When investing, whether you’re a portfolio manager, advisor, or individual, nothing is as rewarding as making the right call and then being proven right by the market. That is a win. And it is even better than just happening to be in the right place and being rewarded by a market move, which happens more often than you might think.

For example, you might have bought a company based on good looking fundamentals like cash flow and earnings growth, and a while into owning it, a geopolitical event makes it scream higher. That feels good.

One of the most pervasive ‘right calls’ that the market is now rewarding is the short duration stance within the fixed income portion of the portfolio, coupled with underweights in traditional bonds. We believe this portfolio positioning to be pervasive based on seeing it in the VAST MAJORITY of investor portfolios and advisor models our team has had the opportunity to analyze. It was the right call, simply from a risk/reward perspective even before inflation started to pick up. Add to this our own stance within multi-asset portfolios we help manage. Let’s all take a moment to pat ourselves on the back.

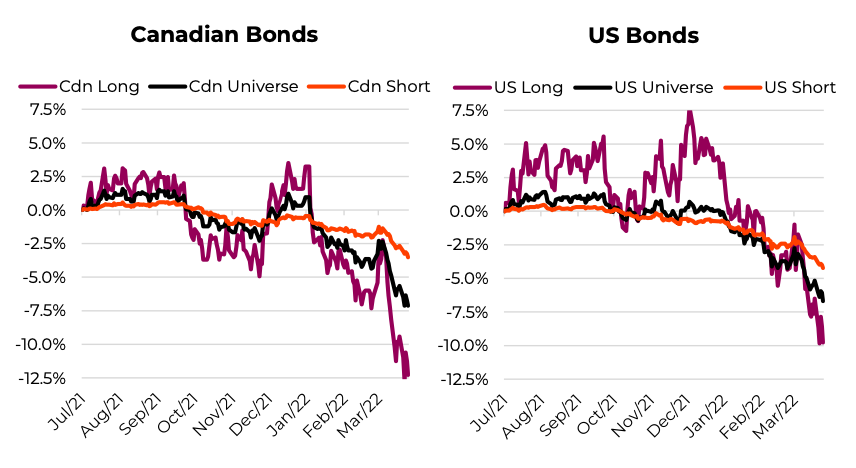

Short duration + underweight bonds = a WIN, that recently got even better. The following chart shows the total return in the Canadian and U.S. bond markets using the more popular ETFs as proxies. Clearly, long bonds (long duration) have been the hardest hit. The universe held up a bit better but is still down almost 7.5% over the past six months. While still down, short bonds held up even better.

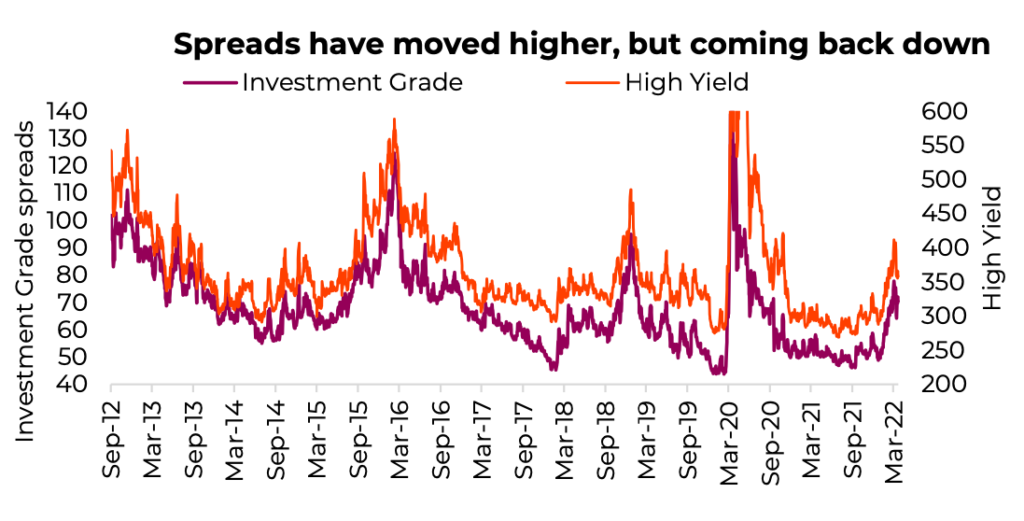

Credit exposure is another widespread hefty weight within portfolios. This is a byproduct of the low-yield environment that persisted for many years. Lack of yield in bonds coupled with cash flow requirements in many portfolios enticed investors to take on increased credit exposure in search of yield. And this has worked out very well.

Firstly, defaults have remained low for many years. Even during the pandemic-induced “recession” of 2020, bankruptcies were minimal thanks to unprecedented monetary and fiscal support – some of which went directly into credit instruments. Plus, many credit-heavy investments tend to have a lower duration.

So, while credit spreads have risen so far in 2022, the lower duration factor has helped most vehicles hold up ok during this bond sell-off.

It is pretty common knowledge as to why bond yields are rising. You can take your pick from the following reasons: the global economy is growing above trend, strong employment gains have created a tight labor market, inflation is high due to demand and supply issues, or central banks left the stimulus spigot open too long and are now reversing quickly to catch up … these are all knowns.

