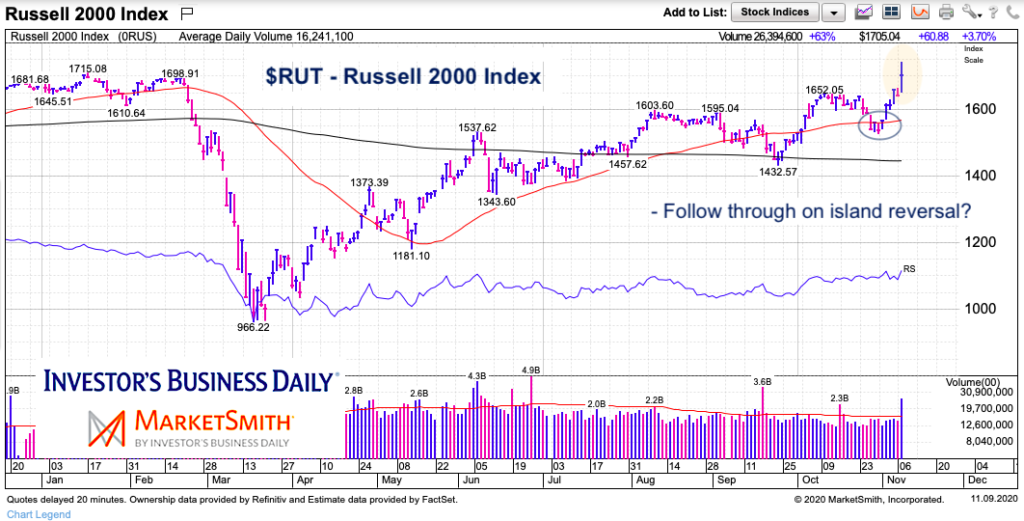

Small cap stocks have come back in a big way of late. The Russell 2000 Index is out-performing the broader stock market and it showed today.

The small cap Russell 2000 Index burst higher on Monday, trading up nearly 6 percent intraday before finishing up 3.7%.

That is a big day for stock market bulls. But, all things considered, it is an odd day to analyze. Why? Several broad stock market indices opened up “big” before selling off. The Nasdaq Composite, in fact, opened up “big” and ended up closing down on the day. Yikes!

Odd market. But that shouldn’t matter, as active investors have several opportunities in front of them every day / week. As they say, there’s always a bull market somewhere.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

Russell 2000 Index Chart

Today’s surge needs to be respected. In short, it’s bullish unless proven otherwise. I wouldn’t be hesitating had tech stocks (i.e. Nasdaq Composite) not sold off and closed negative. BUT, we are following price on the Russell 2000 Index and it is bullish right now.

We have an island reversal that now has bullish confirmation. We tested all-time highs today… so that is our new resistance indicator. A clear breakout to new highs will confirm this bullish pattern. Wait for it.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.