Looking at the charts this week investors remain bullish, and judging by the margin debt and leverage charts – investors are clearly voting with their feet!

This article reviews the latest results of the weekly survey I run on Twitter.

Below I feature just one chart, but note that you can see them all with more color here.

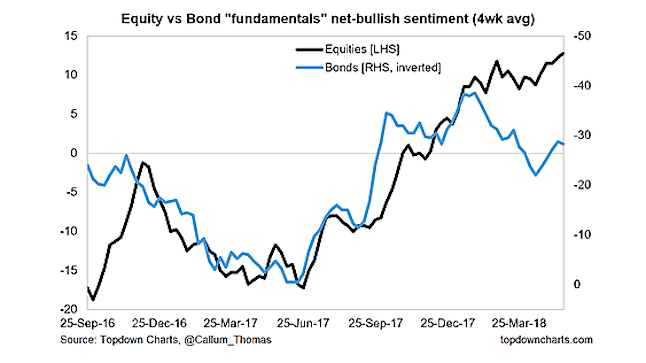

The survey asks investors whether they are bullish or bearish for fundamental vs technical rationale and for both equities and bonds.

This week we actually saw a record broken, with the highest reading on “Bullish (Fundamentals)” for equities since the survey began.

As the sum of the charts below show, investors look to be very confident on the outlook for stocks.

The key takeaways from the weekly sentiment snapshot are:

- Equity investors are very bullish on the “fundamentals” outlook.

- Bond investors on the other hand remain bearish on the fundamentals.

- Equity investors are backing this confidence with substantial bets in leveraged ETFs.

- For that matter, stock market leverage overall remains around record highs in absolute terms and as a percentage of market cap.

Here we look at investor sentiment toward stocks and bonds.

Equity vs Bond Fundamentals Sentiment: Looking at the trends in bond market vs equity market fundamentals sentiment, bond investors remain significantly bearish on the fundamentals for bonds (which is consistent with the bullishness displayed by equity investors on the fundamentals outlook). But I would say that the gap there represents some disparity in views or disagreement. Either way, it’s clear equity investors are bulled up on the fundamentals.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.