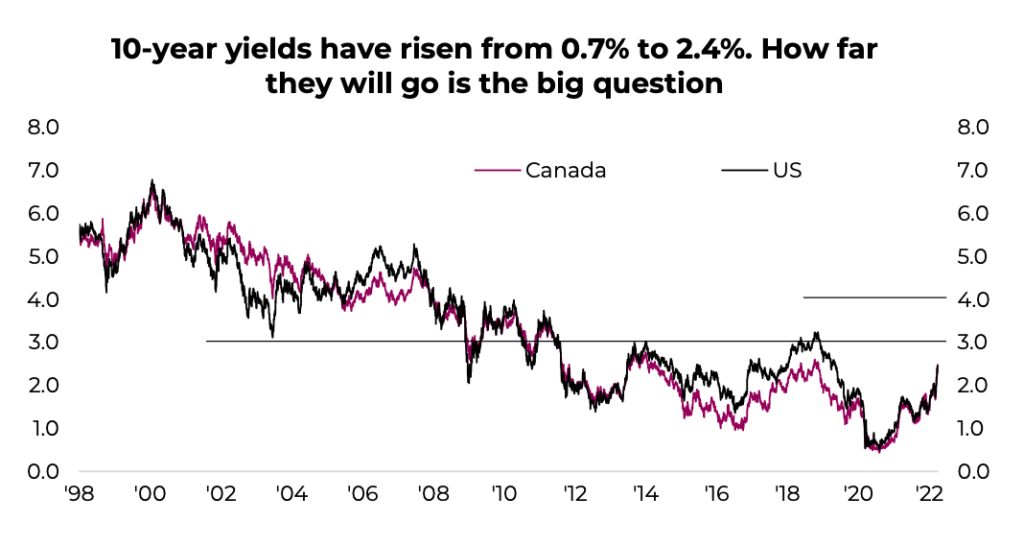

The portfolio construction call to be low duration and underweight bonds was very easy when 10-year yields were sitting at 0.7%. Now at 2.45%, it is much more complicated. Unlike equities, when bond prices fall (yields rise) the future expected return on bonds automatically goes up. This raises an interesting thought experiment. There is a solid ‘buy the dip’ mentality for equities that has been reinforced over the past few years. Should this apply to bonds as well?

We are not going to pretend we know when this bond sell-off will end. Could it be around 3.0%? 4.0%? Could yields overshoot to the upside? The above reasons that are driving yields are still present. That being said, once you have finished patting yourself on the back for having low duration or underweight bonds, this could be an opportune time to start adding duration or simply adding to bonds for a few reasons beyond the fact that yields are much more attractive than they were a few short quarters ago.

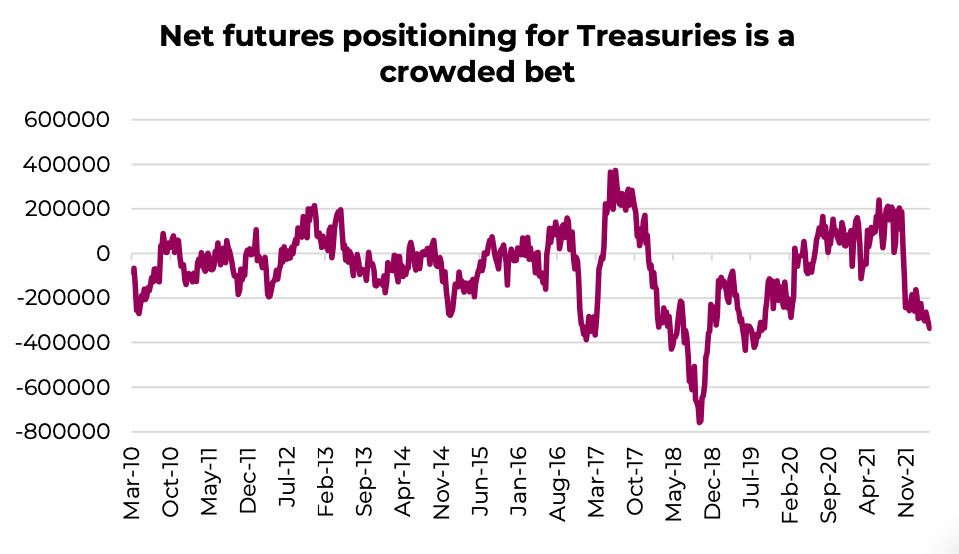

Sentiment, which is often a contrarian indicator, is very negative on bonds. The CFTC non-commercial combined positions have a strong bet calling for yields to keep rising (prices falling). Crowded trades can be dangerous if or when the tide turns. Which, of course, brings up the economy – it’s doing great. Labor gains are very strong but don’t forget labour statistics lag. In the coming months and quarters, economic growth is going to endure: the impact of sanctions, the high level of

energy/commodity prices, and these higher yields. Mortgage rates on both sides of the border have spiked higher as well, with US 30-year rates moving from 3.2% at the start of the year to 4.5% today and Canadian fixed 5s moving higher at a similar clip. All these factors have already started to restrict consumer spending.

In Summary

Don’t get us wrong, we are not saying the ‘R’ word at this point. The economy has some solid momentum. But these headwinds will continue to put strong downward pressure on economic growth over the coming months, which takes time to show up in the economic data. Nor are we suggesting a 180-degree turn in bond allocations. However, if you are underweight bonds, heavily tilted to credit and short duration, it does appear to be an opportune time to self- congratulate for making the “right call”, but also to start backing away from it.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.