Looking back six months ago, we noted in our report that the setup for 2021 appeared ‘challenging’.

Well, ‘challenging’ it was not.

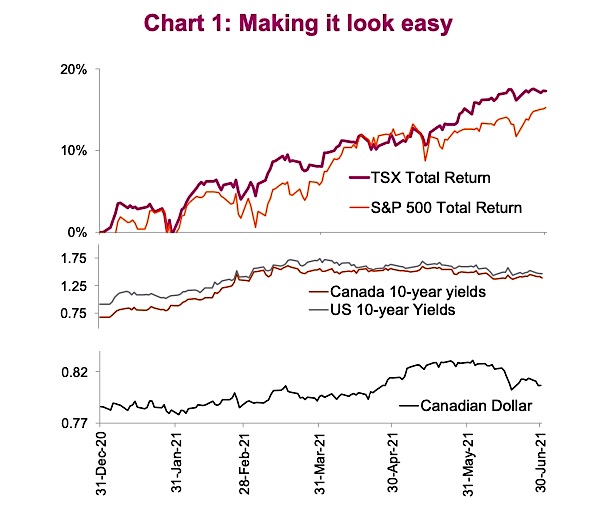

With the severity of the pandemic, vaccinations in early days and valuations at exorbitant levels, one would estimate that was a fair statement. An unbelievable run on equities so far this year has the markets defying everything from rising inflation to COVID-19 variants, with valuations in the nosebleed levels. No one can predict the future, but looking at chart 1, wouldn’t you agree that this looks a little ‘too easy’? However, if equities were a worry six months ago, we would say the paranoia of a pullback continues to increase.

The strong run in 2021 for markets can be attributed to three things: strong growth, strong earnings and low interest rates. A very lackluster bond market is the icing on the cake.

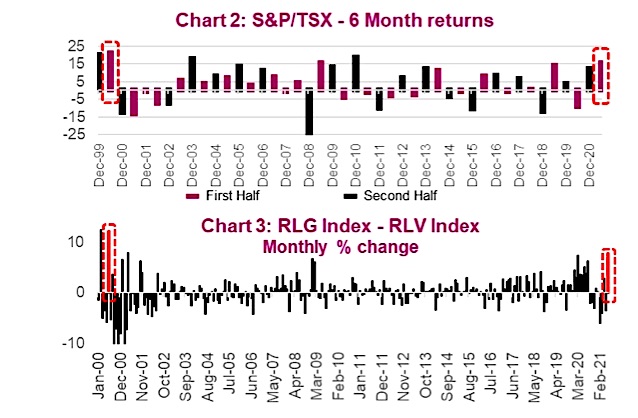

The S&P 500 registered its 5th straight month of gains, posting a +5.1% month in CAD for a six month return of +12.0%. The Nasdaq was the laggard early in the year, but really ramped up returns in June with a massive 8.4% CAD return. The 7th consecutive positive month out of 8 for the Nasdaq has the year to date return right up there with the rest of the major indices at +10.0% CAD. No one could have predicted that six months into 2021, Canada would be leading the world in equity returns. Shockingly, that is exactly where we are. It is so shocking in fact, that if you look at the historical six-month returns, the TSX posted its strongest first half return since 2000 (Chart 2). Although the halftime lead for Canada has condensed, we are still up 17.3% YTD.

Growth style investing has really dominated value for much of the past decade. However, in late 2020 value started to outperform. All the stars were aligned for value including a sizeable valuation discount, the re-opening of the economy that would benefit value due to the constituents being more economically sensitive, rising yields and rising inflation. And it looked like the great value rotation had started … until last month cast some doubt. Value stalled and growth rebounded, mostly due to a pullback in bond yields.

The reversal was so great that the Russell 1000 Growth index outperformed the Russell 1000 Value index by whopping +7.9%. The largest margin since, you guessed it, June 2000 (Chart 3). See the trend here?

The CAD/USD pulled back in June by -2.7%, settling in around $0.80 halfway through the year but remaining positive on the year by +2.7%. Yields rose from the ashes this year, from trough to peak, almost doubling. But since then, the US 10-year has levelled off at around 1.47%. The true story with yields lies with the real yields pinned at -2.2% by elevated Core CPI.

Stateside, large crude draws for the last five weeks show that the demand for oil continues to rise. New York WTI saw a +11% month to US$73.47/bbl. In any other year, this would be considered abnormal, but we have simply grown accustomed to these magnified moves. With an improving economy and talks of eventual taper, Gold consolidated this month by -7% to US$1,770/oz.

For the latter half of 2021, there are still risks remaining. Some choppy trading could ensure if the Fed continues discussing tapering or inflation runs too hot for too long. Unemployment benefits south of the border run out for many Americans in September which is something to keep an eye on too. But for now, as the great philosopher Dory said, Just keep swimming.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.