Last week I talked about a low risk directional options trade that I like quite a bit: The Butterfly. I discussed how I don’t want to pay more than 10% of the strike differential for a nice 1:9 risk reward ratio and that all strikes are equidistant. Well, today I want to talk about a variation of the Butterfly where the strikes are not equidistant.

Last week I talked about a low risk directional options trade that I like quite a bit: The Butterfly. I discussed how I don’t want to pay more than 10% of the strike differential for a nice 1:9 risk reward ratio and that all strikes are equidistant. Well, today I want to talk about a variation of the Butterfly where the strikes are not equidistant.

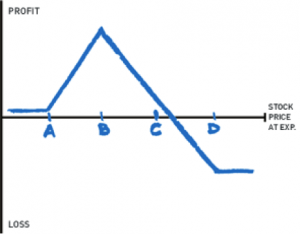

It is, though, either all calls or all puts. It is called a broken wing butterfly or a skip strike butterfly. Here is your graph looking at a call broken wing butterfly:

The strategy is long strike A one time, short strike B twice, skip strike C and buy one Strike D. As in every option strategy you want the expiration to be exactly at your short strike. This is a slightly bullish strategy with the stock normally around strike A and ideally you want to do it for a credit. That makes your break even point strike C plus the net credit.

Your maximum profit is strike B minus strike A plus the credit received. Your maximum loss is limited to the difference between strike C and strike D minus the net credit received. Ideally you want everything but strike A to expire worthless.

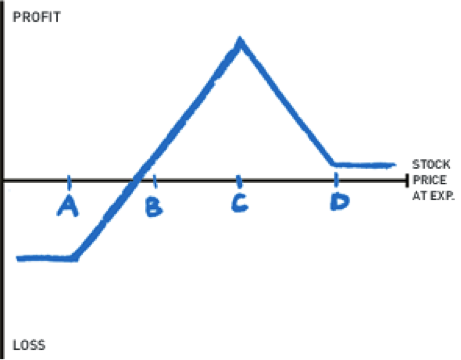

The broken wing butterfly options strategy using puts looks like this:

You are long strike A once, you skip strike B and sell strike C twice and buy strike D once. You’re slightly bearish and want an expiration exactly at your short strike, strike C. When you run this the stock is generally around strike D giving the trade a bearish bias.

Given a normal put skew it is difficult to put this trade on for a credit. Normally it will be a small debit making your maximum profit strike D minus strike C minus the debit paid. Your maximum loss is the difference between strikes A and B plus the debit paid. Your break even points are strike D minus debit and strike B plus debit paid.

I would not recommend this trade for anyone but a seasoned and veteran trader. In fact, I don’t recommend or advise any particular trade. I am an options educator, not a financial advisor. What I can do, though, is translate *your* view into a favorable risk vs reward strategy. For more information please visit my website: www.thelissreport.com.

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.