The Federal Reserve Act, as mandated by Congress, established a dual mandate of price stability and maximizing employment to guide the Federal Reserve (Fed) in setting monetary policy.

Price stability, the topic of this article, allows investors, corporations, and consumers the ability to better predict future prices and optimally allocate their investments and spending. The benefits pay dividends not only to those directly involved but importantly to the health of the economy and prosperity of the populace as well.

To consider why price stability is important, consider an oil producer deciding whether or not to invest in a new well. To simplify, assume the producer needs only to consider three variables to properly evaluate the project: (A) investment costs (fixed/variable), (B) a reliable estimate of the amount of oil that may be extracted, and (C) the future price of oil. If the expected return (B x C / A) projects a return above their bogey they might go ahead with the project. The company has reasonable control over investment costs and comfort around their surveying methods to determine the well’s success. Missing however, is that they have no control over the price of oil in the future. Therefore, the more stable and predictable the future price of oil, the more confidence the producer will have regarding achieving the expected return and the decision about a new well.

The Federal Reserve’s Definition of Price Stability is Likely Different than Yours

As laid out in the above scenario, the Fed’s price stability objective appears to be constructive for people tasked with making investment decisions. The problem we raise here is not the objective, but how the Fed defines “price stability.” Currently, the Federal Reserve believes that their mandate to maintain “price stability” would be met if prices, as measured by the Core Personal Consumption Expenditures deflator (Core PCE- Fed’s preferred inflation gauge), were to increase at a rate of 2% per year.

That mandate, as they define it above, is assumed reasonable and to our knowledge has never been challenged in congressional testimony, Federal Reserve press conference or during a question-answer session following a speech.

Ask your spouse, family member or friend what price stability means and they will likely describe a constant price for goods and services over time. Corporate executives and investors would likely answer similarly.

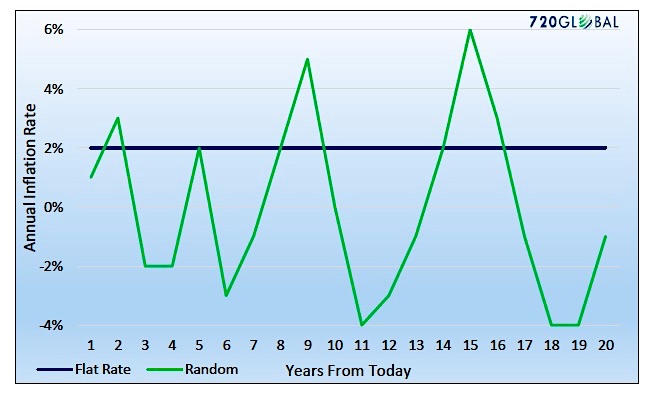

It is this juxtaposition between the Fed’s definition of price stability and the definition most people would use that is worth exploring. More specifically, how has the Federal Reserve sold the public on the idea that inflation targeted at 2% and price stability are the same thing? The chart below illustrates two annual rates of price changes to help us answer that question.

In this graph, which is more stable, the blue or the green line?

We venture to guess that the intuitive response is the blue line. The problem with that answer is that it does not consider the effects of consistently rising prices over time.

To maximize profits or quality/quantity of consumption, investors, corporations, and consumers are better served with predictability – the effect of price changes over the long term. Given the long time frames associated with investments, capital expenditures and even the consumption of higher-priced goods, monthly or annual variations in the rate of inflation does not impart much information of value. Longer term price trends and their effects on the value of the dollar are what matter most.

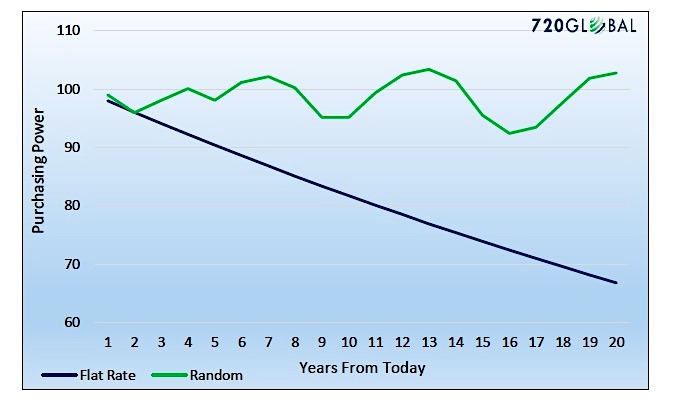

The graph below charts the purchasing power of $100 over a 20 year period using the respective annual inflation rates from the graph above.

At a “stable” 2% rate of annual inflation (blue line), the purchasing power of the dollar will diminsh appreciably. Said differently, the car you like today priced at $35,000 will cost $52,000 under a “stable price” regime in 20 years. Conversely, under the random scenario (green line), with less predictable year to year price changes, the purchasing power of the dollar remains largely intact for the entire period. Now reconsider the question asked earlier, which scenario is more stable? Which scenario provides decision-making confidence to the oil executives or anyone else deciding how to invest or spend their money?

Summary

As the overhang of debt obligations mount and the productivity of debt declines, America finds itself in a hole. From this difficult position, the massive debt burden must be reduced if we are to generate sustainable economic growth of years past. This task can be done organically or it can be done as it has been for the last 20 years, by manufacturing lower than reasonable interest rates to reduce the debt service burden. The other option is to relieve the debt anvil by way of inflation.

The Fed has opted for the expedient but ill-advised policy path of artificially influencing interest rates lower and inflation targeting. This path is not only destructive for the U.S. dollar, but it is also destructive for the standards of living for citizens, the effects of which are only just beginning to become evident. This policy cocktail to “manage” economic growth has created the optics of prosperity through financial asset price inflation, however, it lacks the requisite economic growth to support valuations. Unfortunately, this cocktail ultimately produces a hangover that only promises to get worse.

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” – J.M. Keynes

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.