Among the many trading proverbs, the one about gaps is easily among the top ten in terms of how frequently it is (ab)used and how many attach significance to it.

Before digging into it, let’s first make sure everyone understands what a gap is and how market gaps form.

A Gap Defined

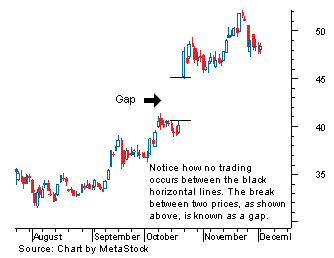

According to Investopedia, “a gap in a chart is essentially an empty space between one trading period and the previous trading period. They usually form because of an important and material event that affects the security, such as an earnings surprise or a merger agreement.”

Here is a graphical representation of a gap, also from Investopedia:

Gaps happen in both directions. In bullish situations securities “gap up,” as depicted in the above chart. Conversely, in bearish situations (e.g. bad corporate earnings) securities “gap down,” resulting in a reverse of the above image.

When the price moves into and covers the empty price range created by the gap, this is referred to as “filling the gap.” In the above example, this particular gap would be filled if the price of the security moved lower to 40.

Do “Gaps Always Get Filled?”

You probably already know the answer to this question.

Setting aside the obvious problem with any phrase that uses a word like “always,” it is not hard to find examples where this adage is wrong.

For a shorter term example, look at the chart of Amazon.com Inc. (AMZN) below. The stock had two significant gaps earlier in the year and these are nowhere near to getting filled despite the current market weakness.

As a longer term example, consider the three-year chart of Nike Inc. (NKE) below. The stock had two significant gaps back in 2012/2013 that are still not filled, as well as another one from last September that was only partially filled before the stock took off again.

You should not have a hard time finding charts with unfilled gaps that go back 10, 15 years, or longer.

Bottom line is that strongly trending stocks or markets will create gaps that will not be filled for many years, if at all.

Gaps in Range-Bound Markets

The adage holds a lot better in sideways or range-bound stocks or markets.

continue reading about gap trading strategies…