There are pockets of forced selling taking place in the global markets, and I find it curious that these different asset classes are politely ‘taking turns’.

Below I identify these asset classes and try to find meaning for investors in the forced selling… and rotation.

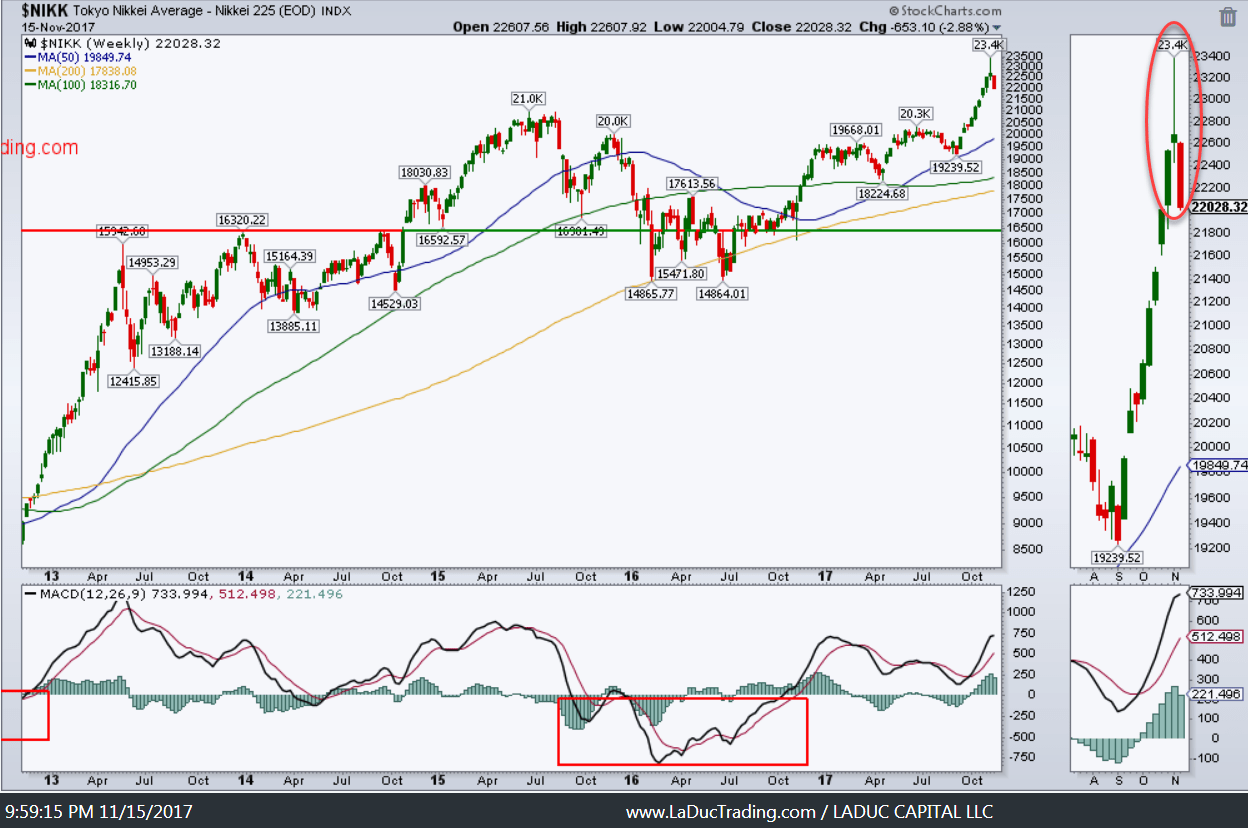

JAPAN: November 9th the Nikkei went from +2% to -1.7% to almost even in one session. That’s called Volatility. But with that 1,100+ point move, it was The Tell the Nikkei was putting in a big reversal in Japanese stocks.

