In the markets, periods of consolidation are generally followed by periods of contraction.

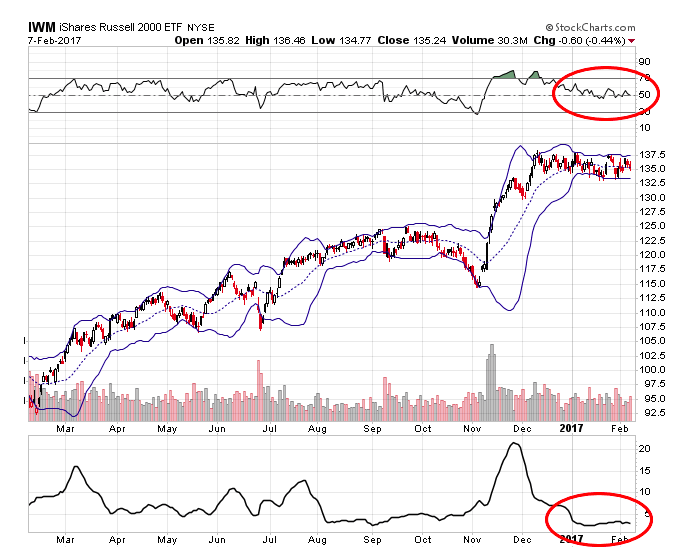

The Russell 2000 ETF (NYSEARCA:IWM) has been trading sideways for 2 months now. The Bollinger Bands are incredibly tight, the tightest we have seen in the last 12 months.

One way to play for a breakout (or range expansion) is via a long strangle. A long strangle is an option strategy that benefits from a large move in the underlying stock in a short space of time.

The trader doesn’t care which way the stock moves, as long as it moves a lot.

Traders can place the trade and wait for the move to play out.

The downside of the trade is that time is not on your side. Each day the stock doesn’t move, the position will slowly deteriorate thanks to time decay.

A long strangle has positive vega, meaning that the trade benefits from an increase in implied volatility.

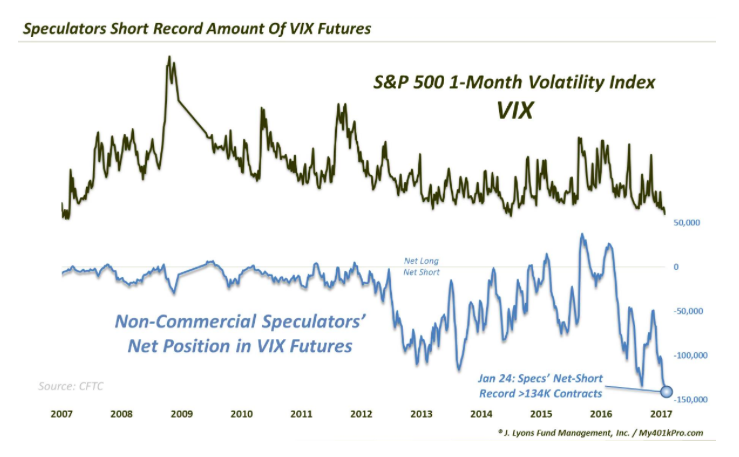

Dana Lyons recently reported that the short volatility trade is incredibly crowded right now. Generally when everyone is on one side of the market, things start to turn around, so perhaps we are going to see in increase in volatility shortly. This is not good news for anyone looking to start an iron condor, but it is good news for long strangle traders, provided the volatility increase does come.

IWM tends to move further than the other major indexes when a move occurs. Given that it has been trading sideways for two months, it could be an ideal candidate for a long strangle. RSI has been bouncing around the 50 level for a month indicating that a move in either direction could be imminent.

We know that financial markets are constantly changing and what has been slow and quiet will likely become volatile in the future.

I would expect volatility in the Russell 2000 ETF (IWM) to pick up at some point soon. To me, it seems like IWM is coiling, waiting for a big move, the perfect scenario for a long strangle.

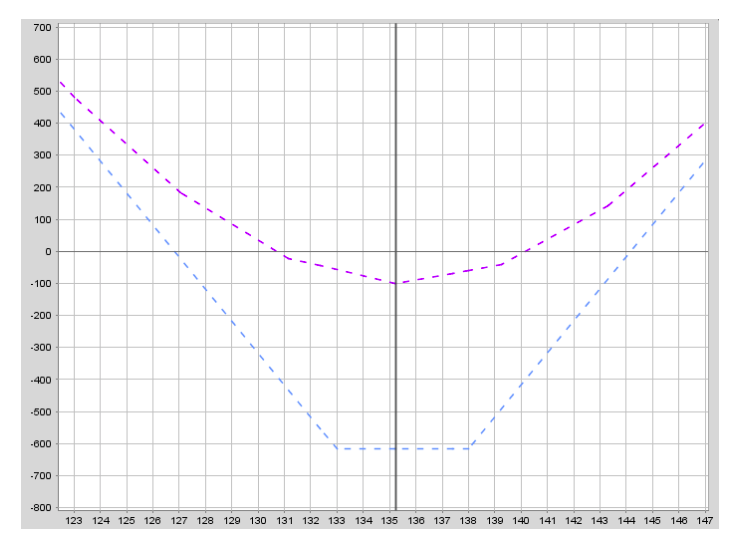

A trader wanting to employ this strategy could buy the April 21st 133 puts and the 138 calls. That trade currently costs around $616 per contract. This is the most that the investor can lost. Profits are theoretically unlimited.

This trade would need IWM to move above $144 or below $127 at expiry to be profitable. However, profits can be made from a smaller move if it occurs early in the trade, particularly if the trade is accompanied by an increase in implied volatility.

The chart below shows the profit or loss at expiry (blue line) and two weeks from today (purple line). You can see that the trade will not lose much money over the next two weeks if IWM fails to make a move and will begin to profit above $140 and below $131.

Long strangles are a great trade for investors expecting a big move in the price of the underlying, but are unsure which way that move will occur. Stocks and ETF’s that have traded sideways for an extended period are fantastic candidates for long strangle trades.

Again, these are idea for professional traders. The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not experienced in options trading or familiar with exchange traded options. Any readers interested in this strategy should do their own research.

Thanks for reading.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.