In the investment world, the game never ends… the score simply changes. And at the moment, traditional portfolio diversification, the type you’ll find from your local run-of-the-mill financial advisor, is losing in a major way.

You’ve heard it before: You must “diversify”! Jim Cramer even popularized the phrase “diversification is the only free lunch”. Actually, I’d argue portfolio diversification has been stealing your lunch money the last few years.

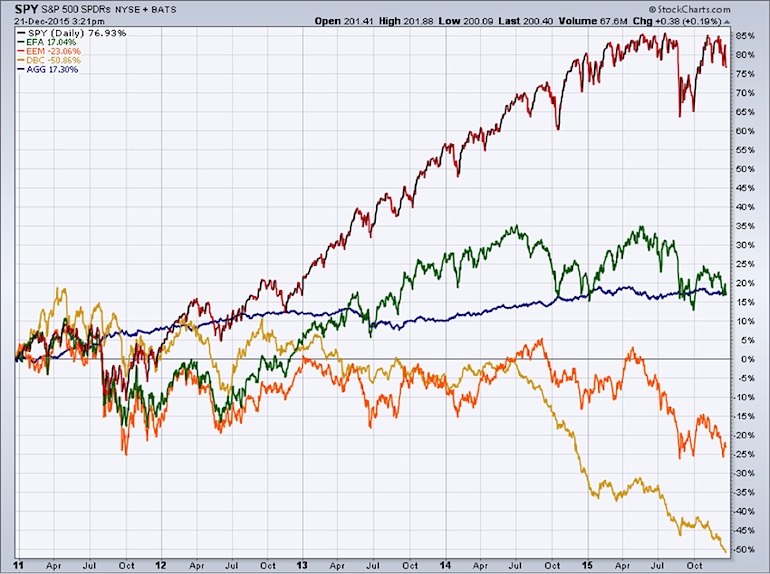

Consider the performance over the last five years of traditional portfolio diversifiers such as international stocks (EFA), emerging market stocks (EEM), commodities (DBC), and aggregate bonds (AGG). While the exchange-traded fund SPDR’s S&P 500 Index (SPY) is higher by 76.93% in price-only returns the last five years, the best of these diversifiers has generated price-only returns of 17.30% (aggregate bonds) and the worst has lost -50.86% (commodities).

In the equity space, the emerging markets, as measured by the exchange-traded fund EEM, has declined -23.06% in price-only over the last 5 years, a lag of 99.99%! It’s safe to say the average retail investor has underperformed the S&P 500 massively over this time period.

Performance Across Asset Classes (2011 to 2015) – Is Broad Portfolio Diversification Working Here?

Now, the point of this article is not to demonize the long-term benefits of portfolio diversification. It’s as certain as death and taxes that there will a 5-year period where the returns of the last five years will be completely inversed.

The point is to challenge Wall Street’s conventional wisdom. Wall Street’s idea of “diversification”, a colorful pie chart combined with annual rebalancing, has essentially sold the retail investor a bill of goods. Contrary to popular belief, you do not have to be “diversified” through all market conditions, just like you do not have to passively own equities through all market conditions. Furthermore, a colorful pie chart and annual rebalancing for no other reason than a change in calendar year is not the holy grail of investing for success over the long-term. Even Harry Markowitz, a godfather of portfolio diversification has been critical of Wall Street’s manipulative twisting of “Modern Portfolio Theory”. In a 2010 article Harry was quoted as saying:

“I’ve never been a buy and hold guy,” and he thinks his “modern portfolio theory” has been misapplied into naively staying the course when deeper analysis is warranted.” – Chicago Tribune

The last five years were one of those time periods when “deeper analysis” was warranted. Rather than staying the course and rebalancing to laggards each of the last five years, investors could have challenged conventional wisdom and attempted to analyze the merits of portfolio diversification more closely.

A personal favorite of mine is to rely on ratio charts to identify relative strength among the securities considered for portfolio inclusion. A classic example is the decision to diversify your equity allocation globally by including both domestic and international stocks. Wall Street would suggest your portfolio always takes a global view, and I’d suggest you ask Wall Street…why?

Let’s look at an example.

continue reading on the next page…