Nikkei 225 Index Chart – selling candles

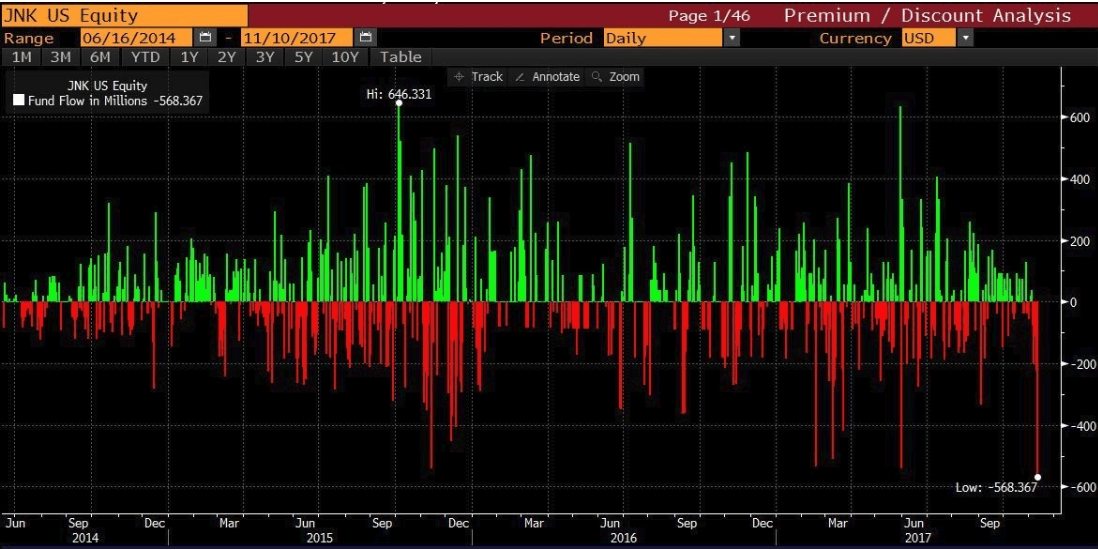

JUNK BONDS: We had some significant selling in high yield corporate debt and junk bonds since the 1st of November. The ETF $HYG (NYSEARCA:HYG) is down around 2.3% from its late October high while $TLT is up around 3.4% from its late October low. That doesn’t sound ‘impressive’ but this credit market is YUGE so it matters. In fact, “the high yield ETFs and mutual funds had a combined $4.43 billion in outflows. These were the largest outflows in over 3 years and the 3rd largest week of outflows ever. The second largest was in August 2014. The HYG ETF had $1.43 billion in outflows from last month and the $JNK ETF (NYSEARCA:JNK) had $934 million in outflows.” That’s some forced selling.

