The equity markets pushed higher last week with the S&P 500 Index (INDEXSP:.INX) and the Dow Jones Industrials (INDEXDJX:.DJI) falling just short of the record highs scored in early March.

The support for the rally included improving first-quarter corporate earnings and expectations for tax reform in 2017. Final results for the first three months are not complete but it appears that S&P 500 companies will register double-digit profit gains for the first time in many years.

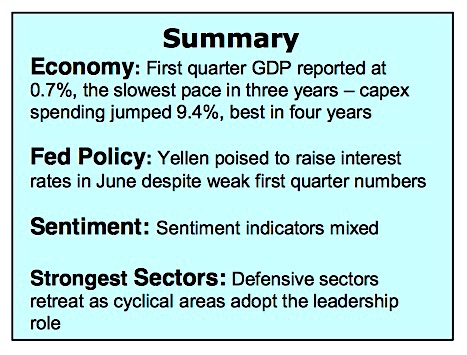

The jump in profits occurred during a period when GDP growth slowed. Last Friday it was reported that first-quarter GDP grew at 0.7%. A slowdown in consumer spending and a reduction in inventories was responsible for the weak number. The bullish message within the report was the fact that capital spending soared at a 9.4% annual rate, the best quarterly growth since 2013. Increased spending by business could be a game-changer for overall growth. Consensus estimates are that the economy will grow at a 3.0%+ rate in the second quarter.

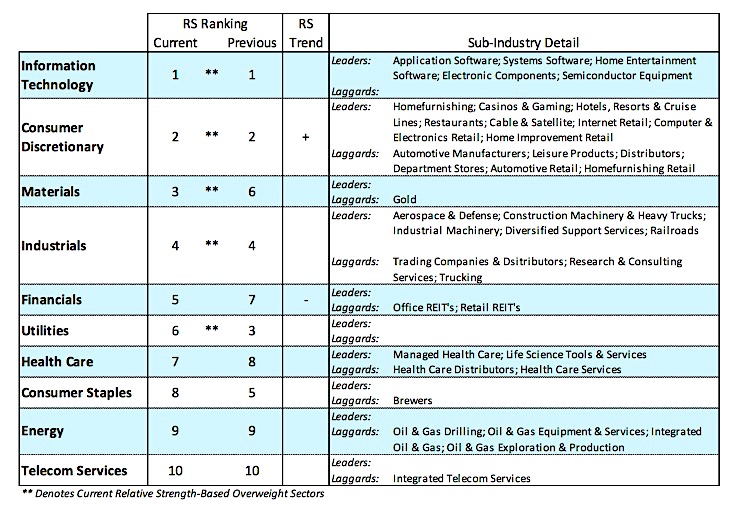

The combination of stronger growth and the prospects for tax reform could be the catalyst that triggers a summer rally that carries the averages to new highs. The performance in the stock market last week at the sector level tends to confirm the potential for a stronger economy. The leadership in the market is now in those areas most closely tied to the economy and away from defensive areas. Historically, when cyclicals are leading and defensive areas trailing this has had bullish ramifications for the stock market. The strongest sectors include information technology, materials, consumer discretionary and industrials.

The technical indicators, while short of issuing a buy signal, are slowly improving and suggest that any further weakness is likely to be limited. Market trends improved last week with 73% of NYSE issues now trading above their 10-week moving average and 70% trading above their 30-week average. Additionally, the weekly number of stocks hitting new 52-week highs expanded above 500 from less than 300 the previous week. Although the Dow Industrials and S&P 500 indices failed to reach new high ground, the Russell 2000 and NASDSQ Composite Index hit new all-time highs. Disappointing was the fact that the Dow Transports declined last week, increasing the spectrum of a potential divergence within the Dow complex.

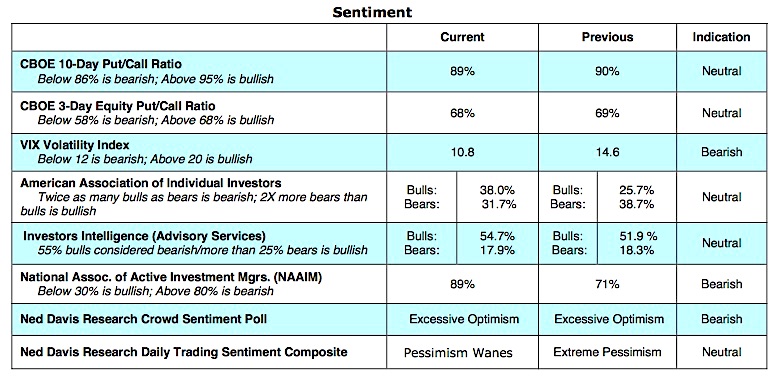

Sentiment indicators continue to be problematic. Typically, at a market low, investor sentiment reaches an extreme in pessimism. The fact that this did not occur during the March/April consolidation opens the possibility that prices have not yet fully corrected. The most recent data from the American Association of Individual Investors (AAII), Investors Intelligence (II) and the National Association of Active Investment Managers (NAAIM) all show a measure of optimism quickly returning. This suggests a measure of complacency that is confirmed by the CBOE Volatility Index (VIX) trading at an unusually low 10.8. On balance, the technical indicators point to the consolidation phase extending in May but with limited liability to perhaps the 2330 to 2360 using the S&P 500.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.