Is the Past Prologue to the Future?

The graphs above use conservative and relatively stable earnings and dividend assumptions. If the economy slides into a recession, not only may P/E ratios dip below the mean, but earnings and dividends growth may falter. The extent to which these measures adjust is often influenced by the extremity of valuations.

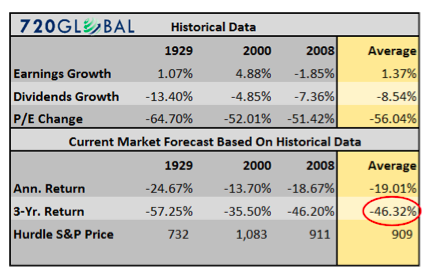

The following table highlights historical experiences that occurred the three other times that P/E ratios resided at or above current levels. The top half of the table displays the changes in the ten year average earnings growth, dividend growth and P/E ratios that occurred during the 1929, 2000 and 2008 market corrections. The bottom half of the table uses that data as its assumptions and forecasts how similar changes would affect total returns today.

Summary

Equity valuations are grossly dislocated from supporting fundamental data. Comparisons to historic norms, despite what Janet Yellen claims, are far from reality. Investors willing to study history and look at current data will come to the same conclusion. Those that do will also likely agree that the downside looms large as mean reversion is, after all, a powerful force in the markets.

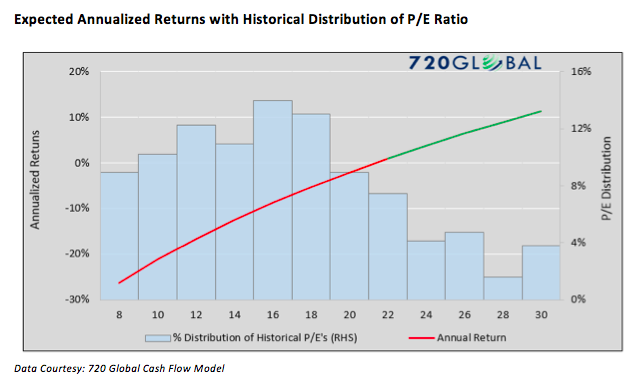

The purpose of this article is not to claim that the market will immediately correct. In fact, there are several reasons, however unsound, that valuations may indeed rise further. The point is to stress that the odds are not in your favor of that occurring. Any sort of regression to mean, or as frequently occurs below mean, will result in a sizeable market correction as shown. To reiterate this point, the graph below shows the range of returns associated with the various P/E ratios described earlier. Additionally, the bar chart backdrop illustrates the percentage of time the market traded at the corresponding P/E ratios. Based on this analysis, one should expect negative returns if P/E ratios revert to historical ranges.

The current economic recovery and equity bull market rank among the longest on record. Concurrently, domestic and global economic data are slowing markedly while U.S. corporate earnings are declining. Even more concerning, the Federal Reserve’s tool kit is sparse and their ability to continue to prop up the market appears limited. Given the aforementioned fundamental risks and the poor risk/return skew, history is clearly not in favor of those who remain long equities banking on the Fed to continue to levitate valuations and prices with limited tools and faulty narratives.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.