Junk Bonds ETF Fund Flow Chart

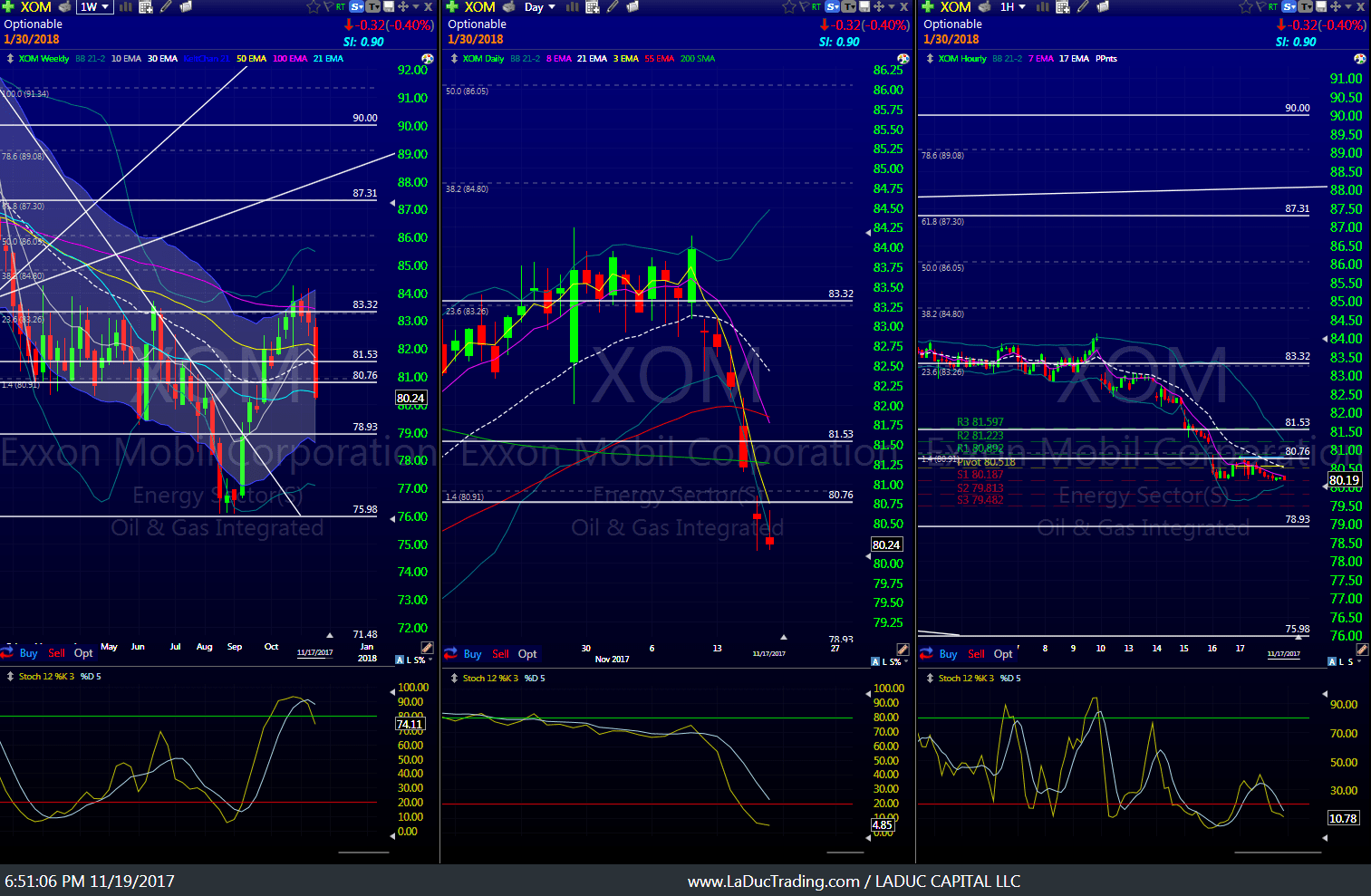

OIL: Oil rolled over about the same time as Japan with ExxonMobil (NYSE:XOM) being sold off forcibly.

Norway’s sovereign wealth fund made headlines when they announced they would sell their oil equities from their sovereign wealth fund, including XOM. From Bloomberg:

The $1 trillion fund that Norway has amassed pumping oil and gas over the past two decades wants out of petroleum stocks. Norway, which relies on oil and gas for about a fifth of economic output, would be less vulnerable to declining crude prices without its fund investing in the industry, the central bank said Thursday. The divestment would mark the second major step in scrubbing the world’s biggest wealth fund of climate risk, after it sold most of its coal stocks.

“Our perspective here is to spread the risks for the state’s wealth,” Egil Matsen, the deputy central bank governor overseeing the fund, said in an interview in Oslo. “We can do that better by not adding oil-price risk.”

The plan would entail the fund, which controls about 1.5 percent of global stocks, dumping as much as $40 billion of shares in international giants such as Exxon Mobil Corp. and Royal Dutch Shell Plc. The Finance Ministry said it will study the proposal and decide what to do in “fall of 2018” at the earliest.

