R1 (RCM) Stock Research

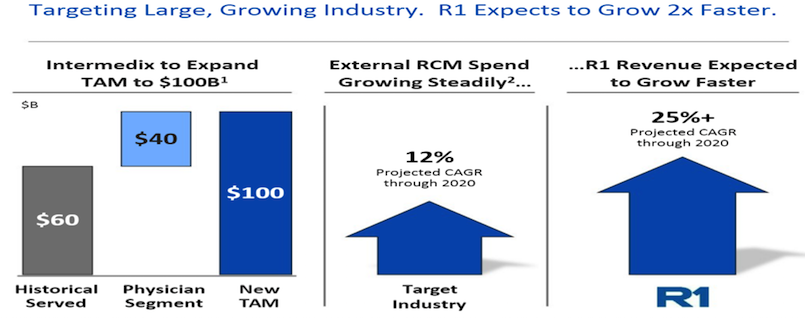

R1 is a leading provider of revenue cycle services and physician advisory services to healthcare providers. It is targeting a large Acute & Physician RCM market of $100B and forecasting $1.25B in revenues by 2020 from $450M in 2017 and expecting EBITDA to jump to $250M from $50M over the next three years.

The company drives financial improvement and a better patient experience by plugging into health providers’ existing IT systems resulting in lower costs, faster collections, and higher revenue. R1 (RCM) has shown strong revenue growth over the last seven quarters and is in the process of acquiring Intermedix to further build out the integrated revenue cycle. RCM paid $460M cash for Intermedix valuing it at 7.9X EBITDA with the deal expected to close in Q2. The deal expands its TAM to $100B from $60B.

The company can generate even more upside with new business wins, expansion of capabilities and cross-selling to an existing user base, and margin expansion through the benefit of scale and automation. RCM is around 6% EBITDA margins and sees 19% by 2020. Stats Sentieo & image from company presentation.

The $785M Company trades 59.1X Earnings, 1.75X Sales and 7X FY19 EBITDA. Competitors providing similar services include Cerner (CERN), Computer Program Systems (CPSI), Meditech (Private), and Epic Systems (Private). CPSI is the closest in size to relate and trades 11X EBITDA with single digit revenue growth and 16.5% EBITDA margins.

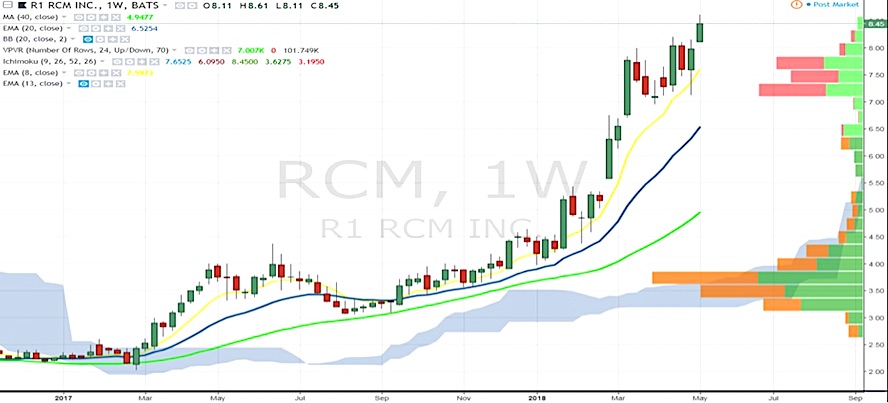

RCM has clear momentum moving out of consolidation this week and seen heavy accumulation volume, shares +80% YTD. RW Baird upgraded shares to Outperform in early April with a $9 target with expectations for momentum building the next few years and high visibility of the 2020 targets. Cowen doubled its target to $10 in March seeing further margin expansion ahead.

In closing, RCM is exactly the kind of small cap I look to invest in, offering growth above industry peers in a large and growing TAM, substantial margin expansion opportunities, and attractive valuation over highly visible three year forward targets. I realize there has been a surge in shares recently and see any small correction as a good long term opportunity for a stock that can easily double over the next few years.

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading and good luck out there!

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.