It always amazes me how much bad, disingenuous or downright false information there is out there in options education land. And too many people make options too complex as well. Sure, options can be complex and they can also be as simple as can be. Just like options can be speculative, it can also be as conservative as you like.

It always amazes me how much bad, disingenuous or downright false information there is out there in options education land. And too many people make options too complex as well. Sure, options can be complex and they can also be as simple as can be. Just like options can be speculative, it can also be as conservative as you like.

I am going to talk about what is probably the simplest and best-known options strategy there is and why so many so called advisors out there get it wrong. Namely, the covered call, ie, buy the stock, sell the call (also known as a covered write).

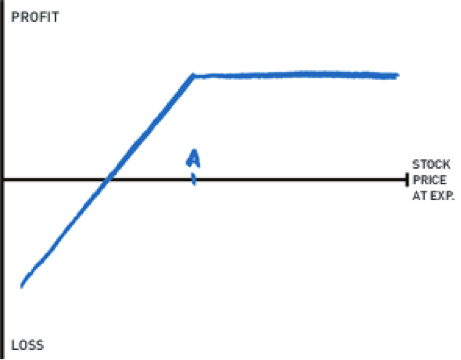

Look at this P&L graph (to the left). Your profit is capped by the premium you receive for the call. That premium is also the only protection you have to the downside. If the stock falls farther than the premium you receive you start losing money. How is this different from selling a put? It isn’t! This same graph applies just as well to being short the put.

Take an imaginary stock, XYZ, trading at 50. If I buy the stock at 50 and sell the 52.50 call at 2 the most I can make is 4.50 if assigned on the call. 2.50 in the stock plus 2 for the call. And I start losing money at 48. The exact same thing holds true if I sell the 52.50 put at 4.50. The most I can make is the 4.50 I get if the put expires worthless, and I start losing money if the stock falls below 48.

Moreover, selling the put is one transaction instead of two, thereby saving on commissions. And, since I am not buying the stock, less money is tied up. Sure, I have to put up margin for the short put but that margin can be in the form of an interest bearing asset such as a T bill. So, selling the put is actually fractionally more profitable than doing a covered write with exactly the same risk.

In fact, I don’t like the covered call strategy at all. It caps your upside potential while offering minimal downside protection. It is not a direction neutral strategy, it is an entirely bullish trade. If you want to be that bullish then just sell the put!

Please note that I will be absent for the next two weeks as I am going to Amsterdam with my wife to visit my daughter and grandson. Talk to you all about options when I return!

Randall Liss is the author of The Liss Report.

Twitter: @RandallLiss

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.