Energy has been one of the worst performing sectors in Q1 of 2017. The Oil & Gas Exploration ETF (NYSEARCA:XOP) is down 10% and Energy Sector ETF (NYSEARCA:XLE) down more than 6%.

A new theme in options trading activity has presented itself this week and aligns with three strong price-action days. The group is finally showing some relative strength with recent inventory data.

The next major catalyst for the group may be the OPEC Summit on May 25th, but we are also in a strong seasonal period with the XOP averaging a 10.8% gain in April the last 3 years, and averaging a 12% gain from March to April over the last 10 years.

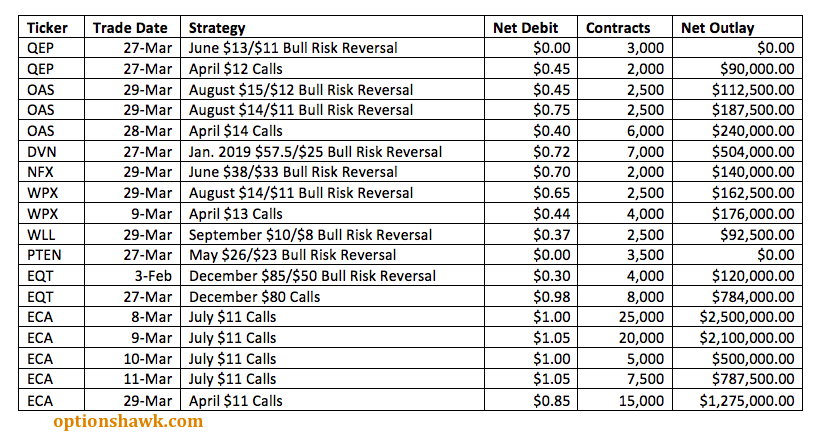

In the last few days traders have been putting on bullish risk reversals (selling downside puts to buy upside calls) in a number of Energy names with a focus on those that are most correlated with price movements, so targeting many of the smaller cap levered names. I will note the trades in a table below without going into any fundamental details. Most of the names have seen April call buying to go along with the longer-dated risk reversals. The majority of the risk reversals are being done at a net debit, implying expectations of shares being above the call strike, while the risk is being put the stock at the put strike.

Looking at the XOP from a technical perspective it is working on a weekly bull engulfing right at key volume bar support, so this week’s low is a meaningful level to trade against as it is also retesting the key August 2016 breakout and weekly cloud support. XOP’s highest weighted holdings are RICE, CPE, SWN, LPI, EQT, CHK, COG, PE, NFX and EGN. If the XOP can clear the $40 level it should open up a much stronger trend move higher.

Looking at the XOP and its components from a fundamental angle it is a group that has suffered major declines from the July 2016 high as Oil prices came down significantly impacting revenues and earnings as production came offline. Most of the group is now forecasting a period of growth as Oil has shown the ability to stabilize with OPEC cutting production. XOP has 65 holdings with an average 13.85% EPS growth outlook trading 24.2X forward earnings and 1.7X Book.

In closing, the options activity aligns with a key support level holding, a strong seasonal period, and improving fundamentals for the supply/demand balance.

Read more of my research and options trading ideas over at OptionsHawk. Thanks for reading and have a great week!

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.