Stock Market Futures Considerations For November 21, 2017

The S&P 500 (INDEXSP:.INX) is trading higher on Tuesday morning as stock market bulls are enjoying a holiday rally. Check out my futures trading commentary and key price levels below.

Note that you can access today’s economic calendar with a full rundown of releases.

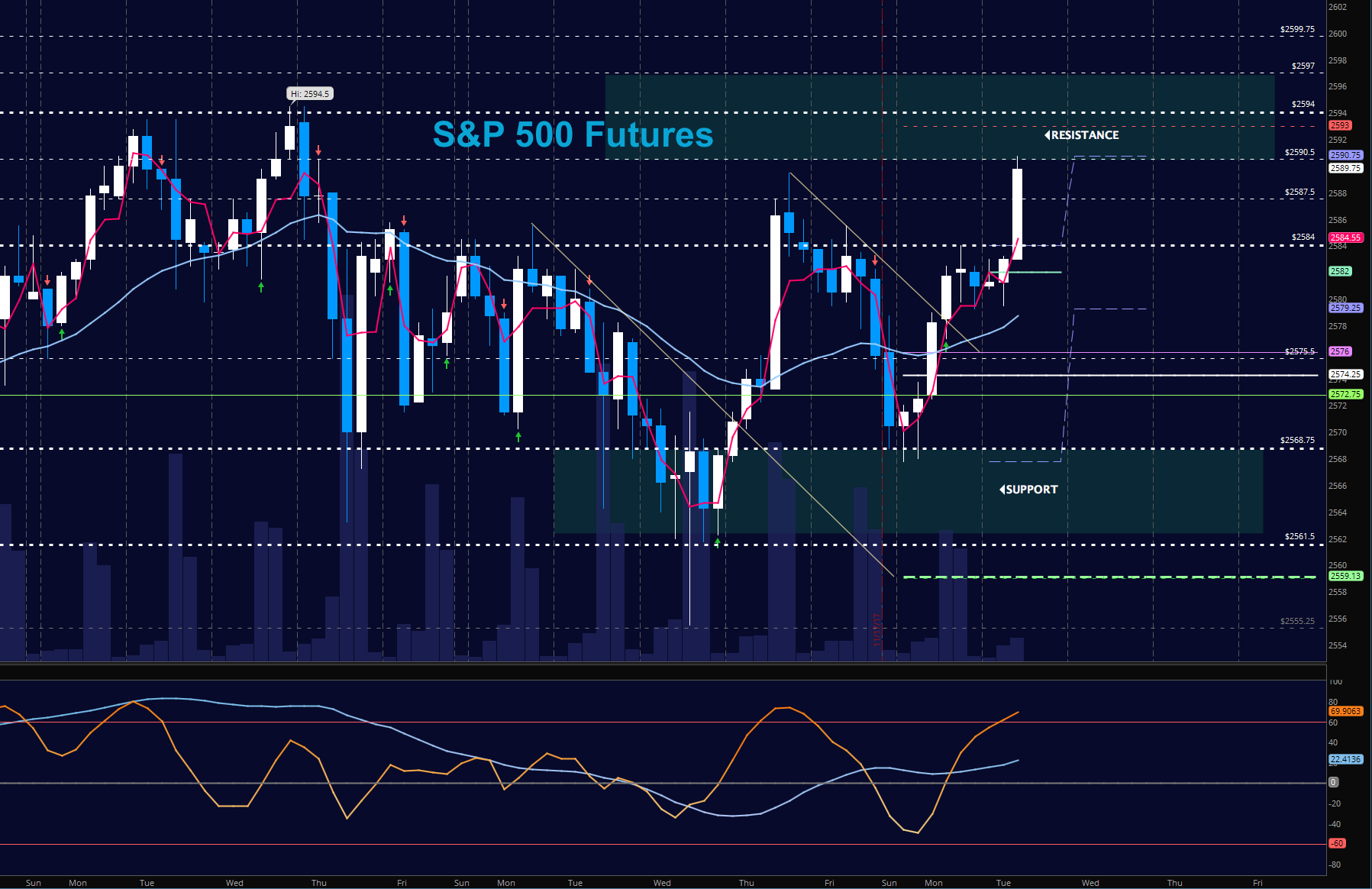

S&P 500 Futures

Charts bounced off support again has and moved into congestion near 2590 for another day. If we hold above 2584, we’ll be in full breach mode. We are outside the range of what the SPX spread suggest for the day’s straddle. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2590.75

- Selling pressure intraday will likely strengthen with a failed retest of 2582

- Resistance sits near 2590.75 to 2594.25, with 2599.75 and 2604.5 above that.

