The market likes some level of “certainty”… especially when it feels like the market has been lacking it. Enter the Fed today. As expected, the Fed held rates unchanged. But what about the rest of the FOMC statement? Well, the Fed statement was carefully crafted/hedged (as usual), with mention of a strengthening labor market and the possibility of a rate increase… perhaps even this year. The usual.

The market likes some level of “certainty”… especially when it feels like the market has been lacking it. Enter the Fed today. As expected, the Fed held rates unchanged. But what about the rest of the FOMC statement? Well, the Fed statement was carefully crafted/hedged (as usual), with mention of a strengthening labor market and the possibility of a rate increase… perhaps even this year. The usual.

And how did the market perceive the Fed’s comments? In stride.

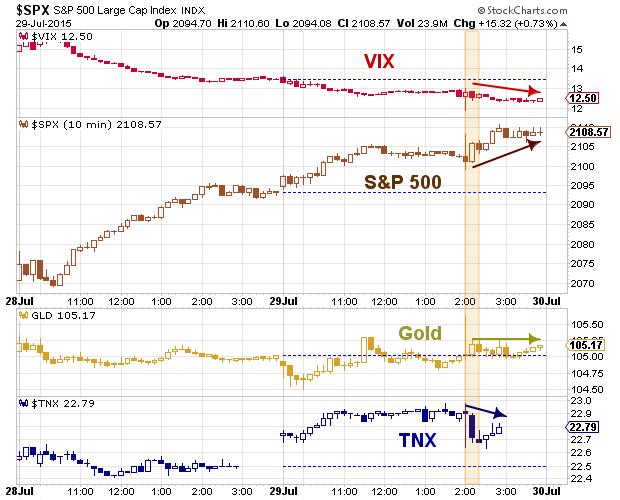

The market rallied into the Fed and seemingly took the news in stride, even if a touch hawkish. In fact, based on the tame reaction, it may have been right in line with expectations. So, why would I say this? Well, let’s take a look at Stocks (S&P 500), Bond Yields (TNX), Gold (GLD), and the Volatility Index (VIX).

In short, the Fed served the porridge just right. The price action saw stocks move slightly higher and hold firm. The VIX and treasury yields slipped a bit while Gold remained stable. In sum, that’s not a sign of a “caught by surprise” crowd.

So the beat goes on… and talking heads and market analysts will continue to parse economic reports, global news, and Fed speeches for clues on timing of the Fed’s next move.

But the best indicator for active investors (in my opinion) will always be “price”. The price action provides traders with an over abundance of clues and details, even in a single session on a 10 minute chart. Trade safe.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.