One thing I’ve been watching closely over the last couple of years is the pace of global trade growth. In the lead up to the market turmoil in late 2015 and the near-miss recession in 2016 there was effectively a “mini recession” in global trade growth.

I talked about this as a key downside risk at that time. But no more.

More recently my global trade leading indicators and high frequency hard-data indicators are showing a very different picture now. So while we might get protectionist headwinds at some point soon if Trump has his way (and that’s looking more like an *if*), for now the story is one of improvement.

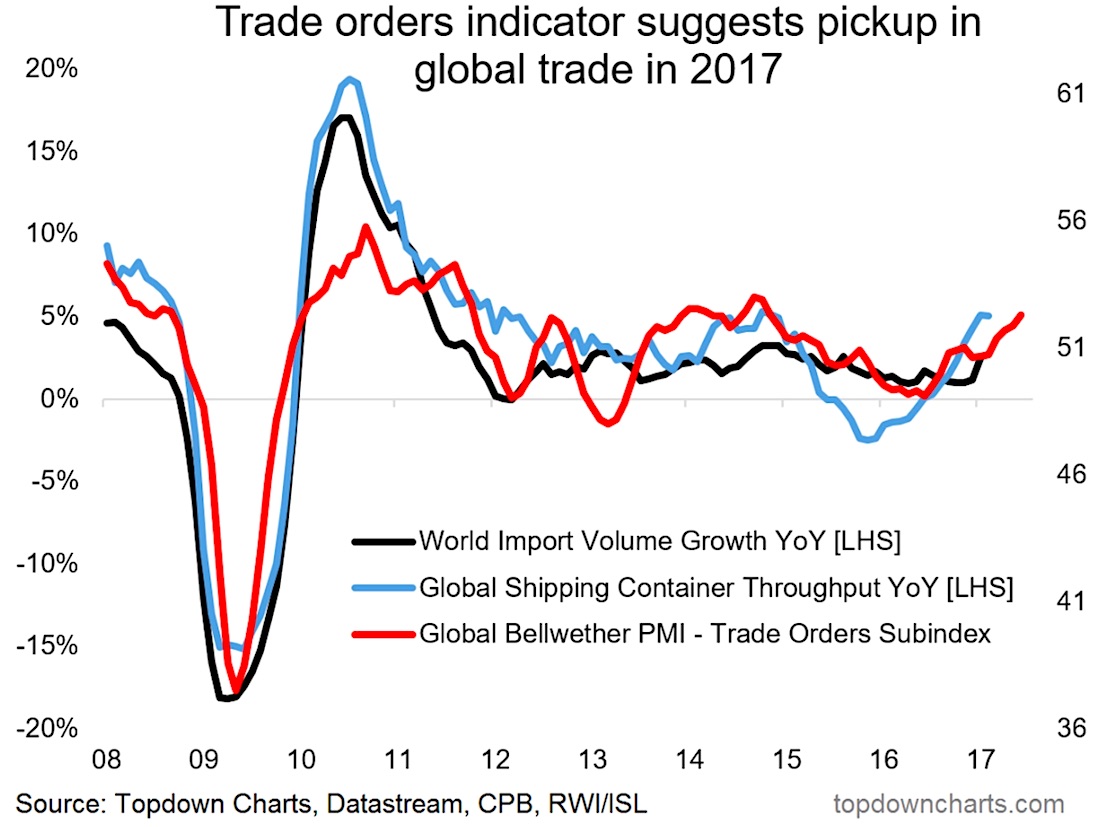

The chart comes from the latest edition of the Weekly Macro Themes in a segment that focused on the big picture global macroeconomic context to help inform the macro view.

Global Trade Indicator Chart – Suggesting Growth

It shows 3 lines (2 hard data, 1 leading indicator – a survey). First on the 2 hard-data lines; one is the RWI/ISL global container throughput index which comes out faster than the other one which is more comprehensive – the Netherland’s CPB global trade volume tracker. Both basically track global trade activity and ignore the value/price swings by looking at volume of stuff.

The survey line is the manufacturing PMI export and import sub-indexes of a collection of key economies (which are important in the global economy and heavily involved in trade). It has provided about a 4-6 month lead on global trade volume growth and was the reason I called for a global economic upturn in the second half of last year – which is still running its course.

The reason why this chart matters, or more to the point, why improving global trade activity matters is that it provides a real activity and hard data backing to the idea of a global synchronized economic upturn. Global trade is a key mechanism by which growth can spiral up (or down!), so stronger numbers here bode well for a stronger global economy. That means a positive backdrop for corporate earnings, more inflationary pressures all else equal, and thus higher bond yields (sooner or later!).

Thanks for reading.

READ: Global Equities Earnings Are Accelerating

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.