The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Earnings Research Overview and Highlights:

- S&P 500 EPS growth for Q2 is set to come in at 4.3%, the lowest level since Q4 2020

- Themes for Q2 and H2 2022: rising interest rates, inflationary pressures, recession risk

- The LERI points to more companies delaying earnings reports than advancing them to an earlier date, a sign of uncertainty on the horizon

- Some big names have yet to confirm Q2 earnings dates, or confirmed unusually late (Costco – stock ticker COST, 3M – stock ticker MMM, Intel – stock ticker INTC)

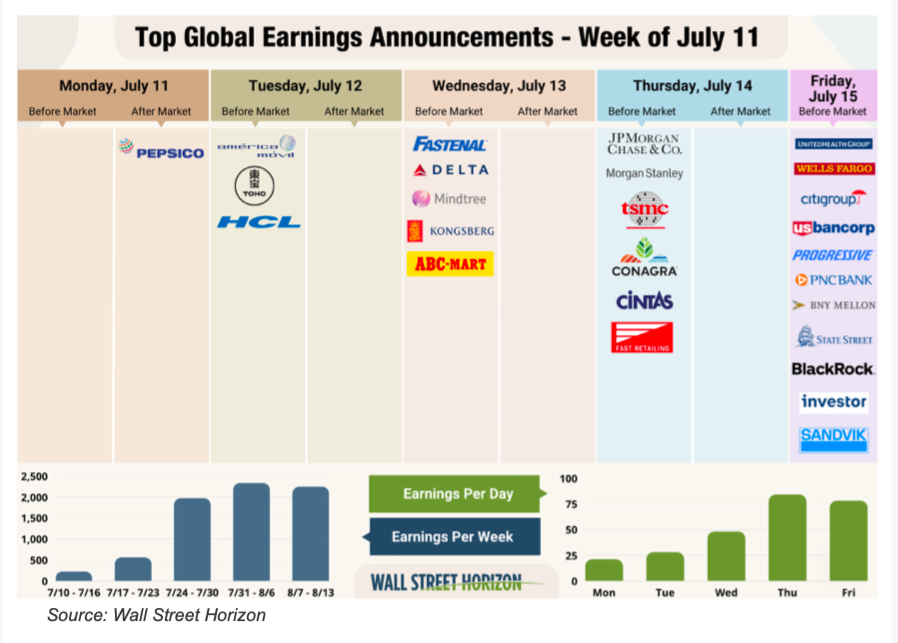

- Big banks kick things off with JPM and MS reporting Thursday

- Peak weeks for Q2 season from July 25 – August 12

Expectations for Q2 Corporate Earnings Reports

Second quarter 2022 earnings season kicks off on Thursday with results from JPMorgan Chase and Morgan Stanley. After a year and a half run of stellar earnings reports in the aftermath of the COVID-19 bear market, historic profit growth and enthusiasm from corporate America is starting to wane.

The blended EPS growth rate for companies in the S&P 500 currently stands at 4.3% according to FactSet. Analysts have started to temper back their expectations since the close of Q1, bringing the expected profit growth rate down 1.8 percentage points (estimated growth for Q2 was 5.9% on March 31), a reversal of the trends we saw in 2021 where there was upward momentum heading into each quarterly earnings season. If this is the final number, it will mark the lowest growth rate since Q4 2020 reported 3.8%. Revenues are expected to come in at 10.1%, the sixth quarter of double digit sales growth and a slight increase from the 9.6% estimate on March 31.

Rising Rates, Inflation, and Recession Fears in Focus

There is no doubt that rising interest rates and inflationary pressures will be top of mind for corporate management on Q2 calls. Mentions of these two headwinds have been picking up this year and are likely to continue. With the target federal funds rate now at 1.5%, the highest level in 2 years, and consumer prices ticking up 8.6% YoY in May, fears of a recession are increasing. Expect many corporations to make note of these concerns on Q2 calls, and to lower Q3 and CY 2022 guidance as a result. According to FactSet, Q2 guidance is already more negative than average. Of the 103 S&P 500 companies that have provided guidance, 69% of those issuances are negative.

Two metrics we’re looking at in particular as signs of waning corporate confidence:

LERI (Late Earnings Report Indicator)

We’ve been diligently tracking “corporate body language” for the last 15+ years, that is the non-verbal cues that publicly traded companies send to the market both intentionally and unintentionally. One tell a company can give regarding their financial health is the timing of their earnings release. Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call, and the reverse is true, an early earnings date suggests good news will be shared. The idea is that you’d prefer to delay bad news, but when you have good news you want to run out and share it.

