As we move into October soon, I wanted to take a moment to highlight some of my recent daily columns from September.

On September 13, I wrote a Daily titled Why Higher Inflation Matters and Transportation is Key. In it, I highlighted that the transportation sector and the high-yield bond market would telegraph where the stock market was headed.

The following day, on September 14, I wrote another Daily titled The Market Stabilizes While Transports Hold Their Breath which reiterated again the need to keep an eye on the transportation industry (IYT) as a gauge of the health of our economy.

The next evening, September 15, FedEx made a shocking Thursday night earnings announcement about a massive quarterly loss and the withdrawal of financial guidance for the rest of the year.

As of Tuesday, IYT led the entire market lower.

Then, for last weekend, I wrote a column titled, The Biotech Sector Should Come Back First, and I explained that biotech, as represented by IBB, should be on your shopping list.

Wednesday, Biogen (BIIB) skyrocketed by 39% today, due to their Alzheimer’s drug being successful in a late-stage trial.

That and the QE announcement by the BoE sparked a major rally.

Yet, what about commodities?

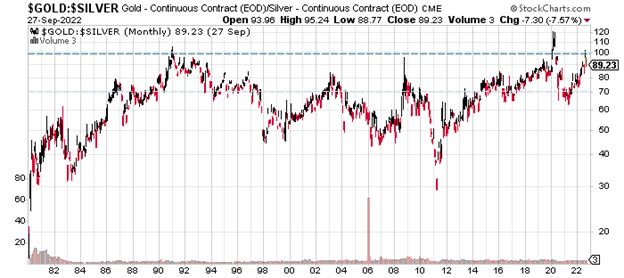

I also wrote a column entitled Is Silver About to Outshine Gold? I explained that when analyzing the trend or a trade-in gold (GLD), it’s a good idea to look at Silver (SLV) because trends in these metals tend to be reliable when they are in sync.

The Gold/Silver ratio.

The Gold/Silver ratio measures the amount of silver it takes to buy one ounce of Gold. Looking at the above Gold/Silver ratio since 1980, one can quickly identify the highs and lows.

Since the ratio has been published, only three times has it been above 95:1. The first time was in the early nineties.

It was at 95:1 intraday today and closed today at 89:1. Today, silver is cheaper than Gold. The Gold to Silver ratio is at historic lows.

Hence, I leave you with one more dose of free wisdom to consider silver and why it might outperform gold in the coming months.

If you find my columns valuable, I invite you to become a MarketGauge subscriber for more regular analysis and to sign up for my discretionary trading service.

You can sign up for a free consultation with Rob Quinn, our Chief Strategy Consultant, about your trading by clicking here. He’ll help you learn more about my top-rated risk management trading service and what level of personalized trading service might be exemplary for you.

Check out Mish’s latest in the Media:

Business First AM-Put Your Cash to Work 09-28-22

Coast to Coast Neil Cavuto Part 1 09-28-22

Coast to Coast Neil Cavuto Part 2 09-28-22

CMC Opto Markets: When to Put Cash Back to Work? 09-28-22

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Right into resistance however, with an impressive reversal bottom

Russell 2000 (IWM) Cleared some resistance but still needs to prove it can hold now about 167

Dow Jones Industrials (DIA) Right into resistance and still the weakest of the indices-300-301 needs to clear

Nasdaq (QQQ) 280 has to clear and 273 now major support

KRE (Regional Banks) Inside day right at the pivotal 60 level

SMH (Semiconductors) Holding key support but needs to clear 198-200

IYT (Transportation) Mean reversion-impressive hold of the monthly MA and 210 now major resistance

IBB (Biotechnology) Biogen helped this-if the bottom is in needs to hold 117

XRT (Retail) A nice looking bottom provided it clears 62 and holds 57

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.