The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- S&P 500 EPS growth for Q2 is unchanged from last week at 6.7%, the lowest level since Q4 2020

- Retail reports last week showed a US consumer that was still strong in the second quarter, but that could be waning as we head into the second half of the year.

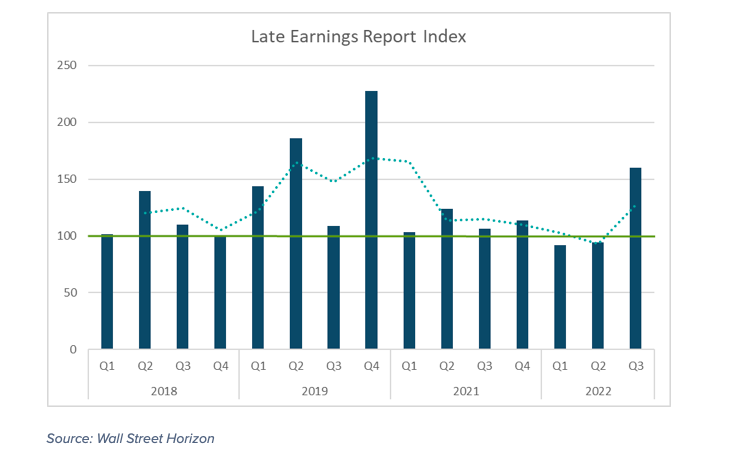

- The LERI ends the season with the highest reading in a year-and-a-half, pointing to a general feeling of uncertainty amongst US corporations.

- Q2 earnings season continues to wrap-up with final reports from retail and tech.

Last week we got some intel on the US consumer as retailers started reporting Q2 2022 earnings and July Retail Sales were published. While most of the news was positive, there were some hints of softening on the horizon.

Big box retailers such as Wal-Mart (WMT) and TJX companies (TJX), as well as home improvement names like Home Depot (HD) and Lowe’s (LOW) all reported better-than-expected earnings last week, while TJX and LOW missed Wall Street’s revenue expectations. Target (TGT) on the other hand garnered most of the attention when they missed bottom-line estimates by 50%, with sales in-line with sell-side expectations. The huge miss came as the retailer has struggled to unload excess inventory in categories that are now dealing with waning demand such as apparel and homewares.

And even as home improvement names were able to post decent results for the second quarter, the housing market showed signs of wear. July home sales fell nearly 6% MoM according to the National Association of Realtors, putting the US housing market in a recession according to the group. So far that hasn’t impacted forward estimates for HD and LOW which are still expected to post growth in H2 2022 and into 2023.

Retail sales for July were also reported last week, unchanged from June due in part to lower prices at the pump and falling auto sales. Excluding both gas and autos Retail Sales increased 0.7% for the month.

As Q2 Earnings Season Closes, the LERI Ends at its Highest Level in Over a Year

With 84% of companies now reporting for the second quarter, the LERI remains at its highest level since the Q3 2020 earnings season. The quarter ends with a reading of 160, on par with Q1 2020’s reading of 147, showing US corporations are uncertain about their future growth prospects.

The LERI (Late Earnings Report Index) tracks which companies are confirming off-trend earnings dates. Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call, and the reverse is true, an early earnings date suggests good news will be shared. The idea is that you’d prefer to delay bad news, but when you have good news you want to run out and share it. A LERI reading over 100 indicates more companies are delaying reports and is meant to be watched carefully.

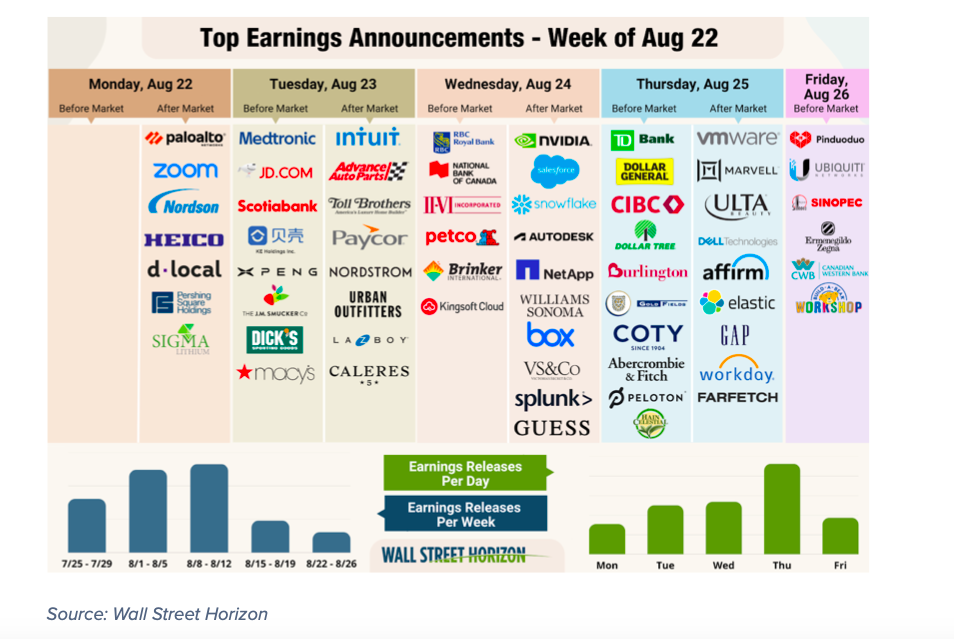

A Final Trickle of Retail and Tech Reports Out This Week

This week earnings releases slow down dramatically, with the final group of reports concentrated within the retail and tech industries. We will hear from department stores Macy’s (M) and Nordstrom (JWN), apparel names such as Urban Outfitters (URBN), Abercrombie & Fitch (ANF) and Gap (GPS), as well as enterprise tech players Splunk (SPLK), Workday (WDAY), and Zoom (ZM). A few highly-followed names will also announce results: Nvidia (NVDA), Peloton (PTON) and Snowflake (SNOW).

Earnings Wave

Earnings reports drop off precipitously this week with only 662 companies anticipated to report. Roughly 94% of companies have confirmed at this point (out of our universe of 10,000 global names), with 84% of those names reporting already. The Q3 2022 earnings season is scheduled to begin the week of October 10 when the big banks begin reporting.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.