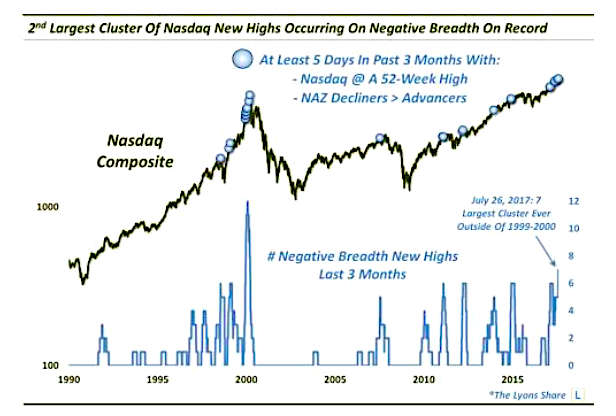

The recent string of Nasdaq (INDEXNASDAQ:.IXIC) new highs occurring with negative market breadth has only been matched by a stretch in 1999-2000.

In Part 1 of our “Internal Cracks” mini-series, we looked at the unusual recent spate of new highs in S&P 500 that occurred on negative NYSE volume. That is, despite the 52-week high in the Index, there was more volume in declining stocks than advancing ones. Specifically, we have seen 6 such days in the past 3 months – double the previous 3-month record going back more than 50 years.

Today’s Part 2 looks at a similar phenomenon. Namely, we have observed a recent cluster of 52-week highs in the Nasdaq Composite occurring along with negative breadth on the exchange, i.e., more declining stocks than advancers.

Wednesday marked the 7th such occurrence in the last 3 months. That is the largest string of these days on record, outside of a run of 12 that ended in late January 2000. I probably don’t have to tell you what happened soon after that episode.

This chart shows all of the 3-month clusters of at least 5 occurrences going back to the late-1980′s.

So is this a red flag regarding the durability of the bull market? Some will point to it as evidence of a thinning out of the rally. We certainly have seen these clusters pop up in the lead up to some tough markets in the past, e.g., 1998, 2000, 2007, 2011. But do the statistics objectively bear out those concerns? This requires a bit more digging…

Over at The Lyons Share premium, we took a deeper look at prior occurrences and the Nasdaq’s subsequent performance to come to an informed, quantitatively-backed conclusion. Check it out if your interested.

Good luck out there and thanks for reading.

Twitter: @JLyonsFundMgmt

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.