It’s May Day: half of the Western world is taking a holiday, but markets in the Americas are opening for business.

It’s May Day: half of the Western world is taking a holiday, but markets in the Americas are opening for business.

In contrast to the message of the universally-known (and not all-that-reliable) “Sell in May and Go Away” market axiom, stocks have historically fared well on May Day itself.

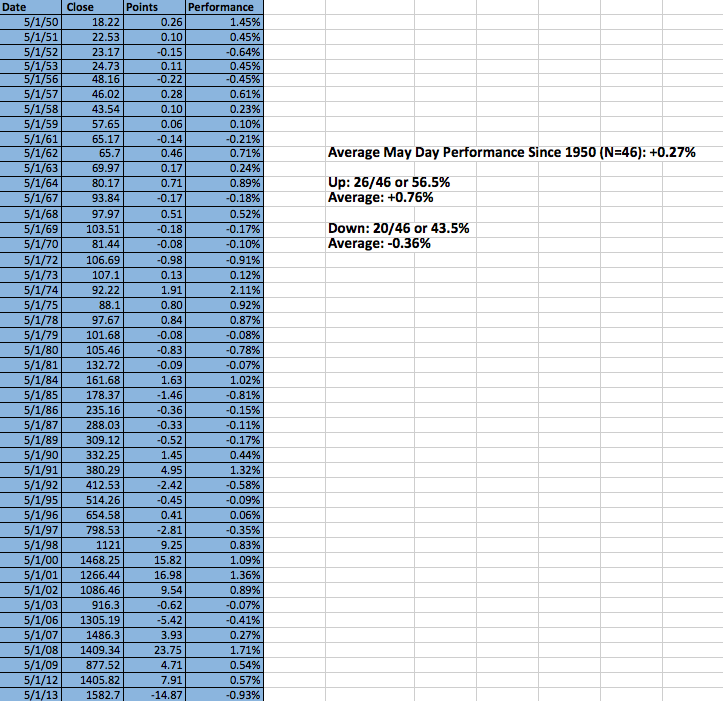

A quick and simple glance at the S&P 500 (SPX) since 1950 shows that positive days are not only more plentiful (56.5% v. 43.5%) but have a much greater net impact on performance, averaging +0.76% v. -0.36%. Across all May Days since 1950, average performance close-over-close comes in at +0.27%.

S&P 500 May Day Performance Since 1950:

Twitter: @andrewunknown and @seeitmarket

Author holds no position in securities mentioned at the time of publication. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.