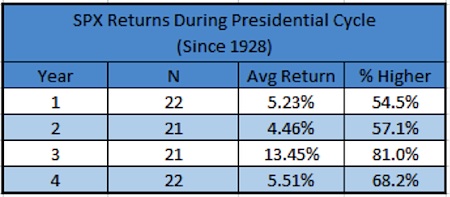

As you probably heard at the start of the year, the third year of the Presidential Cycle has been extremely strong for stocks going back to 1928. As you can see below, it is by far and away the strongest year of the 4-year cycle.

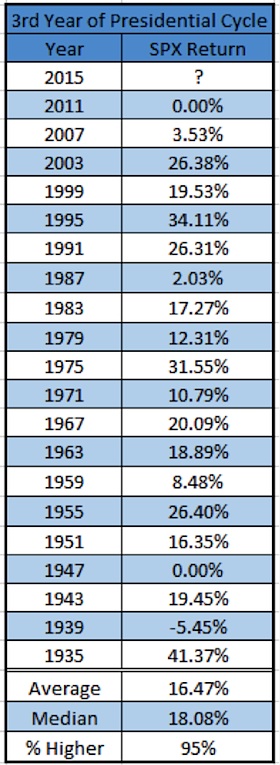

Incredibly, this year has been down just once going back to 1935. It is worth noting though that the past two years (2011 and 2007) have been extremely weak.

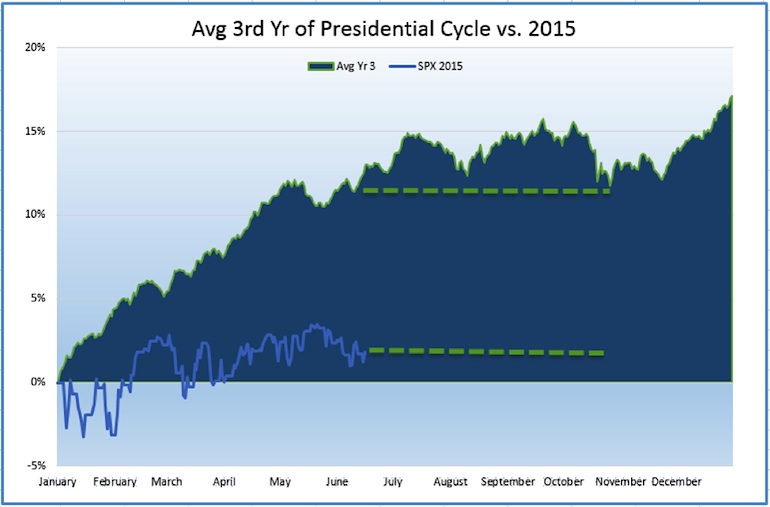

As of June 16 the S&P 500 was up just +1.82% YTD, making it the second weakest third year going back to 1950. Only 2011 at +0.62% was weaker at the same point in the year. Here’s where things get interesting. We all know how strong the third year is, but did you know over the next five months it is flat? I sure didn’t. As you can see below, the next five months surprisingly have averaged a flat return for the stock market.

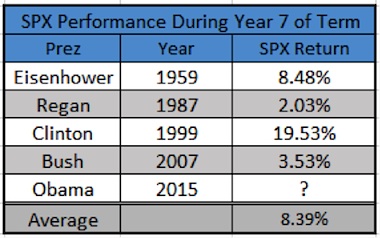

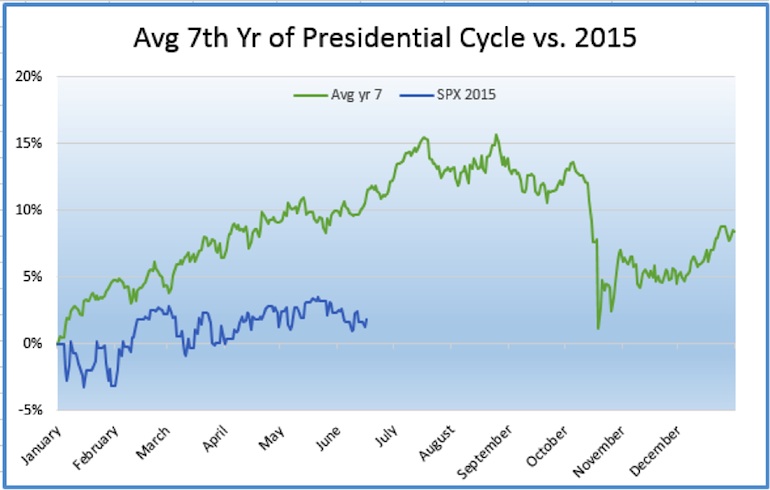

So what exactly is going on here? Why are we so weak during a historically strong period? One thing to factor in is this is actually the seventh year of Obama’s term. Something to consider here is we don’t have the best memories of previous year sevens. 2007 and 1999 were obviously the end of strong bull runs, while 1987 was flat with a historic one day crash later in the year. After six straight up years, is this year matching up with previous bull runs that end during the seventh year of a President’s term?

Here is what the average seventh year looks like. Of course, there are only four years in here, so this is greatly skewed by the Crash of ’87.

So what does it all mean? I’m disappointed in the price action so far this year, but after the six year run we’ve seen maybe a little break is warranted. After all, things haven’t cracked yet by any means. Also, as I noted on Yahoo Finance yesterday, we are seeing a historically low level of stock market bulls with the S&P 500 just a few percent from new highs. From a contrarian point of view, that is probably a good thing.

Thanks for reading and let me know what you think in the comments below.

Twitter: @RyanDetrick

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.