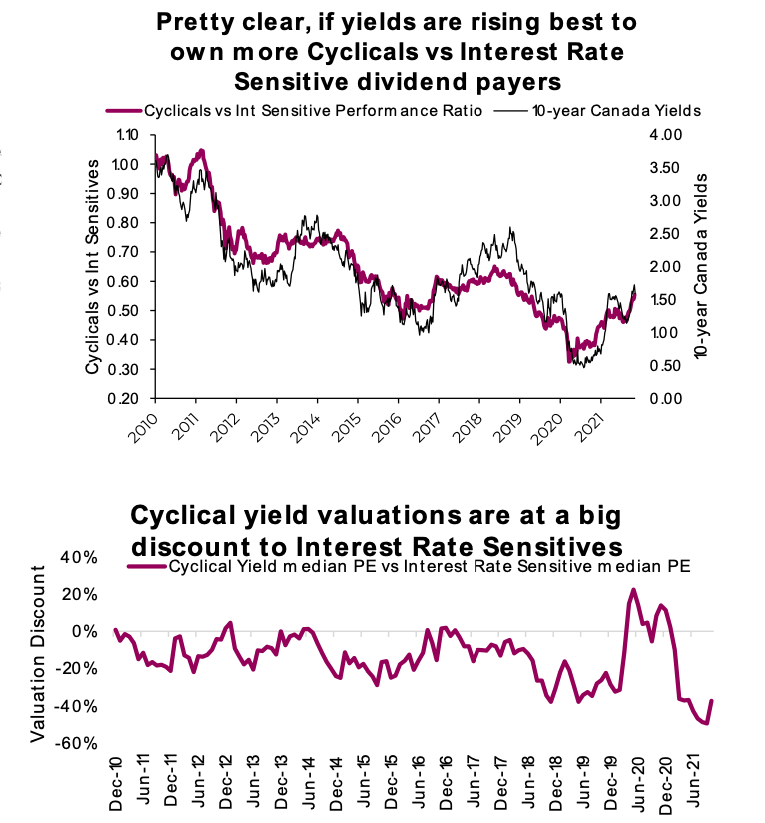

It really does come down to the future path of bond yields. In the chart below, we tracked the historical performance of the Canadian Cyclical Yield industries versus the Interest Rate Sensitives. The line rises when Cyclical Yields are outperforming and vice versa. This line has a very strong correlation to Canadian 10-year bond yields. It’s worth noting that this trend of outperformance by Cyclical Yield dividend payers started about a year and a half ago, after really underperforming the Interest Rate Sensitive dividend payers for most of the 2010- 2020 decade.

CHART

There is also a historically high valuation discount among Cyclical Yield compared to Interest Rate

Sensitives. Historically, there is usually a discount as a dollar of cyclical earnings is not worth as much as a dollar of more stable earnings. However, this discount is near the biggest over the past decade.

Investment implications

We believe that in the next few years, much of the relative performance between dividend strategies will be determined by the direction in bond yields and the balance between Cyclical Yield and Interest Rate Sensitives. After all, not all dividends are treated equally by changes in yields. Inflation has picked up, the economic recovery has solid momentum and central banks appear to have started to tighten/taper. Dividend portfolios should have a mix of both Cyclical Yield and Interest Rate Sensitives, but for now we believe the tilt should be towards Cyclical Yield.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.