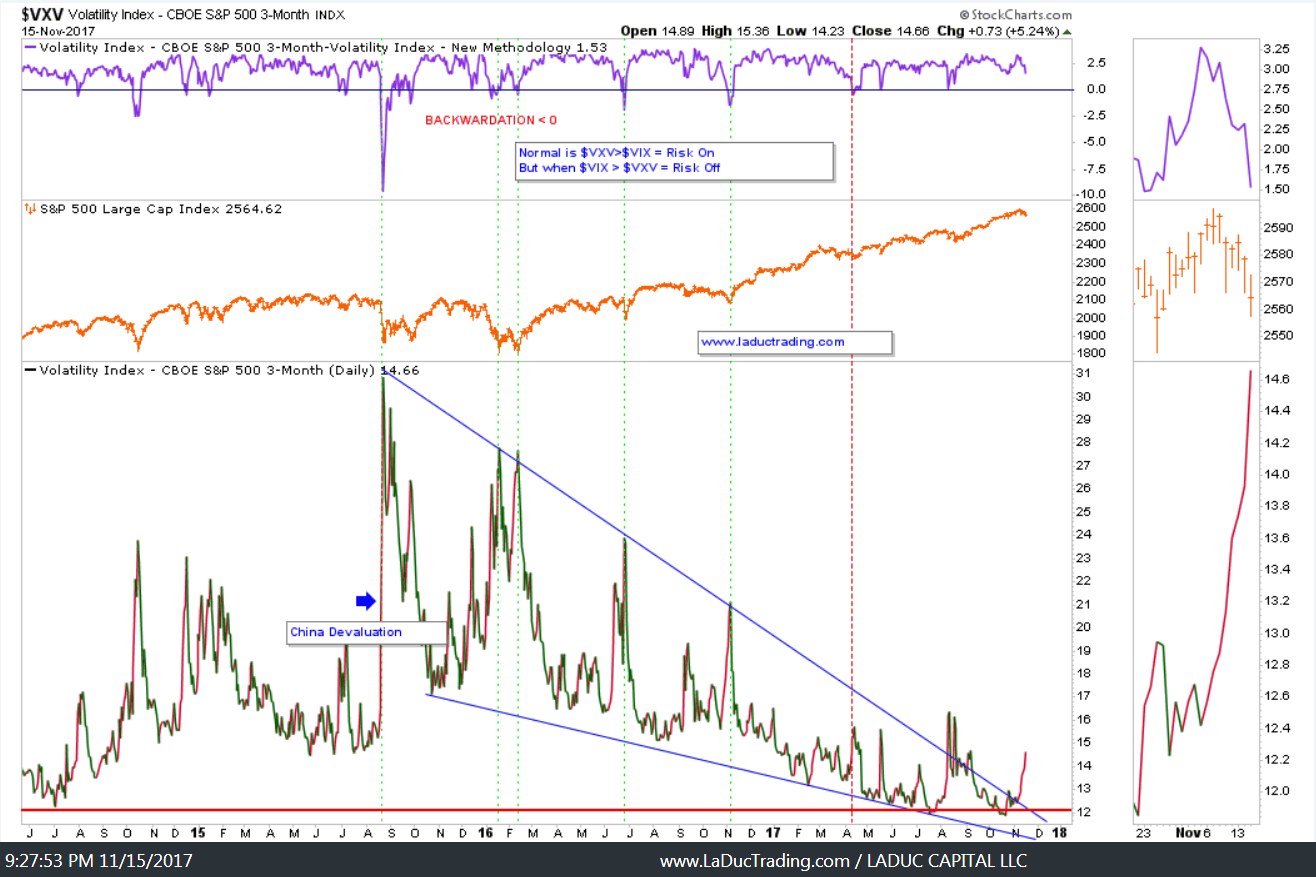

Despite the sudden and so far short-term rout in Japanese equities, junk bonds, and oil, not to mention a large intraday Gold sale (4M ounces of gold sold in 10 minutes), U.S. market indices have been barely shaken, yields have been range-bound and the Treasury market firm. Still, these intermarket relationships are ‘correcting’ one-by-one which foretells the possibility that another market move will be out-sized. But which market?!

Many are placing bets on a Melt Up in the US Indices with the passing of Tax Reform. Judging from elevated VVIX (sentiment in VIX call buying), risk is getting elevated. Keep an eye on the VXV and VIX Volatility Index ( INDEXCBOE:VIX) as well.

The Junk Bond sell off may be overdone but it was not structural; it was forced selling. The source is largely unknown and may have come from any number of places: Telecom woes, potential Saudi unrest, expectation of higher yields, proposed tax cuts removing interest deductability. Mostly, it signals higher risk.

Lack of buyers in $HYG $JNK is The Tell.

The weight of the market will cause it to fall.

Big MM want $SPY to fall!https://t.co/JMyZTsyQ3b— Samantha LaDuc (@SamanthaLaDuc) November 10, 2017

Which brings me to my next point: where will the liquidations appear next? From the asset freeze in Saudi Arabia? Or Venezuelan bond instability? China is deleveraging and the Brexit divorce clearly seems to have hit a hard patch.

When you have $100 billion worth of assets under scrutiny in Saudi Arabia (a third of which has already been frozen), there is a lot of exposure in the global financial system to these assets. If banks and counterparties begin curtailing margins on accounts, and begin stepping back from notable banks that deal with these accounts, you can quickly get destabilization across global markets. – Bryan Rich, Forbes

