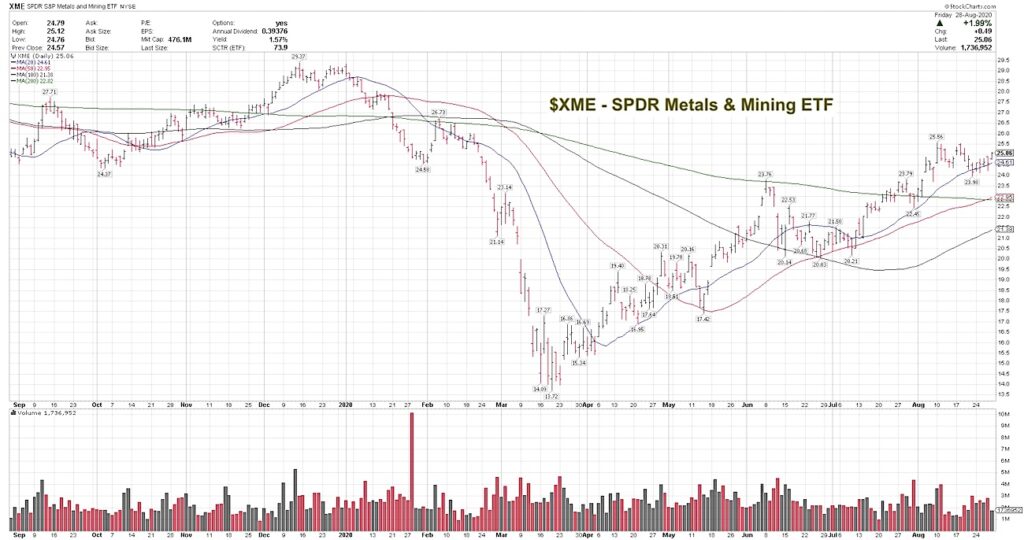

The Metals and Mining ETF (XME) is one of our top technical ideas here and is in a technical up-trend above the rising 20, 50, 100, and 200-day moving averages, a signal of a strong up-trend on multiple time-frames.

It recently broke out above $24, then tested and held that range before moving higher, a positive signal.

XME recently completed a 50/200-sma cross, another bullish technical signal, indicating that intermediate-term momentum is improving as well and has held the rising 50-sma since late April, which can be used as a key trend gauge here as well.

On a non-technical note, the Federal Reserve announced last week that they are targeting higher inflation.

If they are successful with this, industrial metals should benefit.

Stop level for ‘long’ position traders is $22.36.

$XME Metals & Mining ETF Chart

Larry is the publisher of the Blue Chip Daily Trend Report.

Twitter: @LMT978

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.