Get ready for a terrible, horrible and otherwise very bad day.

It’s Friday the 13th. Stocks come into morning trade following a weak showing in yesterday’s session with the S&P 500 (SPX) closing lower after 7 consecutive closes higher and already there’s talk of bear machetes coming out to install a major market top.

Will equities narrowly miss attaining new all-time highs again, closing in a sea of red, narrowly skirt tragedy in pre-FOMC aimlessness or reassert themselves higher? Is a stock market pullback in the offing?

Here’s a quick look at where the broad US equity indices are this morning.

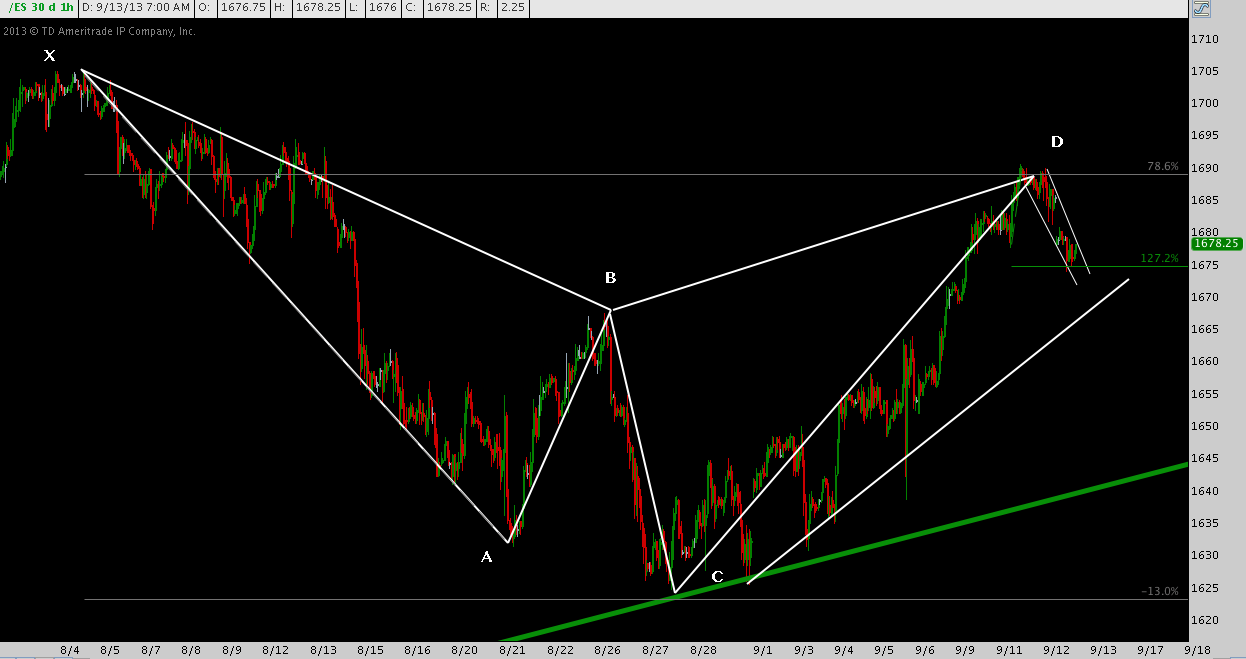

The S&P 500 was rejected at the 78.6% fibonacci retracement back to its August 5th all-time high after a near uninterrupted claw back up from 1625 two weeks ago. This comes at the potential reversal zone for a bearish Cypher harmonic pattern that caps out at 1690. Yesterday’s decline framed the index in a narrow descending channel to 1675 before bouncing modestly this morning. Immediate-term rising trend line support comes near 1670 with primary rising trend line support (green) running some 2% lower at 1645.

