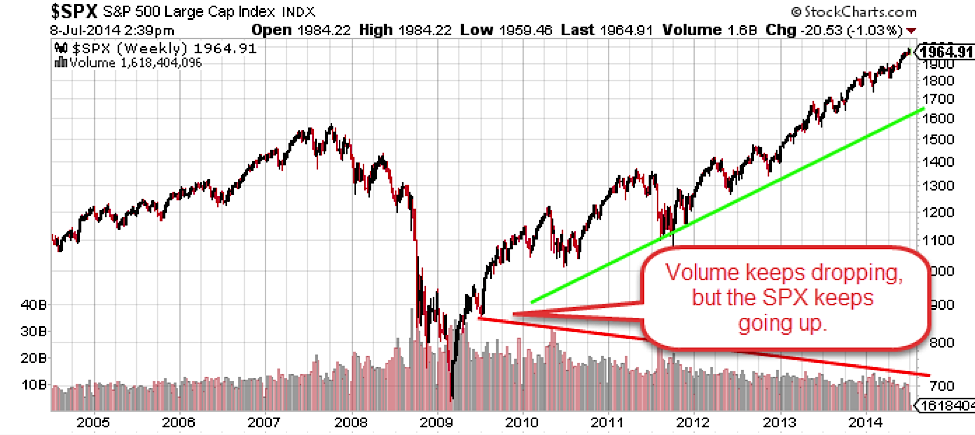

One of the long used bearish points during this bull market has been volume is light. The thinking is that low volume is a sign of a lack of participation. And that this will open the door for a big sell-off.

One of the long used bearish points during this bull market has been volume is light. The thinking is that low volume is a sign of a lack of participation. And that this will open the door for a big sell-off.

The only problem with the low volume argument is we’ve been hearing it for years now.

I remember back in September 2009 first hearing this while doing some bull/bear debates. Five years later the rally continues to move higher and volume continues to drop. This chart sums it up.

