We found across a number of large equity ETFs that the drop in performance ranged from 1% to 3% (annualized). Looking at bond ETFs, the trend was the same but showed a bit more of a decline ranging from 2% to 4%. We could conclude ETF holdings and flows are even worse than mutual fund investors at trying to time the market or buy and sell at the right time. It is also worth noting the most damage to long term returns appears to occur during periods of heighted market volatility. Both how investors act during the market decline and how long it takes for a bull market to start encouraging capital to be redeployed.

This does not reduce or limit the efficacy of using ETFs as a low cost passive component of a portfolio. However, it does highlight the risks of actively trading in and out of ETFs as this can often lead to chasing performance and sub-par results.

Maybe Short-Termism isn’t that prevalent

In aggregate, some of this data and analysis appears rather damning for investors. Buying at the wrong time, selling at the wrong time, suffering the consequences. However some of this data is skewed. Chances are the majority of shares of SPY are buy and hold, while a small portion is churned by market timers, algos, speculators, etc. There is also evidence that following the last recession, Short-termism has been on the decline. The big banks exited high frequency trading (proprietary trading desks), which led to some improvements in volumes and turnover.

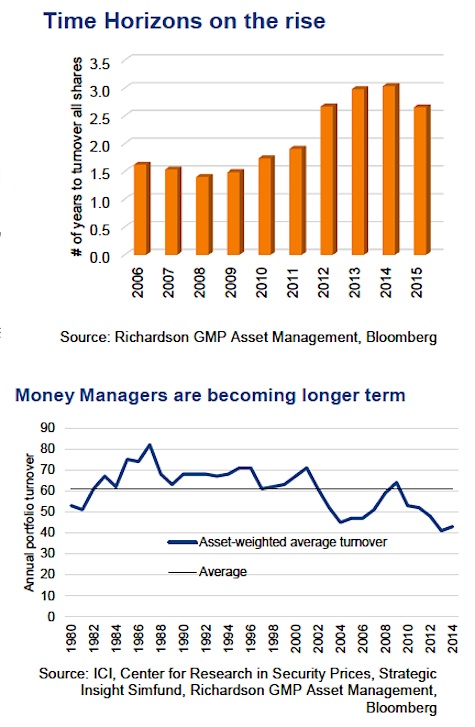

So how to look past some of these distortions. Putting the ETFs to the side as we don’t know who the traders really are, let’s look at individual company trading. We took the average turnover rate (in years) for the S&P 100 constituent members over the past decade. Now remember the SPY ETF turns over in seven days but the average turnover for these big cap companies was as low as 1.4 years in 2008 and has risen to 2.7 years in 2015.

There is more good news that investors are returning to longer term thinking. According to Dalbar, the average retention rate or holding period for funds has risen from a survey low of 3.86 years in 2008 to 4.78 years in 2014. This is clearly a sign of declining short-termism, yeah!!

Professional Money Managers

So are professional money managers suffering from Short Termism? Here too we find some encouraging data and trends. ICI, Center for Research in Security Prices and Strategic Insight Simfund have done research into the asset weighted average turnover within U.S. mutual funds. Their data goes back to 1980 and is represented in the chart to the right. In fact, the last couple years have seen the lowest turnover on record.

This is a healthy sign and we could argue that professional portfolio managers are less apt to chase performance. While that might be a tough argument, those that spend their days focused on the craft are probably less likely to react in knee jerk fashion when things go up or down quickly.

Connected Wealth Turnover

We manage about $400m across a number of strategies, most of which would be considered lower turnover. The chart to the right is the annual dollar turnover across all our equity mandates during the past year. Most of our mandates are in the 20-30% turnover range while the industry norm is closer to 40-50%.

Conclusion

- Lower transaction costs, overabundance of financial information and easier strategy implementation have likely led to shorter investor time horizons or holding periods. This appears more prevalent for those using ETFs.

- Investor behaviour, in the timing of purchases and sells for both ETFs and Funds, appears to significantly detract from long term wealth creation. Chasing performance, capitulating near market bottoms, not investing until later in bull market runs appear to be the biggest detractions from performance.

- While investor time horizons appear to be shorter, buy side money managers have been increasing their time horizons over the past few decades. There is also some signs investor time horizons are reversing and starting to increase lately.

- Don’t chase performance, don’t let your emotions manage your wealth.

Thanks for reading.

Twitter: @CraigBasinger and @sobata416

Get more research and analysis from Richardson GMP

Richardson GMP and/or clients may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.