The Dow (DJIA) installed a very strong performance Wednesday +135 versus the S&P’s comparatively modest +5.14; and yesterday outperformed its broader counterpart once again. Dow Futures (YM) are in a clear high-and-tight flag consolidation: not always, but often a light stalling period before pushing markedly higher. A break above flag trend line resistance near 15335 and then a move over Wednesday’s high 15345 would be the first signs of this scenario unfolding.

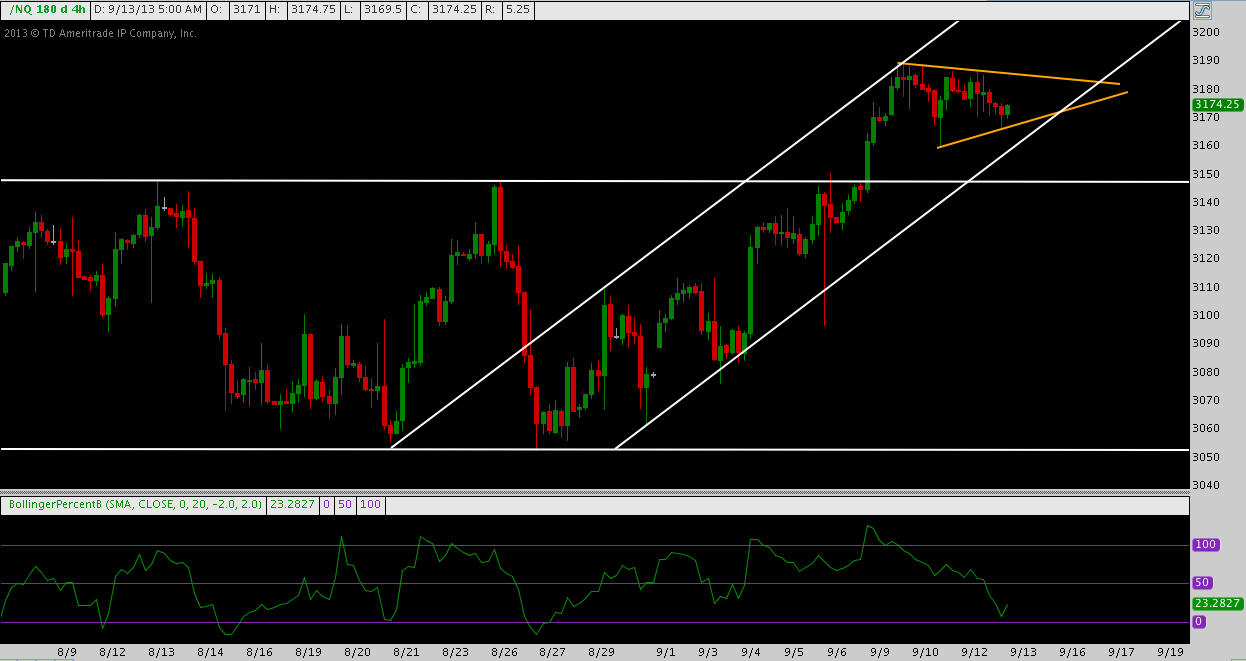

NASDAQ 100 futures (NQ) are likewise holding up well. NQ found support overnight near 3170 to formally create a short-term pennant (yellow). This week has been one of sideways movement for the NASDAQ with a mixed raft of events, including the lackluster reception of AAPL’s iPhone 5s and 5c and some disappointment concerning deeper entry into Asian markets. The index’s rising channel of its 08/26 low remains firmly intact, however, with NQ giving every appearance of correcting over time rather than by price.

Small Cap benchmark Russell 2000 (TF) shed nearly -1.5% off of early Thursday morning’s 1057.9 swing high, sliding yesterday and overnight through a descending channel much like the S&P 500. Early morning support has halted the decline at immediate time rising trend line support near 1043. After a brief bottoming pennant there TF has broken tentatively higher in AM trade.

Good luck out there today. Steer clear of the strong, silent hockey mask-wearing types.

Twitter: @andrewunknown and @seeitmarket

Author holds long Russell 2000 position as of time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.