One of the more difficult aspects of writing a column such as this one is that I have little or no idea of the relative sophistication of my readers. Do most of them have an in depth knowledge of options? Or, is most knowledge rudimentary puts and calls? I hate to bore readers with stuff they know already, but do not want to talk over the heads of those with only basic option knowledge.

One of the more difficult aspects of writing a column such as this one is that I have little or no idea of the relative sophistication of my readers. Do most of them have an in depth knowledge of options? Or, is most knowledge rudimentary puts and calls? I hate to bore readers with stuff they know already, but do not want to talk over the heads of those with only basic option knowledge.

Having said that, in my options education I always strive to simplify and demystify. One of the great secrets of the options business is that it’s not really that complicated. It is, quite literally, not rocket science.

So, today I want to talk about one of my very favorite low risk, high reward directional strategies: the Butterfly Options Strategy.

Fly, Little Butterfly, Fly! A Closer look at the Butterfly Options Strategy

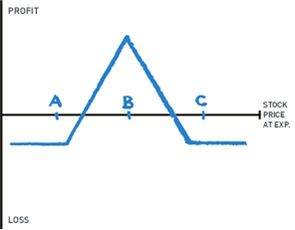

The butterfly options strategy is long strike A one time, short strike B twice and long strike C once. The strategy is all puts or all calls. As you see, you can look at it as a combination of two vertical spreads, one long and one short. You want the long vertical to expire at maximum value and the short vertical to go out worthless. Expiration exactly at strike B, in other words. Your risk is limited to the debit paid.

It is important that all strikes be equidistant from each other. And my rule of thumb is never to pay more than 10% of the strike interval. So, $1 in a 10 point butterfly, $.50 in a 5 point butterfly, etc. This gives us a very nice 1:9 risk/reward ratio.

To be able to do this all parts of the butterfly will be out of the money, making it a directional trade, albeit an inexpensive one.

Let’s look at a real time example of a butterfly options strategy (August 6, 10:30 CDT) using Apple (AAPL). Let’s say I think AAPL has had too nice a run recently and will head back to below 400 by October.

I can buy the October 420 put one time for 4.60. I then sell the October 400 put twice at 2 and buy the October 380 put one time at .90. This means I have paid a 1.50 debit for this butterfly, well within my 10% of the strike interval guideline. This 1.50 is also the most I can lose where ever AAPL expires in October. An expiration at 400 exactly makes me 18.50. 1.50 risk vs 18.50 reward, not bad, eh?

Moreover, as AAPL approaches my 400 target, the butterfly will widen. One of my basic trading rules is always to take off half a position when doing so lets the other half run for free. In trader’s parlance we call this “taking a double” and is simply good risk management. So, if I have the butterfly on 10 times and it widens to 3 I sell 5 and let the other 5 run. Hey, why not play with the house’s money?

In fact, if I think a stock will be super volatile I can put on two butterflies, one call and one put. As soon as one moves enough to pay for the other I take it off and let the other one run.

What if AAPL isn’t going back to 400 but will be over 500 in October? Using today’s prices I can buy the October 490 call once at 9, sell the 510 call twice at 5 and buy the 530 call once at 2.75. I risk 1.75 to make 18.25. Not quite as good as my put ‘fly but within my 10% guideline.

Hey, if AAPL does turn super volatile both ‘flys could double by expiration. Unlikely, I admit, but stranger things have happened.

In any case, I hope that I have shown what a simple, low risk, directional play a butterfly can be. So, open that chrysalis and let the butterflies fly!

As always, if you have any questions or comments, I can be reached either through this website or my own, The Liss Report.

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.