Chipmaker Micron Technology (MU) is trading higher again on Tuesday morning.

This is happening one day after equities analyst Nomura had nearly doubled its target price from $55 to $100, bumping Micron’s stock price 9% higher to over $59.

There is also speculation that Micron may increasingly be viewed as a takeout target, which often involves paying a premium relative to market value.

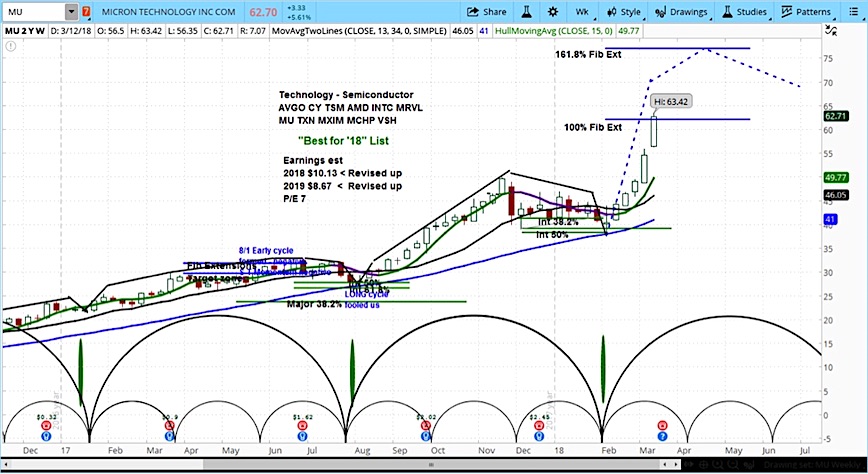

Micron (MU) Stock Cycle Analysis

Upon reviewing MU’s weekly chart below, we can see that it started taking off after the rising phase of its intermediate cycle began. Today’s price action briefly exceeded the 100% Fibonacci extension. Micron is on our “Best for 2018” list with a target for the coming months raised to $77.

The market cycles are designated by the semicircles at the bottom of the chart.

Micron Technologies (MU) Stock Chart with Weekly Bars

For more on the “Best for 2018” (along with the worst) check out our New Year’s Special below.

askSlim Market Week – “New Year’s Special”

For a more detailed look at cycle analysis for a broader selection of futures, watch the askSlim Market Week every Friday afternoon.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.