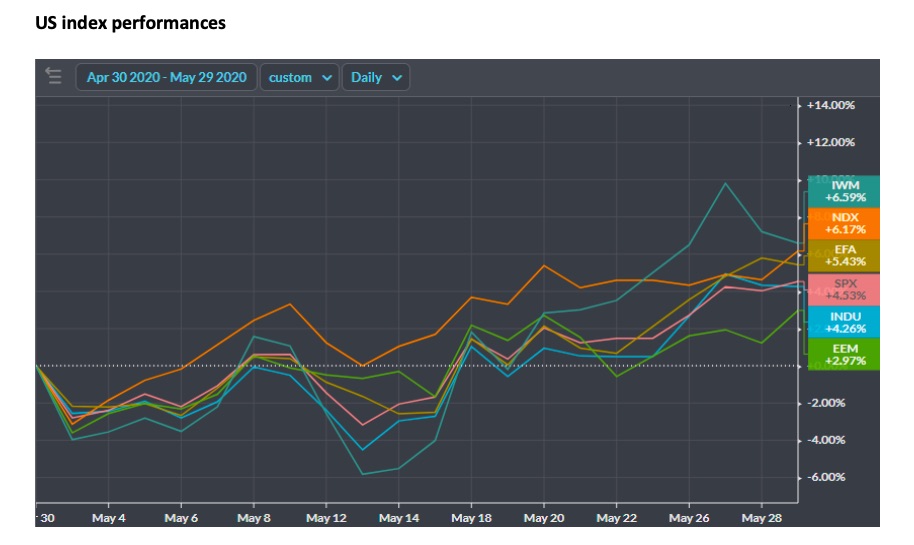

Stocks rose sharply in May with the S&P 500 Index INDEXSP: .INX gaining 4.5% while the Dow Jones Industrial Average added 4.3%. The NASDAQ Composite INDEXNASDAQ: .IXIC rose 6.8% and the Russell climbed nearly 7%.

Equity markets built upon gains from the low hit on March 23. For the year, US stocks are still down about 5.7%

Fixed income markets had a relatively quiet month with the 10-year Treasury yield ranging between 0.55 and 0.80% since mid-April despite bouts of volatility in equity markets and an active US Federal Reserve

Mortgage rates have ticked to fresh record lows as credit market are slowly easing

Economic data from April revealed the worst single-month figures in US history with millions of jobs lost and a soaring unemployment rate

Manufacturing and service functions have been decimated due to COVID-19 and related economic shutdown across the country

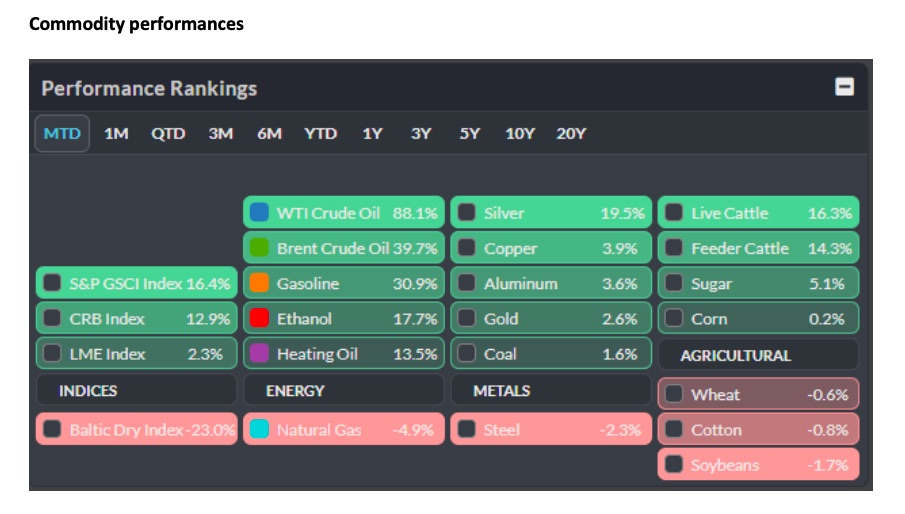

On the commodities front, oil prices mounted a recovery from the late April low and are now trading in the mid-$30s as that market normalizes

Retail gasoline prices have taken a modest turn higher while natural gas prices remain low

Summary:

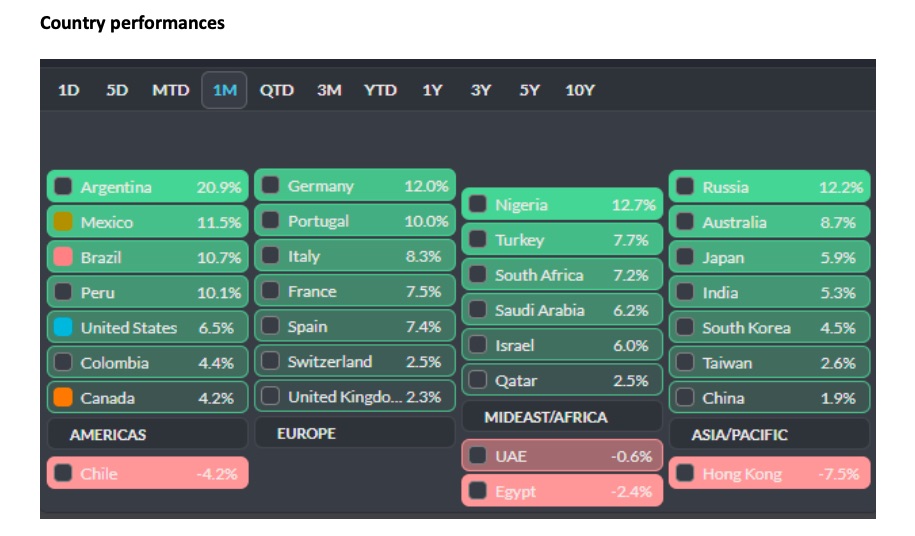

Stock markets around the world continued the uptrend since late March amid dismal economic data and concerns for a second wave of COVID-19 cases later this year with states re-opening. Florida was among the first states to gradually open back up for business, and we have fared relatively well compared to others. Still fears persist that more mobility and socializing could spell a sharper increase in new cases later this year.

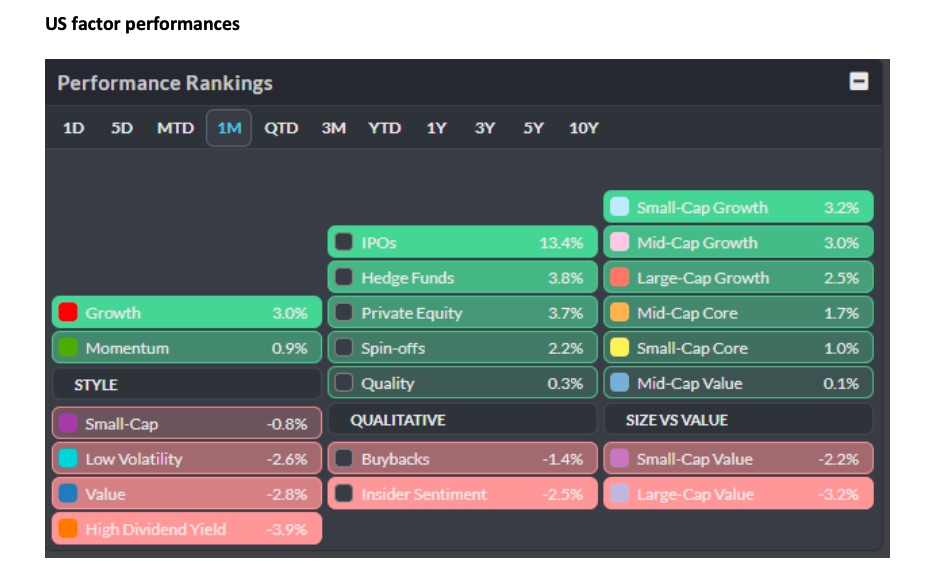

Those fears have not permeated into the stock market, however, as virtually every niche across the equities spectrum posted positive returns during May. Strength was seen among US small companies and value stocks – the same groups that were decimated during February & March.

Stocks:

Few would have imagined that large cap US equities would be within a few percentage points of breaking even for the year given the enormous economic impacts from COVID-19. But here we are. Investors who were able to stomach the near-term pain and stick to their strategy have been rewarded for the most part.

There have been interesting shifts in which areas of equities have taken the torch and run with outperformance, but last month it was the same firms that were taken out to the woodshed during late February through mid-March; small US firms most sensitive to stay-at-home orders.

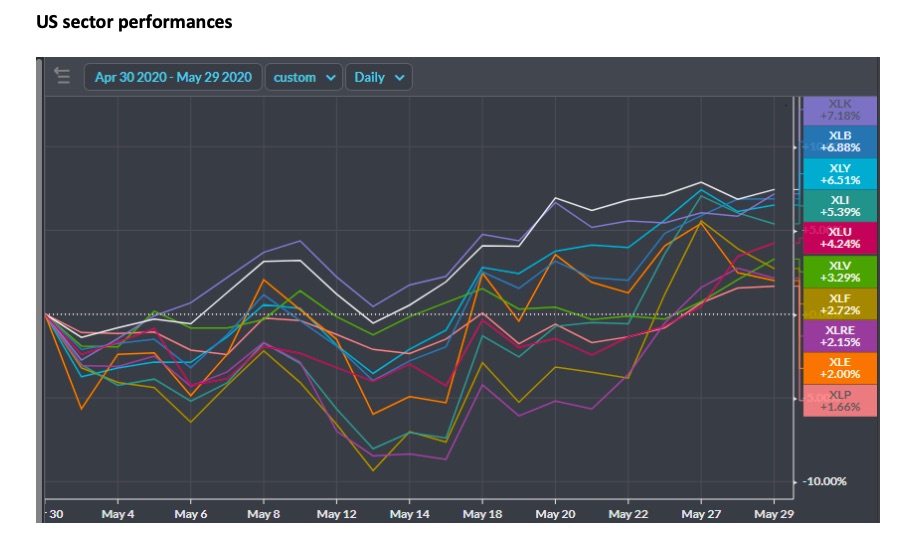

Taking a closer look, homebuilding companies, oil servicers, and retail firms were among the biggest winners last month, as crazy as it seems. The stock market has a way of looking beyond the near-term. Consumer discretionary stocks and industrial also performed relatively well while consumer staples stocks like grocery stores were weaker.

