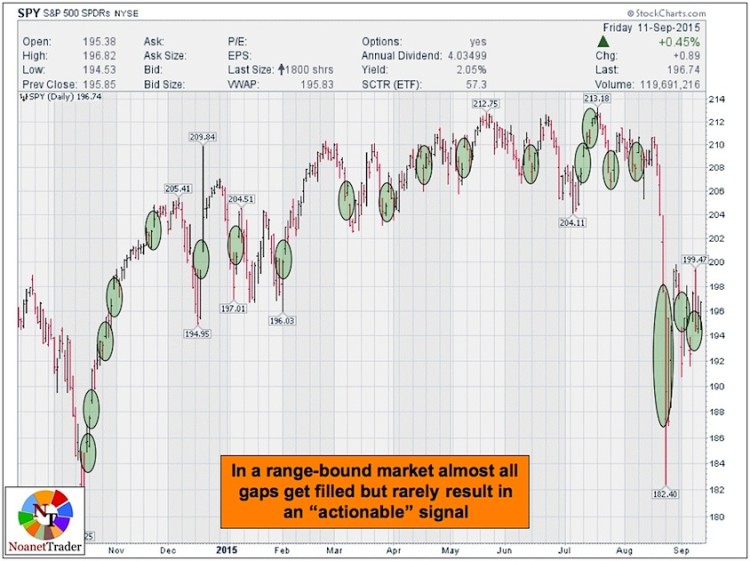

For a fresh example, take a look at this year’s daily chart of S&P 500 SPDR ETF (SPY), where I marked the twenty most visible market gaps (and ignored many minor ones).

As you can see, over the last 12 months, SPY price action created many gaps and all were filled. In some cases it took quite a bit of time – the gaps created by the V-shaped recovery in October of last year were not filled until this August’s crash, some ten months later.

Consequently, the adage about market gaps should be amended as follows to make it accurate:

“Gaps Almost Always Get Filled in Range-Bound Markets”

Implications For Gap Trading Strategies

There are many trading strategies for trying to profit from gaps.

The three most popular (in no particular order) are:

- Fade the Gap – This strategy involves shorting gap ups or buying gap downs primarily because traders expect that gaps indeed always get filled and the fills should happen very quickly

- Go with the Gap – Involves trading in the direction of the gap (buying gap ups and shorting gap downs)

- Fade the Gap Fill – This strategy involves waiting for the price to completely fill the gap and then taking a trade in the opposite direction expecting a price reversal

As we have seen with AMZN and NKE above, strongly trending stocks will create gaps that could remain unfilled for a long time.

Under these conditions the best trading strategy is obviously going with the gap/trend. A gap fading strategy will have little or no edge here and traders expecting a quick gap fill put themselves at a risk of significant losses.

Fading the gap fill strategy is also generally effective for strongly trending stocks. As we have seen with NKE, dip buyers will step in to support any pullback and price will quickly resume the primary trend.

In range-bound markets, the effectiveness of a gap fading strategy improves drastically as most, if not all, gaps do get filled.

Needless to say, going with the gap is probably the worst strategy for range-bound stocks as there is no trend to work with and trend followers put themselves at a risk of the proverbial “death by a thousand cuts.”

Finally, if you look at the chart of SPY above, you will see that the price rarely fills the gap neatly and then reverses immediately after doing so.

In the majority of the instances the price will overshoot the gap in both directions by a significant margin before reversing. For this reason, fading the gap fill in range-bound markets will not be as effective as it is in trending markets.

Thanks for reading.

Twitter: @NoanetTrader

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.