Like many markets, the NYMEX crude oil market has trading volumes that greatly exceed physical supply or demand.

This is one reason why I don’t pay particularly close attention to supply and demand data.

Sure, the weekly EIA report can be a market-moving event, but very often, the market seems to move in exact opposite ways than one might expect, based upon the data. Supply and demand reports, in my view, are primarily occasions for spikes in volatility and the corresponding running of stop loss orders.

According to my calculations (which are open to review and comment), the average daily trading of NYMEX crude oil contracts are 55X the actual demand of physical U.S. oil demand.

And this is just one publicly trading exchange, not including the over-the-counter and other markets.

As a result of this avalanche of electronic orders, I believe that in the short run, the electronic trading of bids and offers sets the price of crude oil, not physical supply and demand. The commodity being traded is therefore the futures contracts itself, not hydrocarbon molecules.

This is why I pay close attention to the individual futures contracts, their corresponding options markets, and their expiration dates.

August 2018 WTI Crude Oil Option Expiration

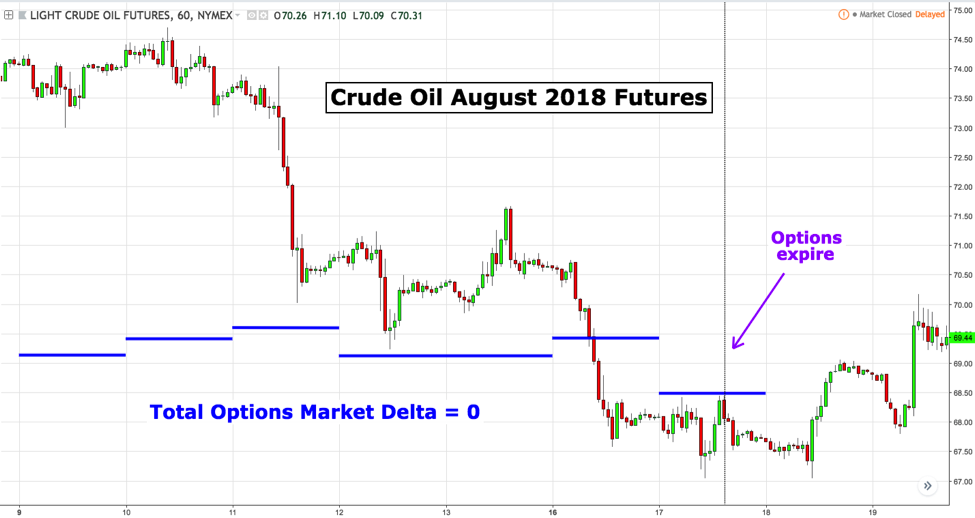

The chart below shows the hourly price action of the August 2018 crude oil contract into option expiration. In blue, I have also graphed a blue line which shows the place where the total options delta equals zero during the option expiration week.

Consistent with Op-ex Price Magnet Theory, the price of crude oil fell from a high near $74.50 to an option expiration close of $68.5, right at the point where total options delta was neutral. Over a dozen different markets over the past year, I have seen this kind of mean-reversion to options delta-neutral about 75% of the time.

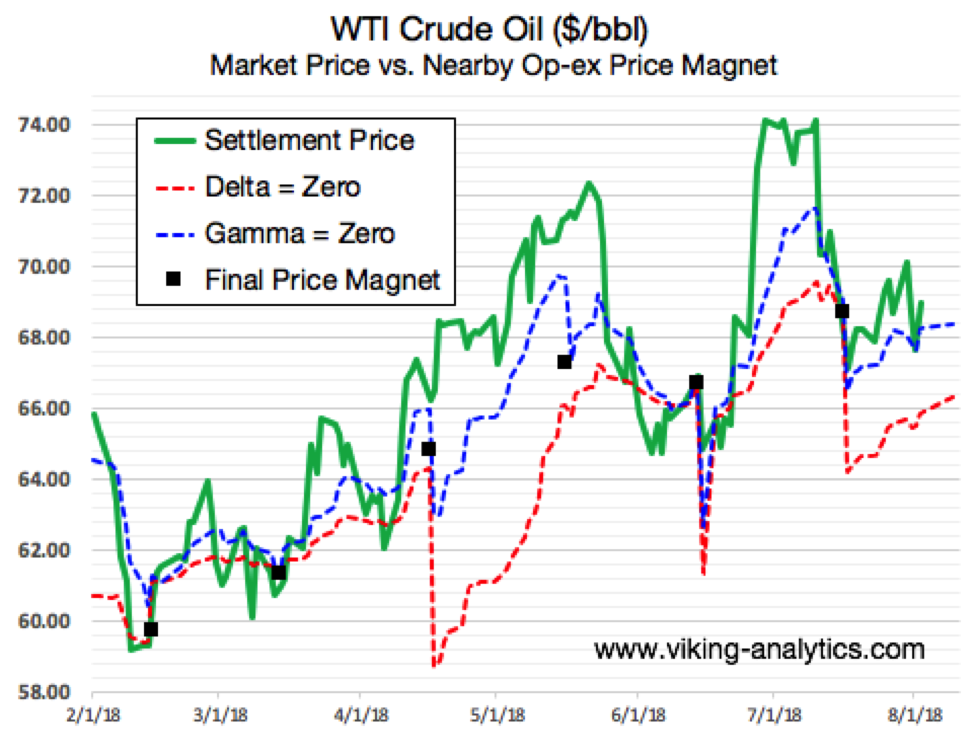

Here is the value of front-month crude oil, together with delta and gamma neutral, from the beginning of February 2018.

Op-ex Price Magnet Theory

Futures and options contracts have definite expiration dates. As the expiration date approaches, market participants roll their positions into later months. This rollover almost always creates a situation where the options market will have increasing value relative to the underlying futures market.

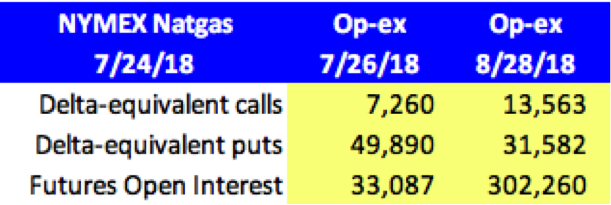

One example highlights the potential influence of the options market on the underlying futures market itself. On 7/24/18, the August NYMEX natural gas futures contract had 33k contracts of open interest and the delta-equivalent puts for the August contract was near 50k. This means that the put sellers – in aggregate – had more natural gas price exposure than the holders of the August natural gas contract itself!

This reveals an incentive for the put sellers to push the price of natural gas higher – on or before 7/26/18. By doing so, the put sellers reduce their put exposure and optimize their overall profits.

Structurally, the day of option expiration gives the large traders the ability to purge risk and maximize profits as they unwind their sizable futures and options positions. The Price Magnet theory doesn’t hold for every month and for every option expiration, but I have seen price move towards delta and gamma neutral about 75% of the time across various markets. When the futures value and Price Magnet do not converge, it often has been following a recent strong up- or down-trend prior to op-ex.

To learn more about the Op-ex Price Magnets, please visit our website.

Twitter: @Viking_Analytix

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.