One would think that a topic regarding managing trading/investing positions would be worthy of a long article.

Perhaps even a book.

Not here. Not today.

However, I do think that the subject is extremely important, especially during volatile uncertain markets like we are facing now.

The reason so many investors struggle in the market is because we let our actions reflect our emotions. Declines make us feel bad, so we sell. And rallies make us feel good, so we buy. But it’s the small nuances that can set us apart from the pack… and these come from having a plan or process for when volatility hits a stock, etf, or index. Below is a brief chart exercise with some thoughts on managing positions.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite. I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

Thoughts on Managing Positions

Volatility can come on at any time, so it’s good to have some idea of how you will manage through it. Long-term investors that are stuffed with heavy exposure should have rules for reducing exposure, while traders should have stops.

Mentally, we are built to think of buying or selling as an “all or nothing” exercise. But that is a recipe for disaster in the markets. Reducing or increasing exposure in increments is one of the best things investors can do pre, during, and post market volatility. (buying / selling in “legs”).

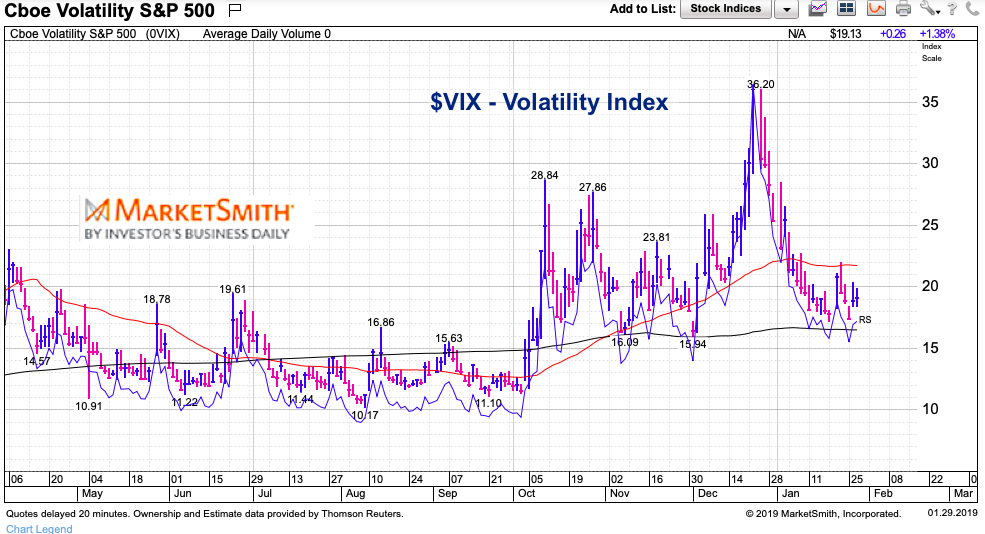

$VIX Volatility Index

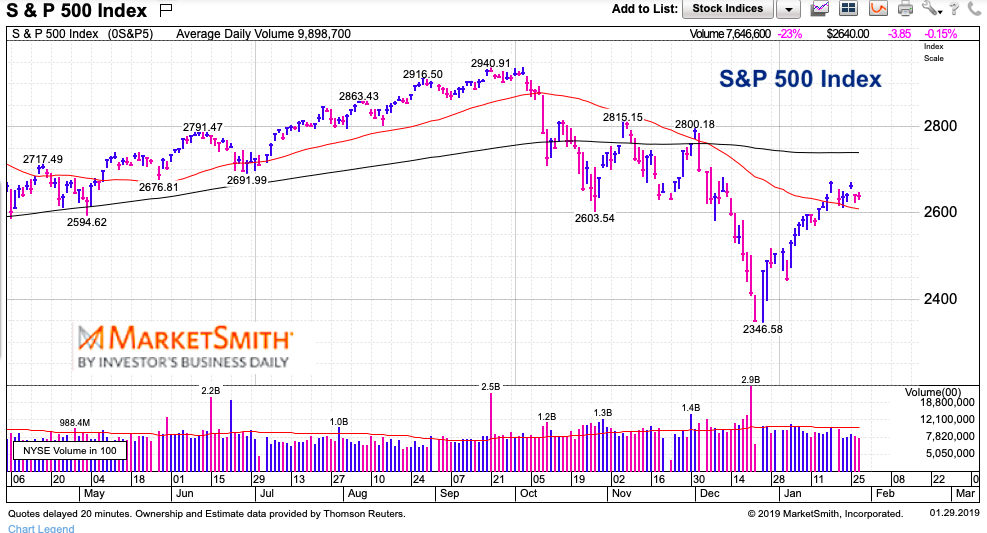

S&P 500 Chart

Examples:

If you sold a 1/2 of your exposure to equities based on rules between -5% and -10%, you’d have cash to buy back in as the market slipped to -20%. This isn’t perfect, but investing isn’t perfect.

If you’re a trader and you buy a position in $SPY at -7%, -12%, and -17%, you’re average buy price would be at -12% off the highs. Again, not perfect, but trading isn’t perfect. It’s about managing risk and increasing your probability of making money over your given time frame.

One other nugget: Think of time in slow motion. There’s no need to race. If you feel like you might miss out on something bigger – i.e. fear of missing out on a rally OR fear of not selling in case the market continues lower – then buy or sell “an increment” of exposure to either get an entry position or to raise cash.

Trade safe and remember to have a plan that follows your given timeframe.

Twitter: @andrewnyquist

The author has a position in SPY and DIA at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.