The U.S. equity markets continue to grind higher as capital finds its way into U.S. denominated assets. Although the recent V-Bottom rally off the correction lows may not be healthy over the near-term, it does symbolize global investors’ desire to get involved in the markets. But, it’s interesting to see where investors are parking their money in 2014. Below is a quick sector performance review, highlighting leaders and laggards. Some of you may be aware of the general breakdown, but it’s interesting to see the defensive posture of the stock market.

The U.S. equity markets continue to grind higher as capital finds its way into U.S. denominated assets. Although the recent V-Bottom rally off the correction lows may not be healthy over the near-term, it does symbolize global investors’ desire to get involved in the markets. But, it’s interesting to see where investors are parking their money in 2014. Below is a quick sector performance review, highlighting leaders and laggards. Some of you may be aware of the general breakdown, but it’s interesting to see the defensive posture of the stock market.

Especially when one considers the recent vertical rally to new all-time highs. That said, I figured it would be good to highlight sector performance from a risk perspective.

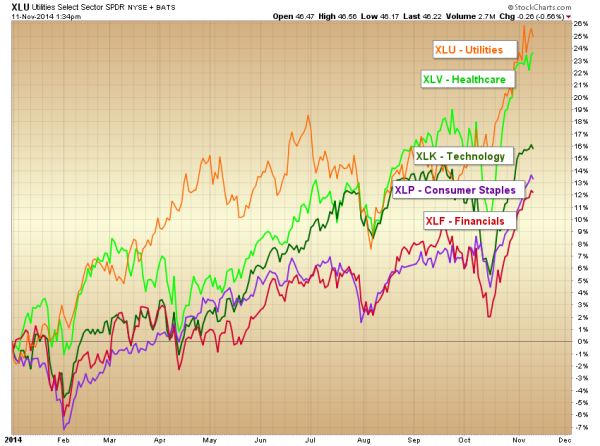

Over the weekend, I highlighted the strength of the Utilities sector in 2014. But this isn’t the only defensive sector leading the way in 2014. In the sector performance charts below, you’ll see that the Utilities Sector (XLU) and Healthcare Sector (XLV) are the leading sectors year-to-date. Both are up well over 20 percent year-to-date. Compare that to the S&P 500 (SPX) being up just over 10 percent (through yesterday’s close). The last time the Utilities lead the way was 2011 when the S&P 500 ended the year flat.

One more nugget: Utilities were the worst performing sector last year, while Consumer Discretionary (XLY) was the best. And with consumers leading the way, the S&P 500 was up 29.60%. This year, Consumer Staples (XLP) is a leader (things consumers need), while Consumer Discretionary is a laggard (things consumers want).

Sector Performance Chart – YTD Leaders

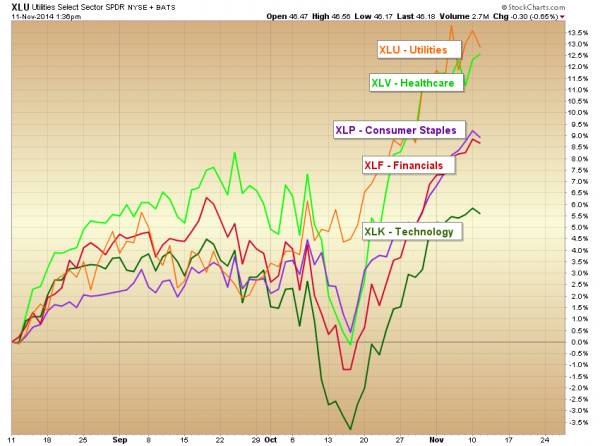

And looking at the 3 month chart below, you can see that Utilities, Healthcare, and Consumer Staples (all defensive sector) are leading the way out of the October lows!

Sector Performance Chart – 3 Month Leaders

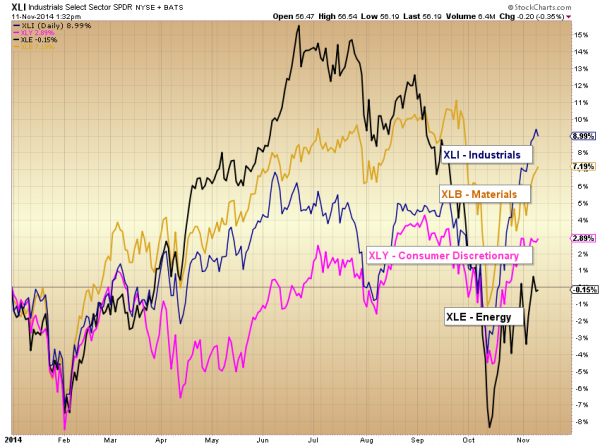

Moving on to the laggards, we see several cyclical sectors like Energy (XLE), Materials (XLB), and Consumer Discretionary (XLY) really lagging behind in 2014. Is this a warning sign, or perhaps some choppy consolidation?

Sector Performance Chart – YTD Laggards

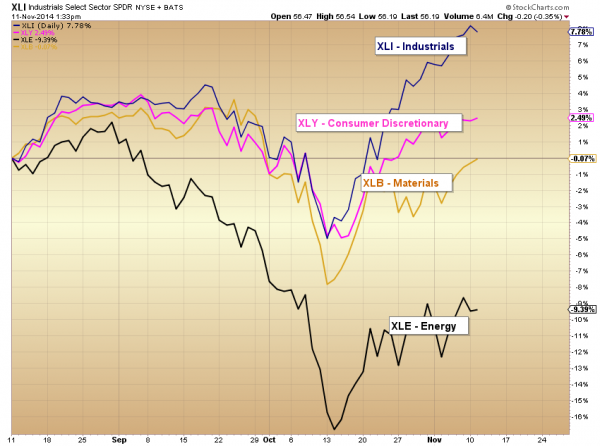

The only lagging sector to really perk higher on the 3 month chart is the Industrials (XLI). Perhaps that is sign that another round of rotation may occur into 2015.

Sector Performance Chart – 3 Month Laggards

Thanks for reading.

Follow Andrew on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.