ShotSpotter Stock Research (SSTI): Company Fundamentals and Outlook

ShotSpotter is a $285M Company that provides gunfire detection solutions to help law enforcement and security personnel in gun violence situations enabling an effective and efficient response.

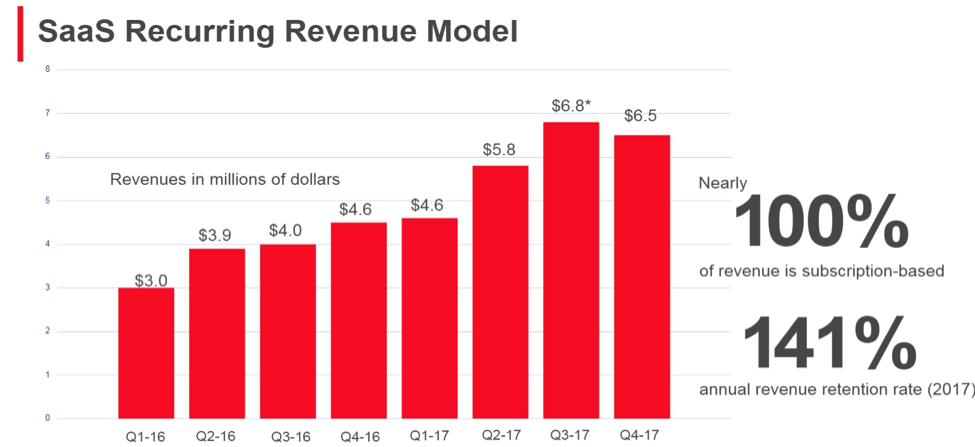

It currently has more than 10,000 sensors deployed and more than 85 cities with 510 square miles under contract and over 700,000 gunshots in its database. The attractive part of its business is the subscription model which allows for stable, recurring revenues and high margins. SSTI’s target market is an estimated $1.2B in annual spend and it has no real competitors in this field. In 2017 its revenue retention rate was 141%.

ShotSpotter estimates it currently has just 5% penetration to its core market opportunity and sees potential to expand internationally, college campuses, and extending its solution offering. SSTI’s “Land & Expand” strategy can offering many years of high growth. In 2017 the company posted 49% gross margins and sees this expanding to 60-65% medium-term while operating expenses currently at 67% expected to fall to 55% medium term and 31-38% long term resulting in 25%+ operating margins.

Statistics source: Sentieo; images from company presentation.

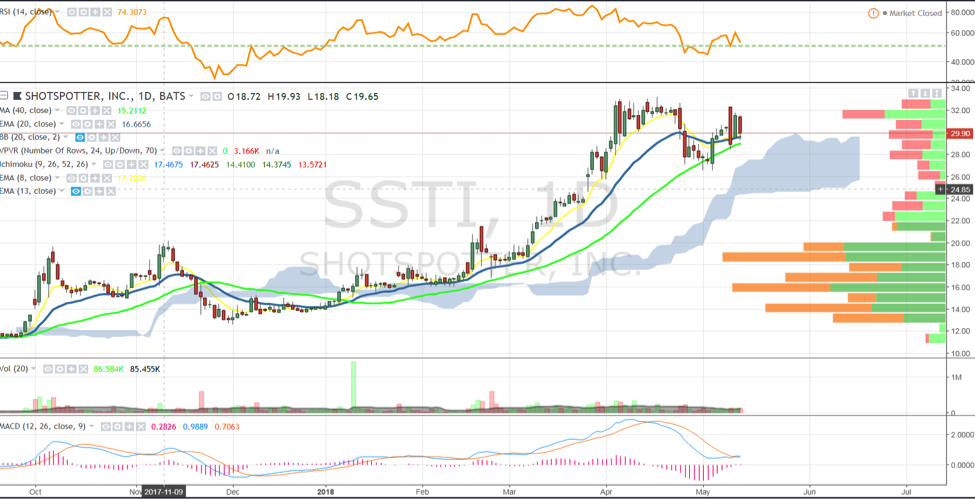

On the stock chart, shares have rallied in 2018 and now flagging under a new high, setting up for a nice breakout move.

Roth Capital recently raised its target to $43 reflecting its upside metrics. Dougherty started shares on 4-24 at Buy with a $40 target noting the company’s unique position to benefit from solutions combatting rising US gun violence.

In closing, I really like SSTI’s business model, defensible market leadership position, large TAM, and margin expansion opportunity as a longer term own. My hesitation is shares trading 9.2X EV/Sales may offer a much better entry point over the next 12 months, while one potential risk to the company is gun reform resulting in less gun violence and need for the solutions it offers.

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading and good luck out there!

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.