In our first 3 weeks of contributions to See It Market, we’ve covered a lot. Global equity markets, financial stocks, Gold, the US Dollar, and more.

Today we look at telecom / mobile tech stocks. And, more importantly, we dive into a pair trade idea.

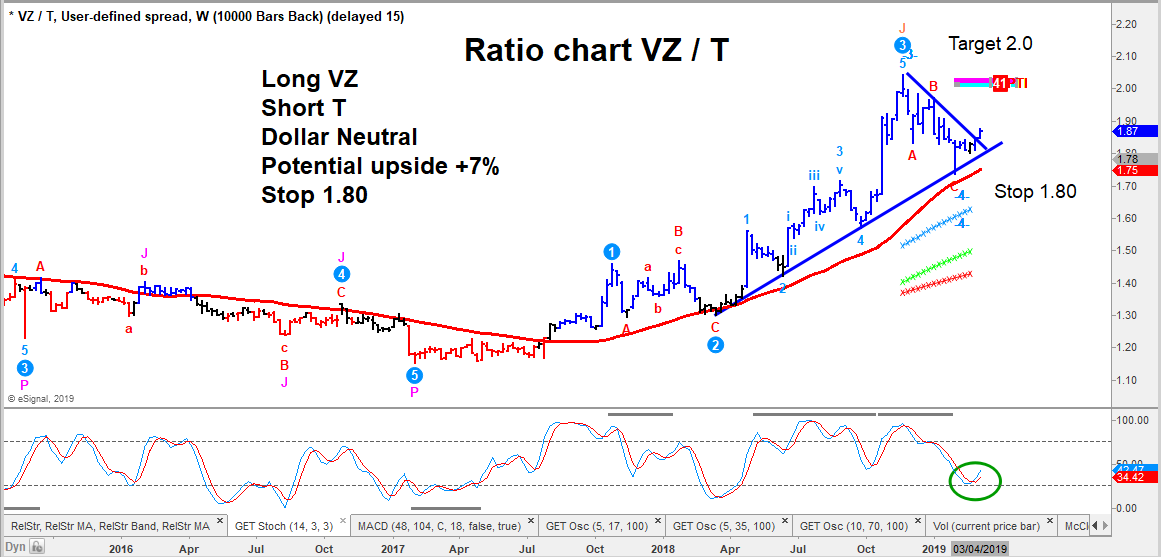

Verizon (NYSE: VZ) vs AT&T (NYSE: T).

Today’s idea is driven by one sector, and two stocks that could be diverging in the days/weeks ahead (in terms of performance).

The key driver for the idea is the strong multi-factor model score for Verizon (VZ) of 5.65 vs. that for AT&T (T) at -6.1.

The ratio chart below has a bullish setup as it has just broke the downtrend off the January high. Potential upside here is around 7%. Stops required.

Verizon (VZ) / AT&T (T) Ratio Chart

Author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.