When investors think of the Utilities Sector (XLU), they typically categorize (or mentally bucket) it as a defensive sector. It comes with a solid dividend and when the market sours, it typically offers strong performance. Now there’s plenty more going on in 2014 than this post will get at, but I wanted to take a quick look at Utilities performance in 2014 and offer some general thoughts and insights.

So, first of all, why am I writing a post on boring Utilities? Because they are literally rocking the house in 2014 with an electrifying rally. Here are a few quick insights about the 2014 Utilities rally:

- While the S&P 500 (SPX) is up 9.93% year-to-date, XLU is up 21.7%.

- The last time The Utilities outperformed like this was 2011, when SPX was literally even (no gain) for the year and XLU was up nearly 15 percent.

- When the RSI for XLU reached above 70 in February, the market continued to chop higher for a while before before turning lower in April. That period was also highlighted by a risk-off rotation to Large Caps stocks and stronger plays.

XLU vs S&P 500 Year-to-date Chart

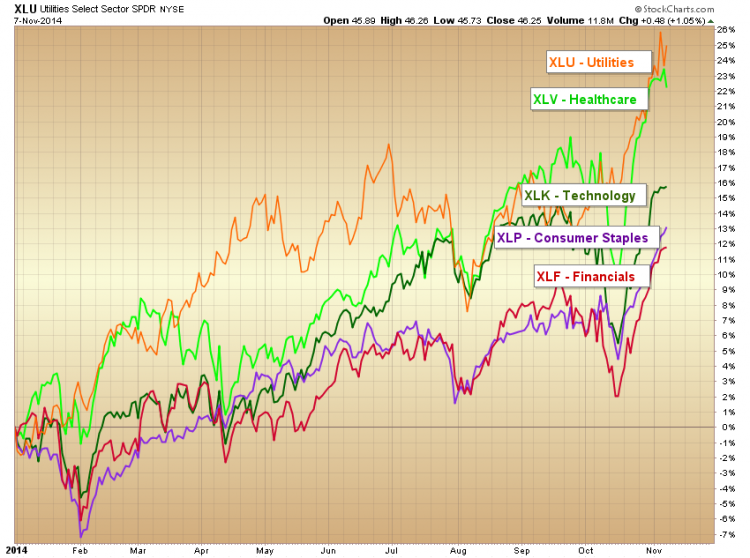

Below is one more chart looking at the 5 leading sectors in 2014. I’ll have more on sector leaders and laggards in a follow up post, but as you can see below the Utilities are leading the way. In fact XLU barely even registered the October correction. Other leaders include the Healthcare (XLV), Technology, (XLK), Financials (XLF), and Consumer Staples (XLP).

Sector Leaders in 2014

So what’s the takeaway? Well, in my opinion, this is simply another sign that investors continue to seek safer risk assets… yes, I used the word “risk” and “safer” in the same sentence. And they are attracted to higher yielding instruments. This has been a major theme of 2014: investors keeping risk-on, yet reducing risk by rotating into large caps and steady sectors.

But with Utilities going vertical of late, it’s another sign for investors to remain focused and aware that the market may see some choppiness over the near-term. Thanks for reading.

Follow Andrew on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.