The Stock Market

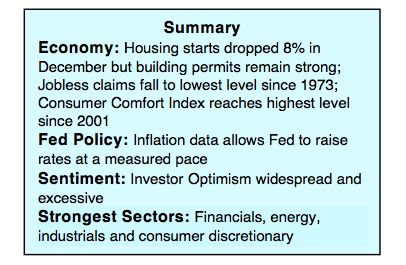

The equity markets continue to move steadfastly higher with the Dow Jones Industrials, S&P 500 and NASDAQ indices finishing at record levels.

Stocks are benefiting from rising earnings expectations as a result of lower corporate tax rates and a stronger economy.

The persistent stock market rally shows few signs of fading as the trend and market breadth remain bullish. This is evident by the fact that the NYSE advance/decline line, which is a measure of market breadth, continues to make new highs.

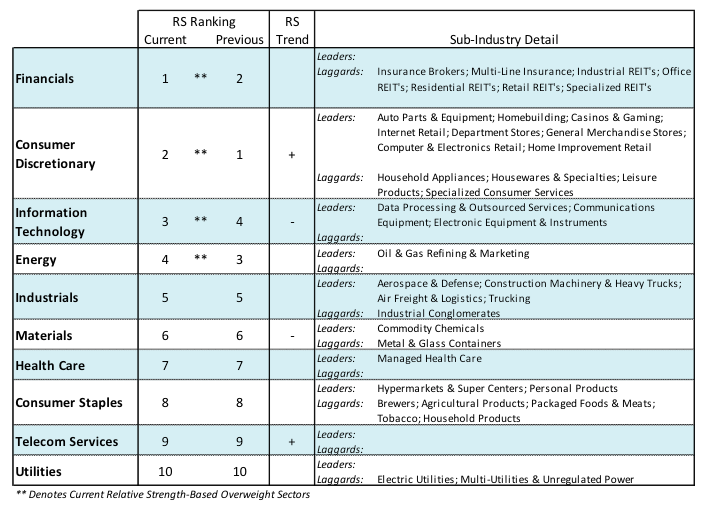

Additionally, the percentage of groups within the S&P 500 Index in defined uptrends expanded again last week to 86% from 75% three weeks ago indicating that most areas are in harmony with the primary trend. Prior to a pause or correction in the popular averages market breadth typically weakens with fewer groups and sectors participating in the rally. The absence of any significant divergences argues that the rally is likely to continue and that any weakness that might develop will be limited in time and price. New funds should be directed to the strongest sectors including consumer discretionary, industrials, energy and financials.

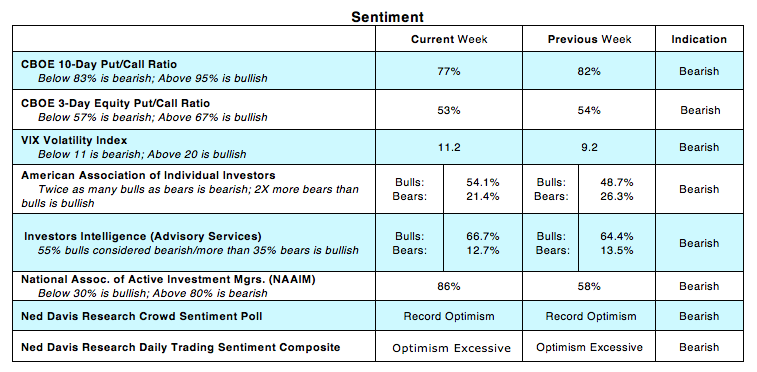

Two areas of concern continue to suggest a short-term pullback or correction in the stock market cannot be ruled out. Historically high valuations argue that the equity markets have little room for disappointment and excessive optimism suggests that liquidity is being drawn down. The unusual investor confidence is seen in the latest data from Investors Intelligence that shows the largest percentage of bulls since April 1986. Additionally, the Chicago Board of Options Exchange (CBOE) reports a plunge in the demand for put options (investors buy puts anticipating a downturn in stock prices).

Supporting the view that investor psychology has shifted toward excessive optimism is the near-record cash inflows into stock funds and ETFs the past four weeks. Additionally, the CBOE Volatility Index has a history of falling during periods of rising stock prices. The behavior of the VIX reversed in recent weeks and is now rising into a rising stock market. The change in character of the VIX, should it continue, would be problematic as the VIX has a history of rising prior to a change in the trend of the stock market.

Economy, Inflation & Interest Rates

The largest threats to the intermediate-term trend of the stock market are earnings disappointments and/or a surge in inflation and interest rates. A rise in inflation and interest rates is interpreted as the most pressing risk. Investors are behaving under the assumption that the rise in rates implies improving economic conditions and, therefore, not a threat. The fact that long-term rates have not reacted suggests that economic growth remains below the threshold that would cause inflation to rise.

As a result, the equity markets have shown few signs of anxiety that would suggest that a move to a negative correlation with rates is imminent. The yield on the benchmark 10-year Treasury note would likely need to rise to 2.75% to 3.00% before stocks would be impacted. Entering the new week investors will focus on the government shutdown over the weekend. Historically, government shutdowns have had no noticeable effect on the economy or the financial markets.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.