- Support holds between 2584.5 and 2582, with 2578.25 and 2571.5 below that.

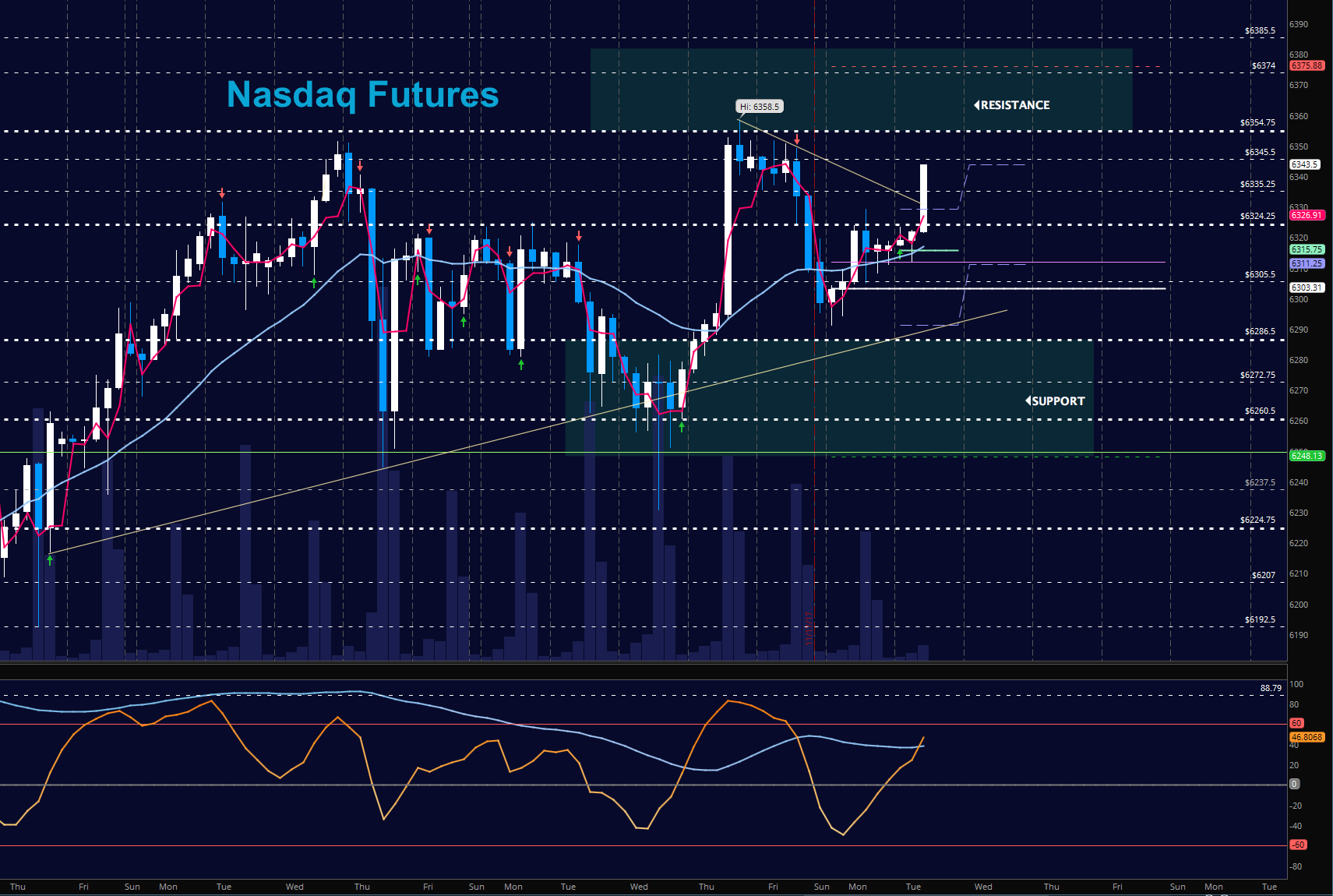

NASDAQ Futures

The NQ_F continued to recover but sits at the edge of congestion near 6345.5. Sellers will have more control below 6324. The chart is caught in an area of new and higher congestion. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6348

- Selling pressure intraday will likely strengthen with a failed retest of 6324

- Resistance sits near 6345.75 to 6354.75 with 6362.5 and 6374.75 above that.