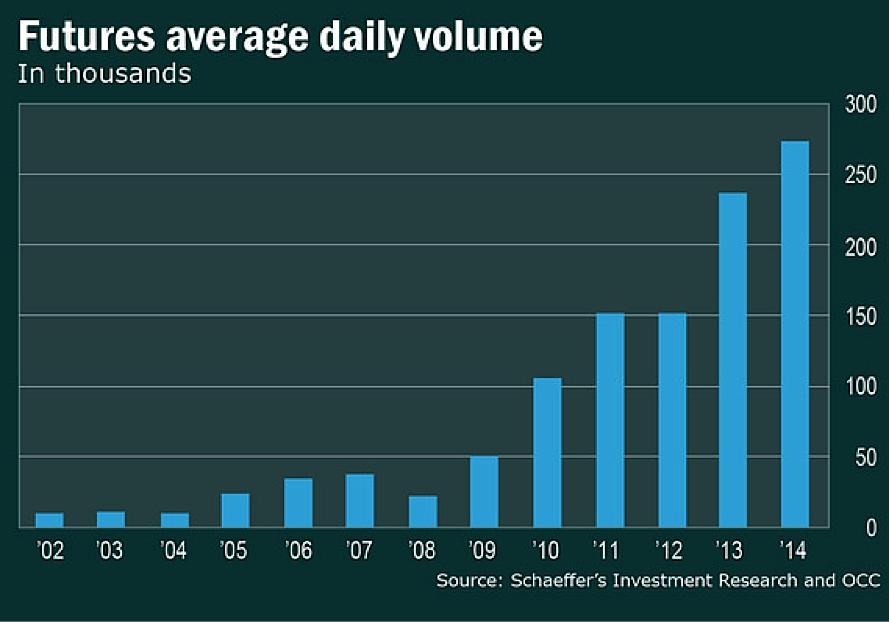

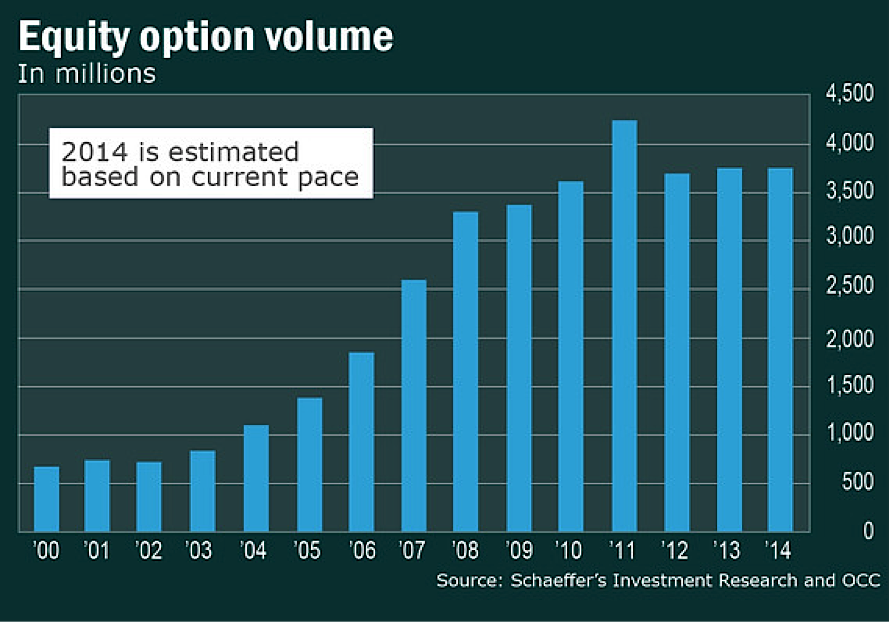

So what’s happening? My pals Victor Reklaitis and Anora Mahmudova at MarketWatch created an awesome display in just 5 charts on why equity volume is low. Fortunately they included me in this discussion and my main argument for years now has been volume might be leaving equities, but volume in futures and options continues to soar. So instead of just saying volume is light, maybe volume is just moving to other assets, as traders become more sophisticated? Makes sense to me.

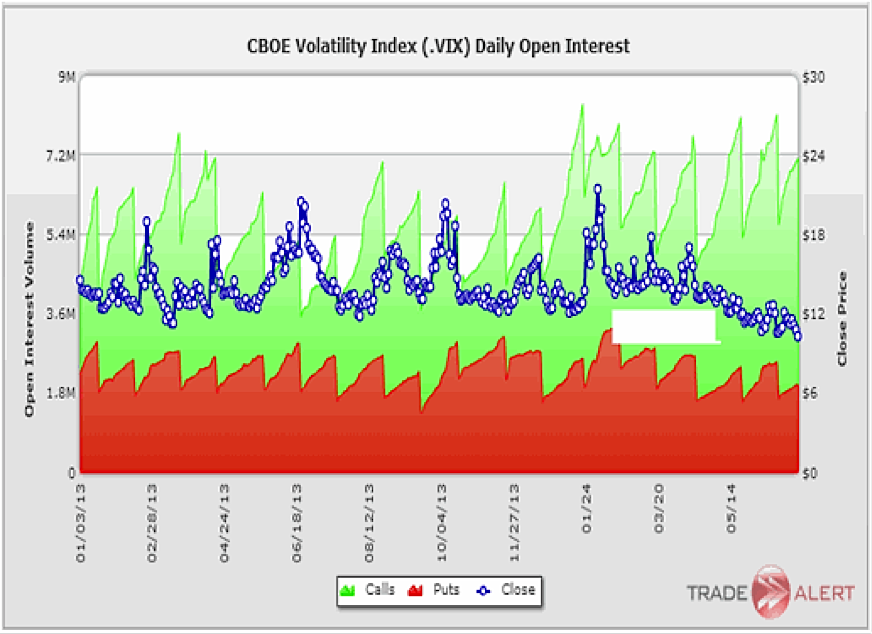

We’ve continually seen huge option volume in VIX call options for nearly two years now. Check out the recent call open interest on VIX options. With about two weeks to go till expiration, it is clear up over seven million open calls. A new record of call open interest by the end of July isn’t out of the question. Again, the masses would rather hedge with cheap insurance than trade individual stocks anymore. Not a good or bad thing, just a fact.

Eventually we’ll have a major market peak and the masses will claim it was due to low volume, but I don’t buy that one. The reality is we’ve been hearing this argument for years and there are some good reasons why volume is lighter now than in the past. Be sure to read what Victor and Anora discovered for more on this subject. Thanks for reading.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.