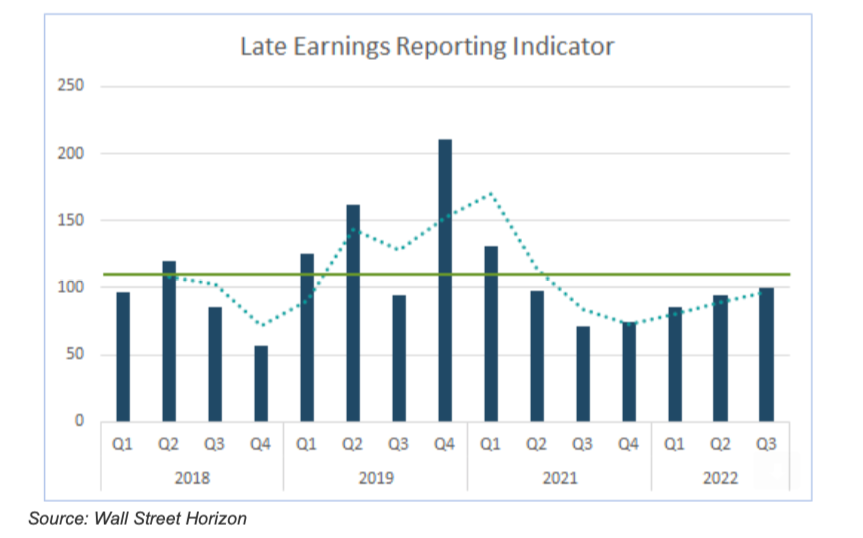

The LERI (Late Earnings Report Indicator) encapsulates this sentiment. It looks at the number of outlier earnings date confirmations and whether companies are confirming earnings dates that are later than they have historically reported, or earlier. The 5-year average for this indicator is 146, meaning that anything above this average suggests companies are confirming later earnings announcements and below this average indicates companies are confirming dates that are earlier. Thus far we see a LERI of 100 for the Q2 season, lower than the 5-year average, but higher than the last 5-quarter average of 85, suggesting the good times corporations enjoyed in the post-COVID bull market are slowly starting to fade. It’s important to note, however, that 2020 was an anomaly, if we remove this year the 5-year average is 111.

Confirmation Timing

We’re also seeing a lower number of companies confirming earnings dates at this point, a total of 726 companies have confirmed (as of Friday) vs. last quarter’s total of 748.

Big names like Costco have yet to confirm their Q2 earnings date, and others such as Intel and 3M just recently confirmed, 3 months later than expected. All of these companies tend to confirm their next earnings date the day after the previous quarters earnings date and we have an A confidence score for each which means they are usually very consistent. Confirming later than usual is consistent with uncertainty and poor guidance to come.

Banks Kick Off Q2 Earnings on Thursday

Financials are expected to be the biggest laggard when it comes to Q2 earnings growth (-23.9%), and the second biggest laggard in revenue growth (2.3%) (Data from FactSet).

The sub-sectors that are the biggest contributors to decelerating growth are consumer finance (-35%) and banks (-25%) (FactSet). Consumer related industries are starting to take a hit as spending slows due to inflation and recession fears.

Banks face a similar uphill climb in a number of areas. Those with a large mortgage lending concentration such as WFC and JPM will suffer as originations and margins are under pressure and lending has cooled after a stellar two years. Freddie Mac said in a statement on Thursday that US Mortgage rates for a 30-year loan fell to 5.3%, the biggest one week decline since 2008.

Banks with a large portion of revenues coming from investment banking activities will have to deal with the current slowdown in IPO activity from Q2. According to Ernst & Young, the global IPO market saw 305 deals raising US$40.6b in proceeds, a decrease of 54% and 65%, respectively, year-over-year.

While higher rates are good for interest income, if rates increase too much and infringe on economic growth then it begins to offset any benefit and become problematic for bank growth.

One pro for banks this quarter would be the sustained high volume of equity trading and volatility, still driven by retail participation in the markets, which would benefit trading revenues.

Thursday, July 14, 2022

JPMorgan Chase (JPM) – Earnings release BMO, conference call 8:30AM ET

Morgan Stanley (MS) – Earnings release BMO, conference call 9:30AM ET

Friday, July 15, 2022

Citigroup Inc. (C) – Earnings release BMO, conference call 11:00AM ET

Wells Fargo & Co. (WFC) – Earnings release BMO, conference call 10:00AM ET

BlackRock, Inc. (BLK) – Earnings release BMO, conference call 8:30AM ET

PNC Financial Services (PNC) – Earnings release BMO, conference call 8:30AM ET

U.S. Bancorp (USB) – Earnings release BMO, conference call 9:00AM ET

The Bank of New York Mellon (BK) – Earnings release BMO, conference call 8:00AM ET

State Street Corp (STT) – Earnings release BMO, conference call 12:00PM ET

Earnings Wave

This season peak weeks will fall between July 25 – August 12, with August 4 predicted to be the most active day with 1,087 companies anticipated to report. Only ~38% of companies have confirmed at this point (out of our universe of 10,000 global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.