Macy’s (NYSE: M) traded 13% lower on Wednesday morning, after posting earnings that handily beat Wall Street expectations and raising its guidance for the fiscal year.

The company reported earnings per share of $0.59 and total revenue of $5.57 billion, above Wall Street expectations of $0.50 and $5.56 billion. Comparable store sales for Macy’s were up 0.5%, compared to estimates of 0.9%.

Macy’s raised its full year guidance by $0.20 per share to $3.95-$4.15, compared to the average estimate of $3.99. It also raised guidance on comparable store sales to 2.1-2.5% from their previous estimate of 1.0-1.2%.

“The combination of healthy stores, robust e-commerce, and a great mobile experience is our recipe for success,” explain CEO Jeff Gennette.

The reasons for why the stock is tanking today vary from higher spending on store remodeling to lower revenue compared to the previous quarter. However, given the recent run up in the stock’s price, it may have been that the market was just expecting better results.

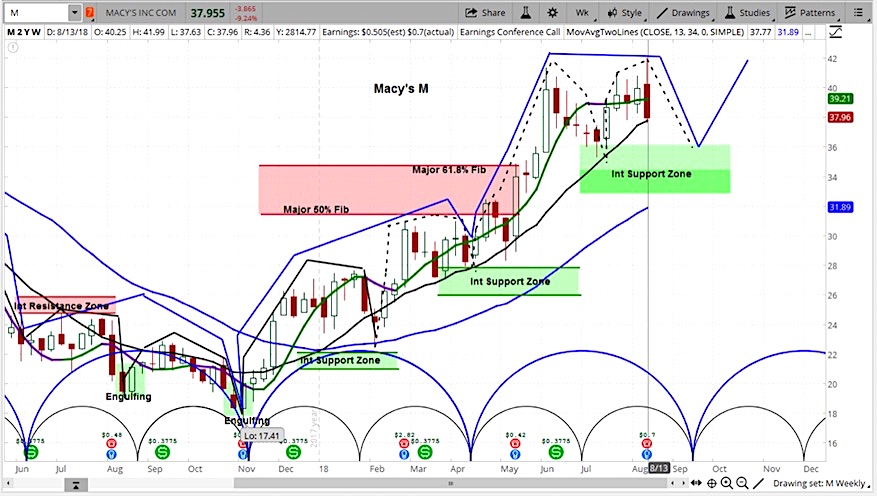

In analyzing Macy’s market cycles, we can see that the stock is now likely in the declining phase of its current intermediate market cycle.

This chart is actually a picture of perfect cycles. Our analysis calls for a drop as this cycle completes. Our near-term target is the intermediate support zone between $34.50-36.00.

Macy’s (M) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.