- Support holds between 6329.5 and 6324.75, with 6316.75 and 6298.75 below that.

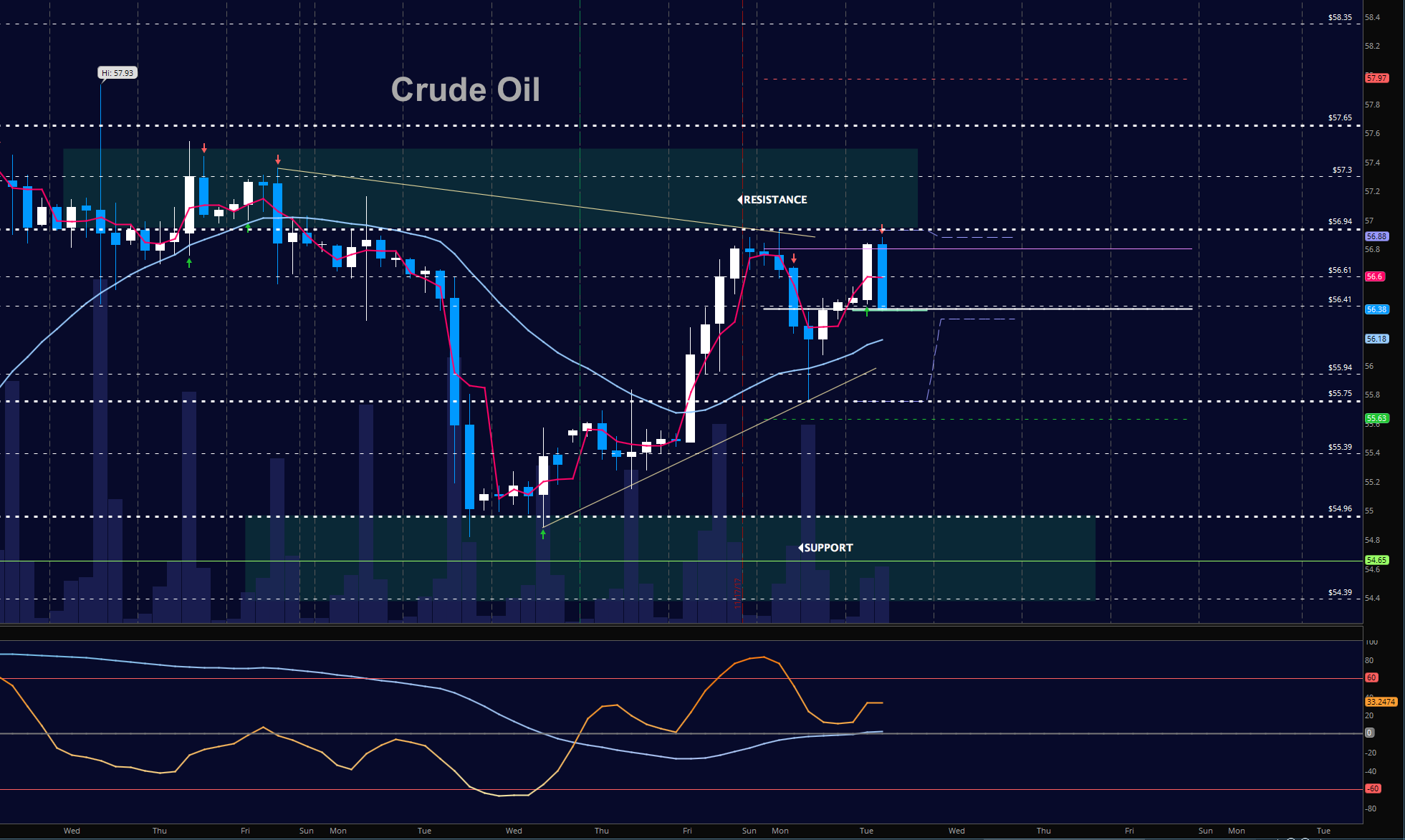

WTI Crude Oil

Oil holds a lower high this morning along with higher lows for the second day. Key resistance remains near 56.94 as momentum continues to slow and is generally neutral and mixed. Support holds near 56.3. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 56.94

- Selling pressure intraday will strengthen with a failed retest of 56.30

- Resistance sits near 56.9 to 57.53, with 57.97 and 58.2 above that.

- Support holds between 56.3 to 56.14, with 55.94 and 55.77 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.