The question remains – is this just a near-term bounce or are the lows for the year in place? It is such a tough question to answer with any degree of confidence. It is more important to focus on your longer-term strategy and your overall risk & return objectives versus trying to time the market.

Fixed Income:

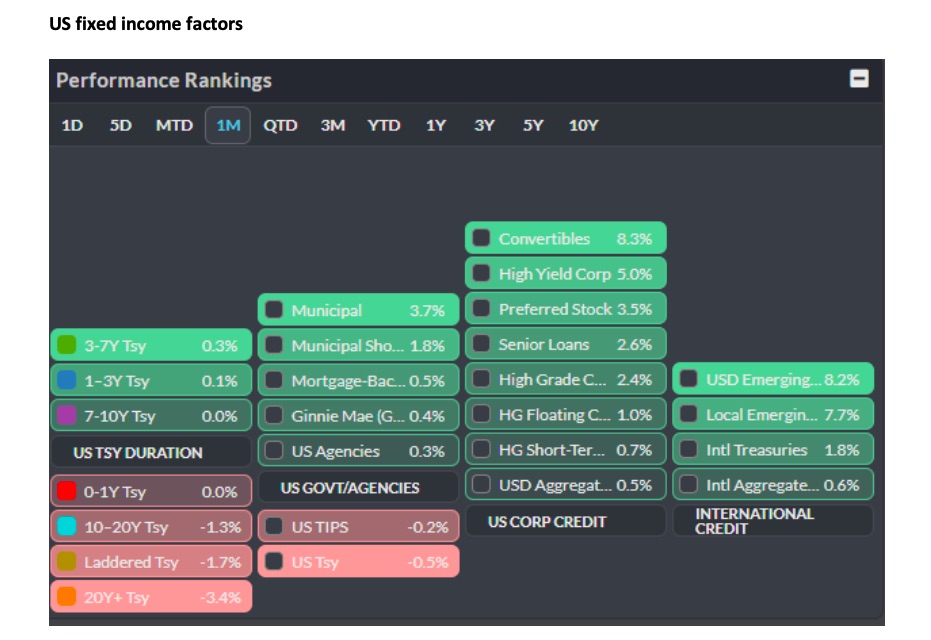

It was a surprisingly quiet month in the bond markets during May. With the US Federal Reserve expanding their buying programs and balance sheet, one would have though that the fixed income space would have been volatile. Not so. The benchmark 10-year US Treasury rate ranged just 0.25% last month, holding steady near 0.70% for most of the period.

The good news is lending standards eased modestly, allowing for mortgage rates to tick to fresh record lows. Historically low interest rates and more lending should help the real estate sector. High-yield junk bonds performed well along with risky emerging market debt. So a few toes were dipped back into areas that were hit hard earlier this year.

Economy:

The economy contracted 5.0% during the first quarter, and Q2 will be absolutely horrific – perhaps -35% according to Wall Street economists. While this is easily the worst quarter for economic growth in US history, the market has had more than two months to digest the extent of the downturn. A sharp recession was baked into the market during late February and March when we experienced all of the financial market volatility. So the headlines will continue to be scary.

The unemployment rate stands at 14.7% as 20.5 million jobs were lost during April. We will get the May figures on Friday, June 6. The ‘real’ unemployment rate, factoring in those no longer looking for work and those underemployed, surged to 22.8%. Unemployment claims, tallied each week, continued to jump during May, but continuing unemployment filings are showing signs of easing.

US inflation is running very weak as consumers hold fast to their cash – it seems there are few places to spend money other than the grocery store, Home Depot, and Amazon!

Commodities & Currencies:

The commodity index jumped 20% last month as oil prices staged a major recovery. President Trump had expressed dismay regarding how low oil prices had gotten, a flip from his stance earlier this year when he tweeted anger about how high energy prices were getting. Oil climbed from under $10 to above $35 in recent weeks. Silver surged during May – climbing about 15% for its best month since 2011 while gold was higher by 3%. Precious metal stocks took a breather by month’s end.

The good news for consumers and homeowners here in Florida is we should experience very low costs to cool our homes this summer given low whole energy prices. We have to be on the lookout for an active hurricane season, however.

The US Dollar weakened during the back-half of the month, but it was not a large move. The currency markets have turned quieter; they were immensely volatile during the months around the worst of the Great Financial Crisis in 2008 as a contrast.

Here’s the point:

April’s recovery in the financial markets continued into May despite dismal economic data. We have an election in five short months and concerns about an impactful second wave of COVID-19 cases later this year. Many risks remain and anxiety persists. The dichotomy between the stock market and the economy has perhaps been greater. It is important not to get caught-up in the day to day swings of the market, but to focus on long-term goals and stick to our sound investing strategies. Thank you and stay safe!

Additional Charts:

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in a consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.