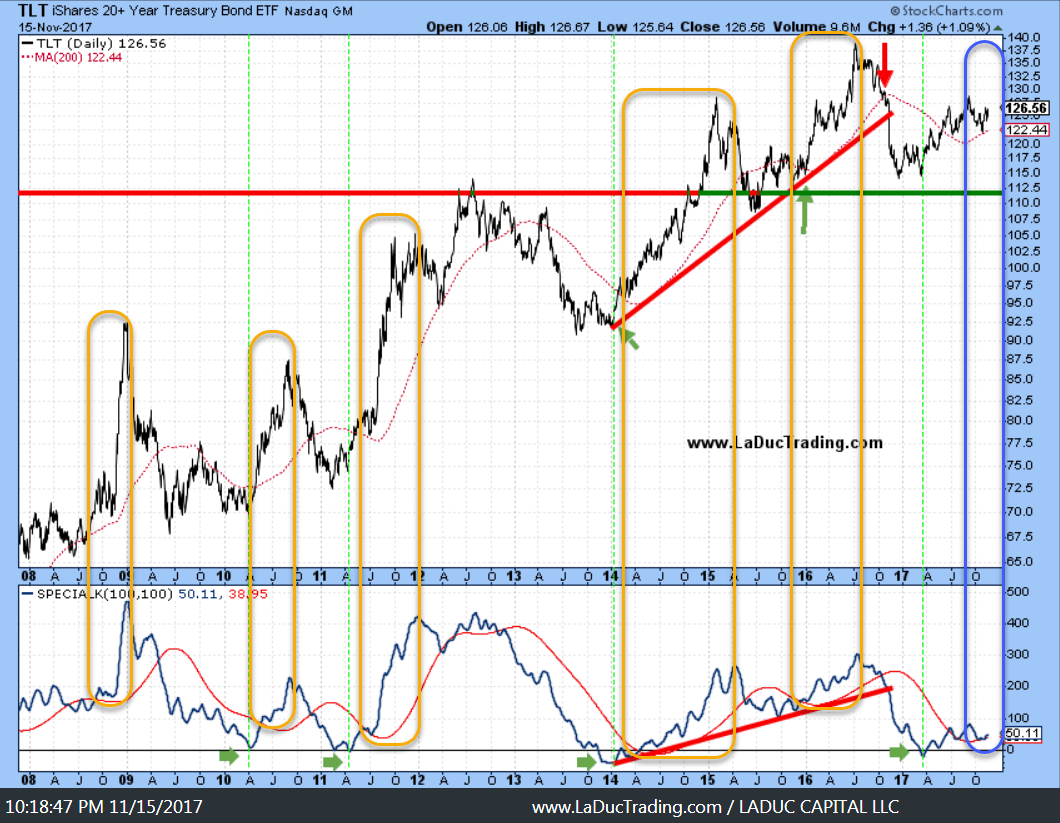

Most are betting Treasuries are next to collapse with a spike in 10-year rates. I happen to be taking the other side of that trade.

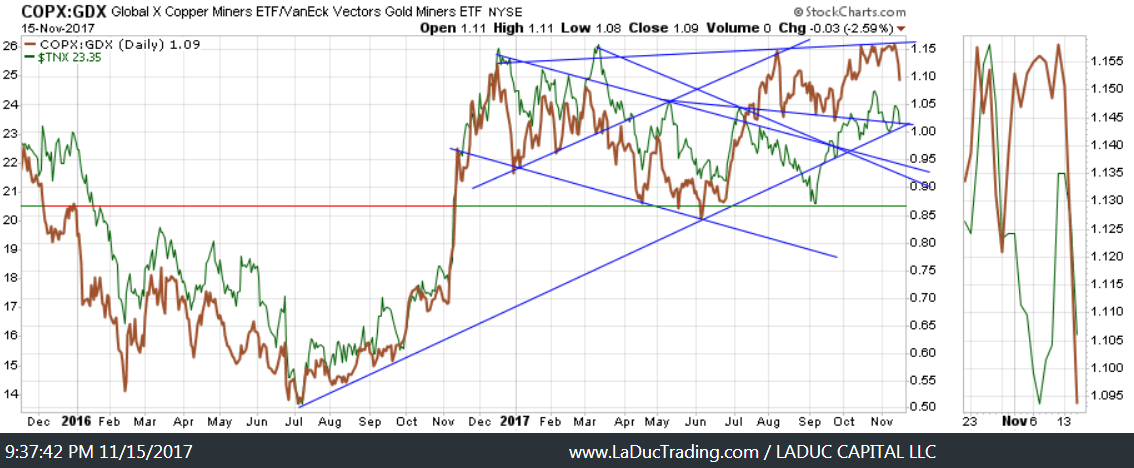

No one wants to say Commodities, led by Oil, will be the next casualty.

So as long as U.S. stocks are holding up, people continue to ignore these “Forced-Selling” risks. But since bonds are better at forecasting the economy than stocks, and retail money isn’t involved in the debt market, maybe we shouldn’t ignore the signs. I track Volatility closely and my recent Stock-Bond-Volatility ratio (only available to clients) signaled that markets are likely to go lower before higher, and forcibly so.

Still no change from Goldman: “We expect the S&P 500 will end 2017 at 2400 (-7.2%)”

28 trading days left

— zerohedge (@zerohedge) November 19, 2017

Many holding gains are expecting/hoping Tax Reform will pass. The rationale may be to hold their equities into next year, further benefit from seasonal strength, then sell next year to benefit from a lower tax hit on profits. But if tax reform doesn’t pass, many may be willing to sell. It may even look forced.

Come join me… I made it super easy for you to pop into my LIVE Trading Room for custom analysis and interaction–any time! You choose when to fish: Trade the Open or the Close, make a day of it or stay for the whole month.

Happy Trading and Happy Thanksgiving.

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.