Stocks are primarily unchanged or trading slightly higher as pressures from rising food and energy prices persist.

As I reiterate, among the war’s immediate external financial implications are disruptions in global supply lines for cereals, fertilizers, metals, and energy, all of which are passed on to global consumers in the form of quickly rising food and gas prices.

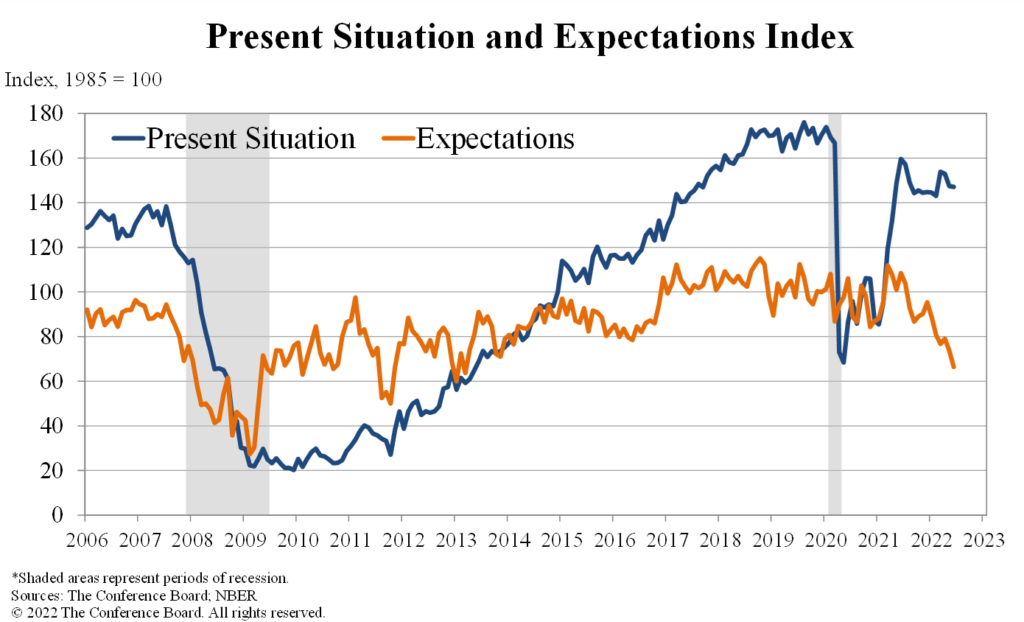

The consumer expectations fell to a 9-year low according to the Conference Board Expectations Index released yesterday. It showed a sharp decrease in June.

Expectations have already dropped significantly, implying slower growth in the second half of 2022 and a greater chance of recession by the end of the year.

However, with Personal Consumption Expenditure numbers (PCE) out in the morning, what is the market is trying to tell us?

The long bonds or 20+ year treasury bonds, rallied with yields slightly declining. An interesting event considering the calls for recession, the persistent inflation and Powell stating that the economy is in great shape.

Also, interesting ahead of the PCE is that oil, metals, and some foods declined in price. However, the PCE number excludes food and energy.

It appears that if you combine Powell’s optimism, the prevailing thought of peak inflation and the performance of the long bonds, the market is saying that the PCE number will be regarded less inflationary but also regarded as an indication that the consumer is slowing down.

If that turns out to be the case, we expect the market to think Powell will act slower on rate raising in July. That in turn could bring some rally to the indices, which right now are teetering on support.

Things We Are Watching:

Grains and metals are deeply oversold.

Yields to hover around 3%

The SPX levels of support for a near-term tradable bottom.

Retail sector (XRT) the most beat up, must close over 60.72 or the 200-WMA for any rally to sustain

Transportation (IYT) another key-to hold over 212 or its 200-WMA

Get your copy of “Plant Your Money Tree: A Guide to Growing Your Wealth”

and a special bonus here

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) 378-380 support zone

Russell 2000 (IWM) Support is 170 and needs to clear 174 to stay in the game

Dow (DIA) 307 support and needs to clear 315

Nasdaq (QQQ) 282.50-283 pivotal and 290 resistance

KRE (Regional Banks) 56 the 200 WMA 60 resistance

SMH (Semiconductors) 209-210 needs to clear

IYT (Transportation) 211.90 support with resistance at the 50-DMA 231.70

IBB (Biotechnology) Above the 50-DMA with resistance on weekly chart at 121.15 support at the 50-DMA 116

XRT (Retail) 58.95 support to hold and 60.75 the point to clear

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.